- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Refinanced my home in 2022

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refinanced my home in 2022

Hi. I refinanced my home in 2022. I paid origination fees (points). Once I enter how much I paid in origination fees, Turbotax Deluxe prompts me to answer "Tell us about any points paid to XYZ2 Loan Services. Be sure to check all that apply to this loan (or refinance):

1. This is a new loan on which I paid points (origination fees) in 2022

2. I bought or improved my main home with this loan in 2022

3. I'm spreading the points over the life of my loan (amortizing)

4. I have no points to deduct for this loan

I check-marked option #1, but would I also check-mark option #2?

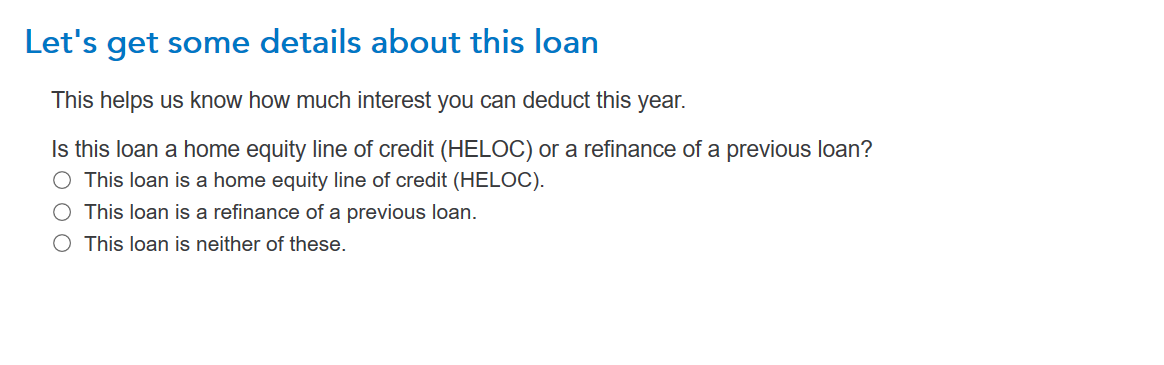

It then asks in the next page,"Is this loan a home equity line of credit (HELOC) or a refinance of a previous loan?

1. This loan is a home equity line of credit (HELOC)

2. This loan is a refinance of a previous loan

3. This loan is neither of these

I check-marked option #2

Lastly, when it scans for errors, it asks about my initial home loan lender. "Home Mortgage Interest Worksheet (XYZ1 Loan Services):" Refi must be entered.

1. No entry

2. Refinance Yes

3. Refinance No

I would check-mark "Refinance No" since the original home loan was not a refinance, correct?

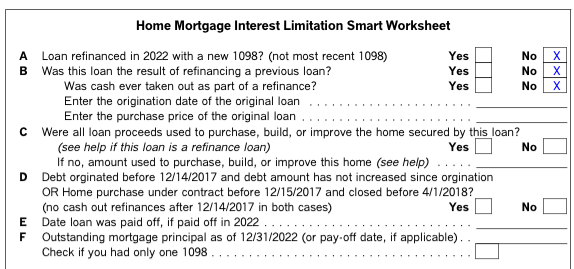

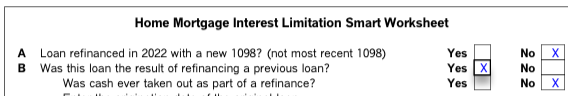

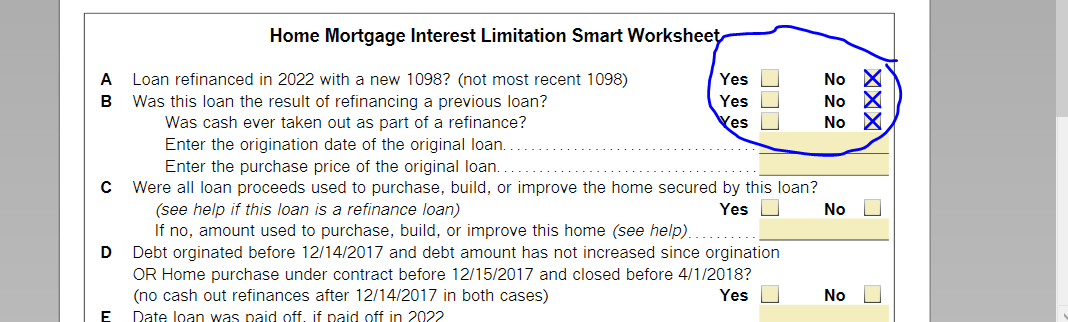

Now when I go look at the home interest worksheet in the forms for the NEW loan (refinance), this screenshot below is what it's showing. I would think B would be Yes. I'm not sure why it's not recognizing it was refinance of a previous loan. Can you please help?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refinanced my home in 2022

Please follow the instructions on how to enter this information in the following Turbo Tax article. In the instructions, it has some useful information.

- In the first point you mentioned above, you will uncheck the box that asks if this is a new loan. It's not a new loan but simply the old loan with renegotiated terms.

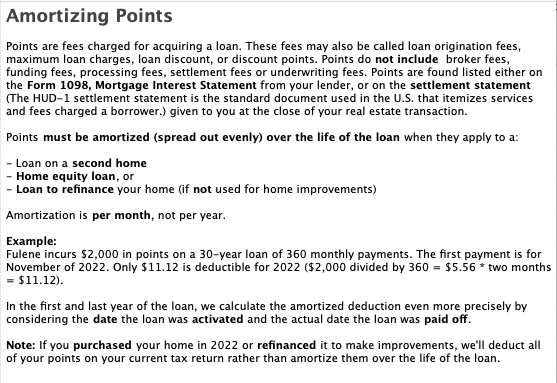

- Be sure to mark option 3 also regarding the points. The points on a refinance need to be amortized over the life of the loan.

- You will select the second option listed because you I bought or improved your main home with this loan in 2022.

- Then you will check that this is a refinance of a previous loan.

- Then no would be the answer asking if the original loan was a refinance.

Reach back if you have further questions.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refinanced my home in 2022

Hi. Can you please help me with the very last part of my question regarding the mortgage worksheet for the new loan that I used to refinance the original loan?

Now when I go look at the home interest worksheet in the forms for the NEW loan (refinance), this screenshot below is what it's showing. I would think B would be Yes. I'm not sure why it's not recognizing it was refinance of a previous loan. Can you please help?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refinanced my home in 2022

Please see the following

“I would like to take a deeper look at this. However, I need a diagnostic file which is a copy of your tax return that has all of your personal information removed. You can send one to us by following the directions below:”

|

TurboTax Online:

TurboTax Desktop/Download Versions:

[EDIT 2/27/2023 11:00 AM PST]

|

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refinanced my home in 2022

Sorry, I couldn’t open this.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refinanced my home in 2022

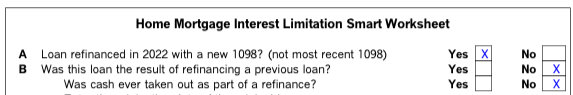

When I opened up your file, I see the issue is correctly resolved with both Box A & B checkmarked Yes. Maybe run an update on your TTD to resolve your issue. When you go into the second mortgage input, make sure Box 7 is checked off. then in the next screen, check off the 1st two boxes like this

then hit continue, any points paid with loan, and then continue, Lets see if this is the most recent form for this loan, yes and then finally the next screen, this loan is a refinance.

Hope everything is good now!

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refinanced my home in 2022

Question. How would I answer the same questions mentioned in your previous response if I had 2 1098’s since my refinance? In this scenario I’m asking about, there is a total of 3 1098’s. One before refinancing. Two after refinancing.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refinanced my home in 2022

Since you have multiple Form 1098 mortgage forms from refinancing you will enter them one at a time. If you paid points when you obtained the loan, no matter if it's the original loan or a refinance, you can get a deduction. Generally, this deduction is taken over the life of your loan. But, when you get a new loan, the points you are amortizing from the old loan can be deducted in full. You can also begin amortizing any new points you paid when you refinanced.

Below are the steps to follow:

Enter the original loan first:

- Sign in to TurboTax and select Pick up where you left off or Review/Edit under Deductions & Credits.

- Select Show more next to Your Home and Start or Revisit next to Mortgage Interest and Refinancing (Form 1098).

- Answer Did you pay any home loans in 2022? and Continue.

- You can either sign in to your financial institution and import your 1098 forms, or select Change how I enter my form.

- Next, you can either upload a digital copy or Type it in myself.

- Continue through and be sure to enter this 1098 exactly as it appears.

- Answer the questions, and when you get to the Let's see if this is the most recent form for this loan screen, answer No to Is 1098 you're working on now the most recent for your loan?

- In the next Let's get some details about this loan screen, and answer whether or not this is the original loan used to purchase your home.

- If it was, answer Yes.

- If you've previously refinanced and this wasn't the original loan, answer No, and we'll ask you a few more questions.

- When you're done, you'll be taken back to the Your 1098 info so far screen.

To Enter Form 1098 for the New Loan please follow these steps in the link below:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refinanced my home in 2022

Hi @AbrahamT again. Sorry for the delay in response. I'm still not 100% certain of the responses you provided considering @DaveF1006 had conflicting responses.

"Tell us about any points paid to REFINANCED LOAN MORTGAGE LENDER. Be sure to check all that apply to this loan (or refinance):

1. This is a new loan on which I paid points (origination fees) in 2022

2. I bought or improved my main home with this loan in 2022

3. I'm spreading the points over the life of my loan (amortizing)

4. I have no points to deduct for this loan

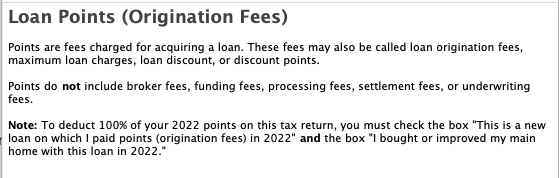

Dave said to check boxes 2 and 3. You (AbrahamT) said to check boxes 1 and 2. Would a refinance be considered a "new loan"? When I click on the "learn more for box 1 "new loan," I get:

When I click on box 3 "spreading the points," I get:

However, no matter what combo of these boxes and after running the update, I still get an error at the end on the home interest form of the ORIGINAL loan mortgage lender worksheet.

This is how the home interest worksheet boxes A and B and C are currently on the ORIGINAL loan worksheet:

This is how the home interest worksheet boxes A and B and C are currently on the REFINANCED loan worksheet:

On your previous response, you advise to press YES for both box A and B (I am assuming you meant on the ORIGINAL loan worksheet), but that does not make sense to me. Why would I answer YES to "was this loan the result of refinancing a previous loan" on the original loan I used for my home? I would like you to please re-look at the situation and advise. Let me know if I am not looking at this correctly. I am happy to provide another token, let me know.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refinanced my home in 2022

Here we go

Try this

Start inputting the info on that first house

When you get to this screen, don't answer anything

Next screen, put in all the loan details, next screen

Is this loan secured by a property of yours, hit yes

Next screen, don't discuss anything about the points, don't answer anything

then Lets see if this is the most recent form for this loan, you'll answer no

On the next screen, lets get some details about this loan, DON'T answer anything

next screen, have you used the money from this loan exclusively on this home, answer yes

then when you go to forms, everything will be checkmarked no.

I hope this will work for you now.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refinanced my home in 2022

Hi Abraham and Dave

I don't think either of you answered the original poster's main question. Why is turbotax checkmarking the box B "Was this loan the result of refinancing a previous loan?" as No instead of Yes? It should be Yes based on how he answered. I also answered This loan is a refinance of a previous loan. Yet it still checkboxes No. Seems wrong and a bug on Turbotax's part. I noticed that in the 2022 edition as well. However, I think it has no impact on filling out Schedule A. Just doesn't breed confidence when there are bugs like this.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

MarkMConverse

Returning Member

user17519972176

New Member

user17519972176

New Member

ecufour

Returning Member

Titanopsis

New Member