- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: NJ SUI and SDI vs NJ SDI

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NJ SUI and SDI vs NJ SDI

Asking for opinions here. I am an NJ resident. Does it make more sense to work in NY or NJ (purely on a tax perspective for this discussion)?

This is what I understand:

1. NJ state taxes < NY state taxes

- It is possible to work in NY and then file taxes in NJ after without having to double pay so this may not be a great concern.

2. NJ SDI (max: 649.54) > NY SDI (max: 0.60/week)

- For SDI, does it only have to be paid in the state you are working in?

- If I work in NJ, I will pay for NJ SDI. But if I work in NY, the NY SDI will be withheld but when I do file taxes, do I have to pay the additional to NJ since NJ's SDI is higher?

3. NJ has SUI (max: 153.86) while NY does not.

- For SUI, does it only have to be paid in the state you are working in?

- If I work in NJ, I will pay for NJ SDI. But if I work in NY, there is no NY SDI so when I do file taxes, do I have to pay the additional to NJ?

Thank you in advance!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NJ SUI and SDI vs NJ SDI

If you live in NJ and work in NY you have to file a NJ resident tax return and a NY nonresident tax return. You pay NY tax on your income from NY. On your NJ tax return you get a "credit for income taxes paid to other jurisdictions." The credit essentially eliminates the New Jersey tax on the income that was taxed by New York, but the credit is not the full amount of the NY tax. You still pay the full New York tax on your NY income. The New York tax rates are higher than the New Jersey rates, so you are paying more tax than you would if you earned the same income in NJ.

Unless you prepare your tax returns yourself on paper, there is an additional cost for filing a second state tax return.

SDI and SUI are paid only to the state that you work in. You only pay what is withheld from your pay. You do not have to pay additional SDI or SUI on your tax return.

New Jersey also withholds FLI. New York also withholds PFL.

SDI, SUI, FLI, and PFL are fairly minor compared to the income tax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NJ SUI and SDI vs NJ SDI

Thank you for your reply, rjs! It was helpful. Here are some follow up questions.

1. How much with the additional cost for filing a second state tax return amount to?

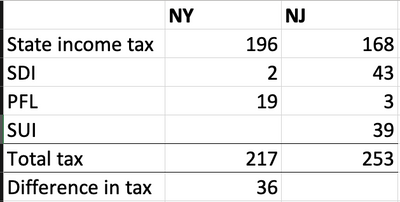

2. I understand that SDI, SUI, FLI, and PFL are fairly minor compared to the income tax. However, a friend was sharing with me his situation - both when (a) he was living in NJ and working in NY vs (b) when he was living and working in NJ. Provided some rough figures below (assuming gross is about 3.5-4k biweekly) and it seems like in some situations, it might be better to live and work in NJ?

Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NJ SUI and SDI vs NJ SDI

@kdivaa wrote:

How much with the additional cost for filing a second state tax return amount to?

With TurboTax Online it's $50 for an additional state return, including e-filing. With the CD/Download TurboTax software it's $45 for the additional state return. There is no charge for e-filing a New York return, so in your particular case there would be no additional cost for e-filing a second state. (For any other state there would be an additional $25 fee if you e-file the second state.) These are current prices for 2020 tax returns.

@kdivaa wrote:

a friend was sharing with me his situation -

It looks like your friend is sharing the withholding from his paychecks. That has nothing to do with the amounts on the tax return or the actual amounts of tax that he paid for the year. The state income tax withholding is essentially an estimate and could be way off from the total tax for the year on his tax return. He could have a big refund or a big payment due on the tax return. And the SDI, SUI, FLI, and PFL all have maximum amounts for the year. Once you reach the maximum, the withholding stops for the rest of the year. So comparing the deductions on one paycheck tells you nothing.

@kdivaa wrote:

it seems like in some situations, it might be better to live and work in NJ?

That's probably true in most situations, assuming that the salary is the same, since New York income tax rates are higher than New Jersey income tax rates. And in keeping with your original question, this is "purely on a tax perspective," ignoring any other considerations.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17620428287

New Member

user17604831070

New Member

DMTCPAW

Returning Member

Ebun1

New Member

Perry Brown

New Member