- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: multiple 1099-DIV's with multiple foreign countries

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

multiple 1099-DIV's with multiple foreign countries

I have three 1099-Div's with a total of 10 countries plus two separate RIC listings across them. I list all the appropriate sources as requested by the Easy Step program but it will not let me enter the income for more than one (sometimes two) each time I attempt to complete the process. With each restart, I have deleted the Form 1116 to attempt a fresh start. How should I be doing this?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

multiple 1099-DIV's with multiple foreign countries

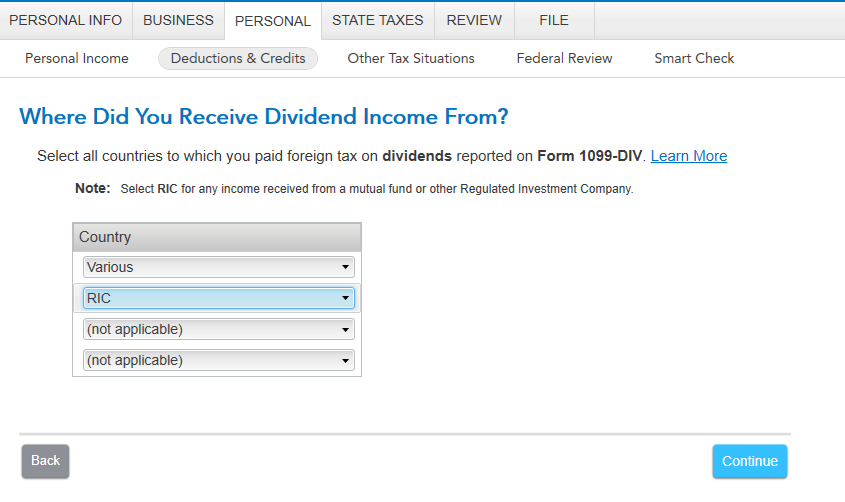

When you select the country in the drop-down menu, select various for the non-RIC listings. This should allow you to enter the total income and foreign taxes paid using this option since it is all dividend income. See if this works.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

multiple 1099-DIV's with multiple foreign countries

When I get past this I get excess taxes that goes toward future years but also a message that I can't file electronic ly. Is this normal? Sagilj

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

multiple 1099-DIV's with multiple foreign countries

No. Wait until 03/10 when Form 1116, Sch B, Foreign Tax Carryover Reconciliation Schedule is available. On 03/11, you should be able to electronic file your return with no restrictions. I would wait 03/12 to electronic file just to be safe.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

multiple 1099-DIV's with multiple foreign countries

No. Wait until 03/10 when Form 1116, Sch B, Foreign Tax Carryover Reconciliation Schedule is available. On 03/11, you should be able to electronic file your return with no restrictions. I would wait 03/12 to electronic file just to be safe.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

multiple 1099-DIV's with multiple foreign countries

I need a clarification. Are you saying to use "various" for all the foreign income or have two separate entries - one for "various" and one for "RIC"? I am finding the latter to be difficult to do but it could be operator error.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

multiple 1099-DIV's with multiple foreign countries

It would be easiest and allowed to just use various.

You can use both RIC and Various. Enter them both on the screen Where Did you Receive Dividend Income From? Then the program will ask you about each one so you can enter the income and taxes related to each category. The program doesn't like to use both for one 1099-DIV. It wants one per choice so various is the only real solution when you have both on one form.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Rockpowwer

Level 4

Matilda

Level 3

household11

Returning Member

sanpilot

New Member

smgrant

New Member