- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Mortgage points

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage points

Where does one record the full amount of mortgage points paid? The only options are for amortizing or when there are no points to deduct.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage points

The tax treatment of points depends on the loan.

If points paid on a mortgage were for the purchase or improvement of a personal residence, they may be deducted in the year they are paid.

Points paid to refinance a home mortgage are not deductible when paid, but must be capitalized and the deduction spread over the life of the loan (amortized).

Follow these steps to add points paid:

- Under the Federal menu, choose Deductions & Credits

- Click Edit/Add next to Mortgage Interest and Refinancing (Form 1098)

- Click Review next to the correct lender

- Verify the lender, click Continue

- Answer the question Do any of these uncommon situations apply, click Continue

- Verify the entries on the 1098 (this does not include the points) and click Continue

- Now you are at the points screen, answer the question appropriately. You will likely choose the first option, We paid points... The mortgage origination date is know based on the information entered on the previous screen for the 1098. Click Continue

- On this screen, provide the information about the points you paid. Click Continue.

This question was previously answered by VictoriaD75

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage points

The tax treatment of points depends on the loan.

If points paid on a mortgage were for the purchase or improvement of a personal residence, they may be deducted in the year they are paid.

Points paid to refinance a home mortgage are not deductible when paid, but must be capitalized and the deduction spread over the life of the loan (amortized).

Follow these steps to add points paid:

- Under the Federal menu, choose Deductions & Credits

- Click Edit/Add next to Mortgage Interest and Refinancing (Form 1098)

- Click Review next to the correct lender

- Verify the lender, click Continue

- Answer the question Do any of these uncommon situations apply, click Continue

- Verify the entries on the 1098 (this does not include the points) and click Continue

- Now you are at the points screen, answer the question appropriately. You will likely choose the first option, We paid points... The mortgage origination date is know based on the information entered on the previous screen for the 1098. Click Continue

- On this screen, provide the information about the points you paid. Click Continue.

This question was previously answered by VictoriaD75

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage points

I'm using Turbo Tax Deluxe. I do not see a Edit/Add option next to Mortgage Interest and Refinancing Form, nor a Review next to the correct lender.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage points

Let's try it this way from the Desktop version.

- Deductions & Credits

- I'll choose what I work on

- Under Your Home

- Select Mortgage interest, Refinancing ... [Update]

- List of lender's names [Edit} the one you want

- Option to correct lender's name

- Answer None of these apply

- Enter your 1098 here

- Answer question on points

- Continue with questions to the end

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage points

I am using TruboTax Premier and it is not allowing me to deduct the complete value of the points I paid for my home mortgage loan originated in 2019. I have read the requirements for this on the IRS web site and meet all the criteria. How can I "force" TurboTax to NOT amortize the points of the length of the loan.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage points

Same situation for me, how can we fix this issue? TurboTax is not showing the option for me to input the paid points

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage points

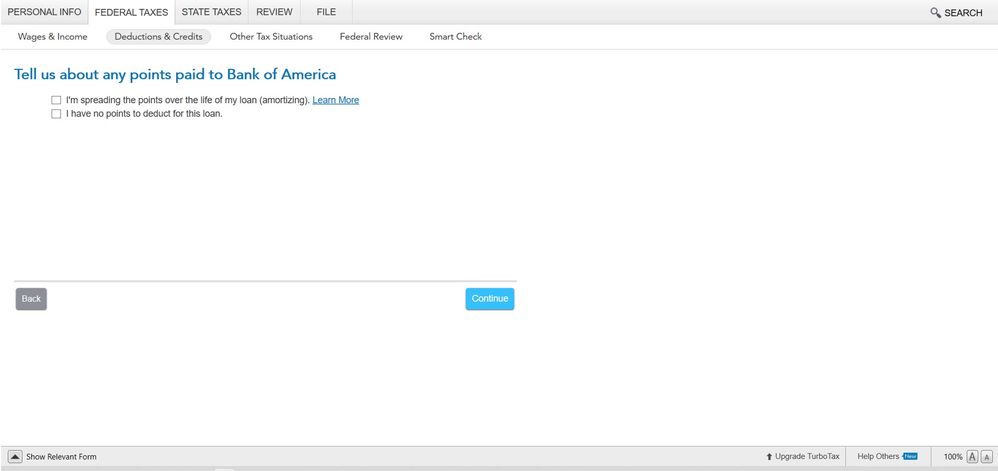

If points paid on a mortgage were for the purchase or improvement of a personal residence, they may be deducted in the year they are paid or amortized. Are you entering a mortgage statement for a mortgage that originated in 2021? Looking at your screenshot, it doesn't look that way. When did you take out the mortgage and pay the points?

Points paid to refinance a home mortgage are not deductible when paid, but must be capitalized and the deduction spread over the life of the loan (amortized).

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

mlefoltz

New Member

robertmozola

New Member

jgackson

Level 3

goldbeda

Level 2

mankind26

Level 1