- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Instructions for turbo tax: For people doing Qualified Charitable Deductions (QCD) for their RMD, they need to provide some supporting documentation with their return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Instructions for turbo tax: For people doing Qualified Charitable Deductions (QCD) for their RMD, they need to provide some supporting documentation with their return.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Instructions for turbo tax: For people doing Qualified Charitable Deductions (QCD) for their RMD, they need to provide some supporting documentation with their return.

The IRS does not require any supporting documentation to be included with your tax return when reporting a QCD.

To report a QCD in TurboTax, enter the Form 1099-R under Wages & Income -> Retirement Plans and Social Security -> IRA, 401(k), Pension Plan Withdrawals (1099-R). In the follow-up indicate that some or all of the distribution was transferred to charity. TurboTax will include the entire amount on Form 1040 line 15a of Form 1040 line 11a but will exclude the QCD amount from the amount on line 15b or 11b. TurboTax will include the notation "QCD" next to the line.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Instructions for turbo tax: For people doing Qualified Charitable Deductions (QCD) for their RMD, they need to provide some supporting documentation with their return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Instructions for turbo tax: For people doing Qualified Charitable Deductions (QCD) for their RMD, they need to provide some supporting documentation with their return.

Thank you but all of the follow up questions referred to disasters, etc. I didn't see any field for contributions to charity. What did I miss? Thank you so much for any help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Instructions for turbo tax: For people doing Qualified Charitable Deductions (QCD) for their RMD, they need to provide some supporting documentation with their return.

I went back and walked through entering 1099-R information but did not find a reference to QCD entry, what am I missing

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Instructions for turbo tax: For people doing Qualified Charitable Deductions (QCD) for their RMD, they need to provide some supporting documentation with their return.

I think you're not finding the QCD questions because you aren't clicking the edit button on the IRA line. I was doing the same thing. It took me a ridiculous amount of time to learn this.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Instructions for turbo tax: For people doing Qualified Charitable Deductions (QCD) for their RMD, they need to provide some supporting documentation with their return.

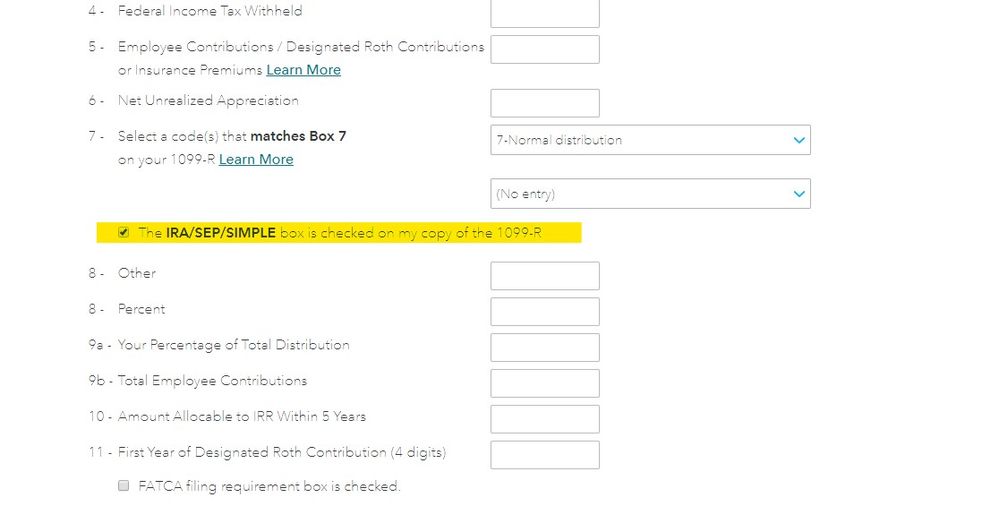

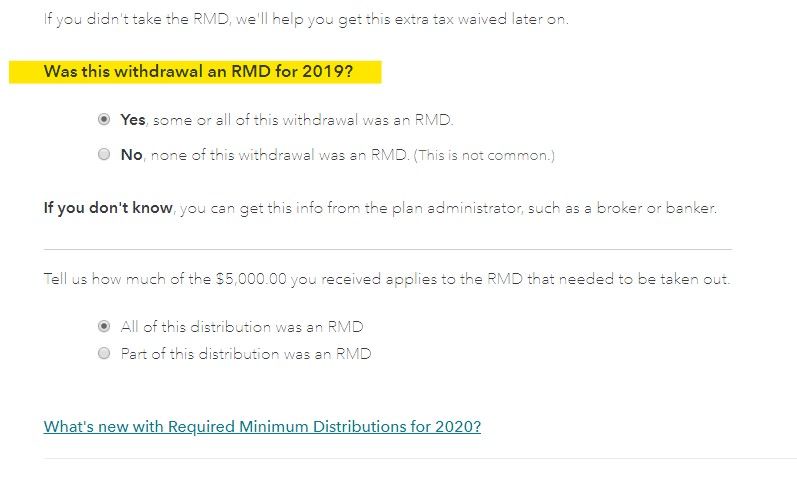

May I suggest you delete the 1099-R and enter it again so you can see all the screens ... make sure the IRA box is marked and your age is correct in the MY INFO section and that part/all was an RMD ... these are the screens you should see ....

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Instructions for turbo tax: For people doing Qualified Charitable Deductions (QCD) for their RMD, they need to provide some supporting documentation with their return.

I’m playing with TurboTax deluxe and can’t see where there is a question related to the contribution going to a charity for a QCD when entering the 1099-R. I can see where you can put in the adjustment in Forms mode but not in the interview section Please advise.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Instructions for turbo tax: For people doing Qualified Charitable Deductions (QCD) for their RMD, they need to provide some supporting documentation with their return.

If this is for the 2020 return then be aware that many parts of the 2020 program is NOT functional yet and will not be until sometime in January at the earliest.

If this is for any other tax year review my answer with all the screenshots to find the screen you seek ... delete the 1099-R and start that section over again if needed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Instructions for turbo tax: For people doing Qualified Charitable Deductions (QCD) for their RMD, they need to provide some supporting documentation with their return.

I was using 2019 deluxe, not TurboTax business. There was no interview question related to deduction going to charity. I’ve deleted the 1099 entry numerous times but no question as to the contribution going to a charity. There is nothing related to QCD.

I’ve entered information into gross distribution, taxable amount, total distribution checked box, normal distribution for box 7, checked box for Ira simple and no questions come up for any part of donation to charity. Have to go to forms mode for that.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Instructions for turbo tax: For people doing Qualified Charitable Deductions (QCD) for their RMD, they need to provide some supporting documentation with their return.

Ok ... then back to the MY INFO section ... is your birth year correct ? The QCD will only be presented if you are 70 or older.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Instructions for turbo tax: For people doing Qualified Charitable Deductions (QCD) for their RMD, they need to provide some supporting documentation with their return.

That did it, thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Instructions for turbo tax: For people doing Qualified Charitable Deductions (QCD) for their RMD, they need to provide some supporting documentation with their return.

I am just now trying to put in my QCDs and have run into the same problem. However I turned 70.5 in 2020 in April. My birth date in the personal info section is correct, however I still do not get these screens. I just updated TT today.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Instructions for turbo tax: For people doing Qualified Charitable Deductions (QCD) for their RMD, they need to provide some supporting documentation with their return.

That 1099-R section of the program may not be fully functional yet ... expected date is 1/14 but it may be delayed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Instructions for turbo tax: For people doing Qualified Charitable Deductions (QCD) for their RMD, they need to provide some supporting documentation with their return.

Thank you, Critter-3. I'll update again next week and see if the same issue exists.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

Scott G1

New Member

snaygro-icloud-c

New Member

joyce-nord

New Member

meglav

Returning Member

BSSE1

Level 1