- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: I received a delayed refund from the IRS. They paid me $416 in interest. I have to claim the ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a delayed refund from the IRS. They paid me $416 in interest. I have to claim the interest but can't find where. Where do I claim the interest?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a delayed refund from the IRS. They paid me $416 in interest. I have to claim the interest but can't find where. Where do I claim the interest?

It would be claimed as regular interest. You should get a Form 1099-INT from the IRS withthe $416 in box 1.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a delayed refund from the IRS. They paid me $416 in interest. I have to claim the interest but can't find where. Where do I claim the interest?

Thank you - I did get a letter. And holy cow...it's turned vertically tiny on the side! Oh dear... totally missed that.. now just need to figoure out where in turbo tax to put it. 🙂

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a delayed refund from the IRS. They paid me $416 in interest. I have to claim the interest but can't find where. Where do I claim the interest?

You will enter your Form 1099-INT into TurboTax in the "Wages and Income" section under "Interest and Dividends" . It is the same as entering a 1099-INT issued by private payer.

This interest is taxable on both your state and federal tax returns.

You can enter your Form 1099-INT information using the steps below:

- Open your return

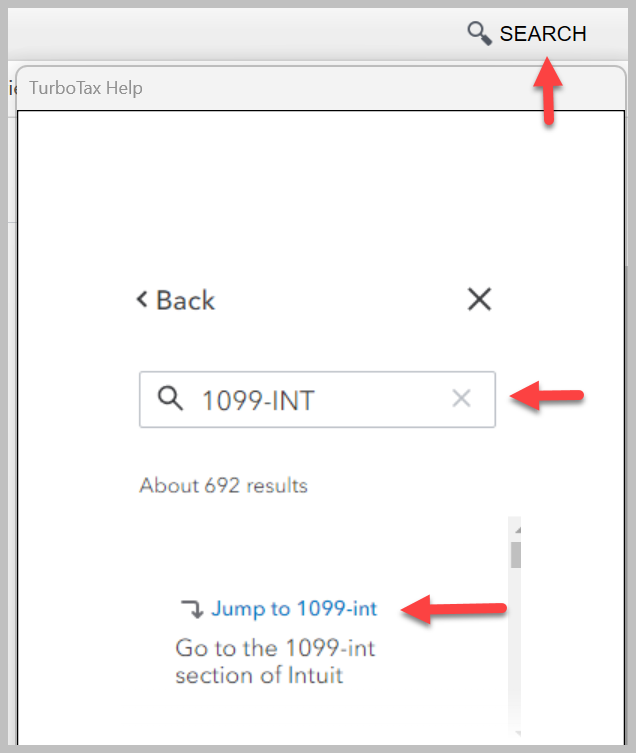

- In the search Bar enter Form 1099-INT

- Select "Jump to 1099-INT"

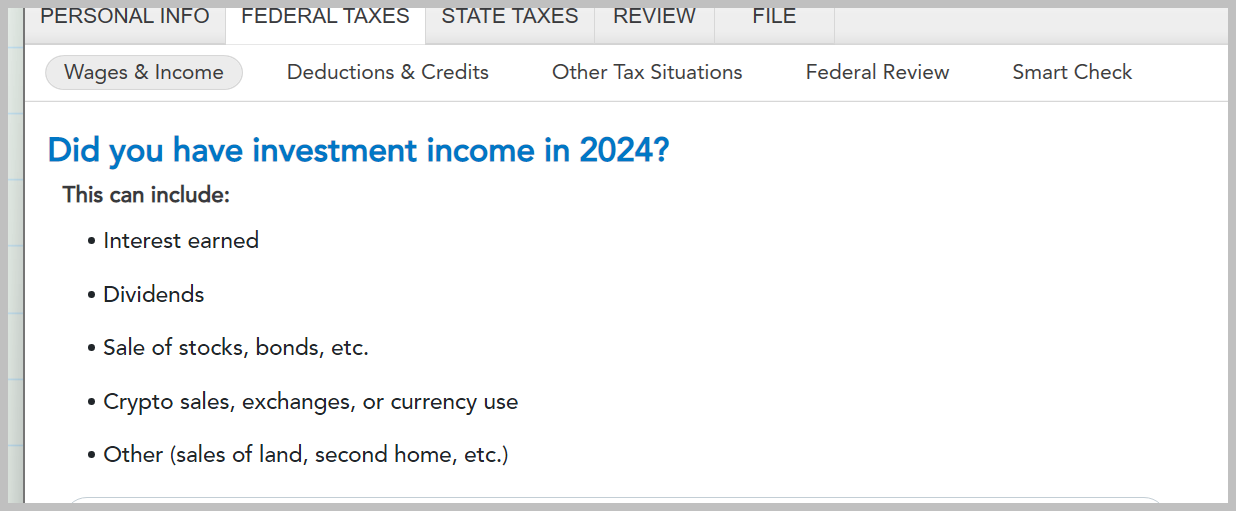

- It will ask, "Did you have investment income in 2024?" Select "Yes"

- Select "Continue"

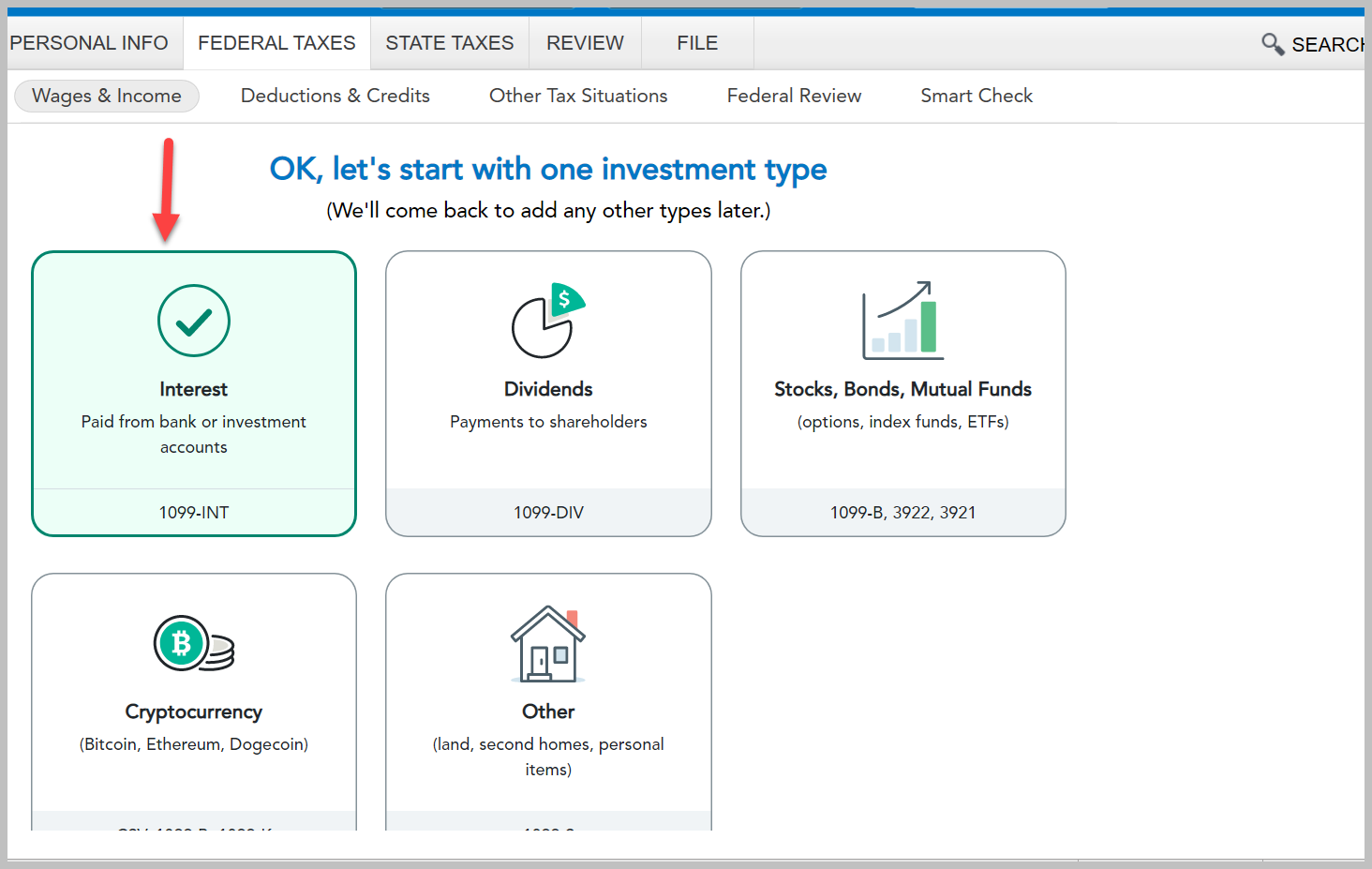

- Select "Skip Import"

- You will Select your investment type which is "Interest"

- You will "Continue"

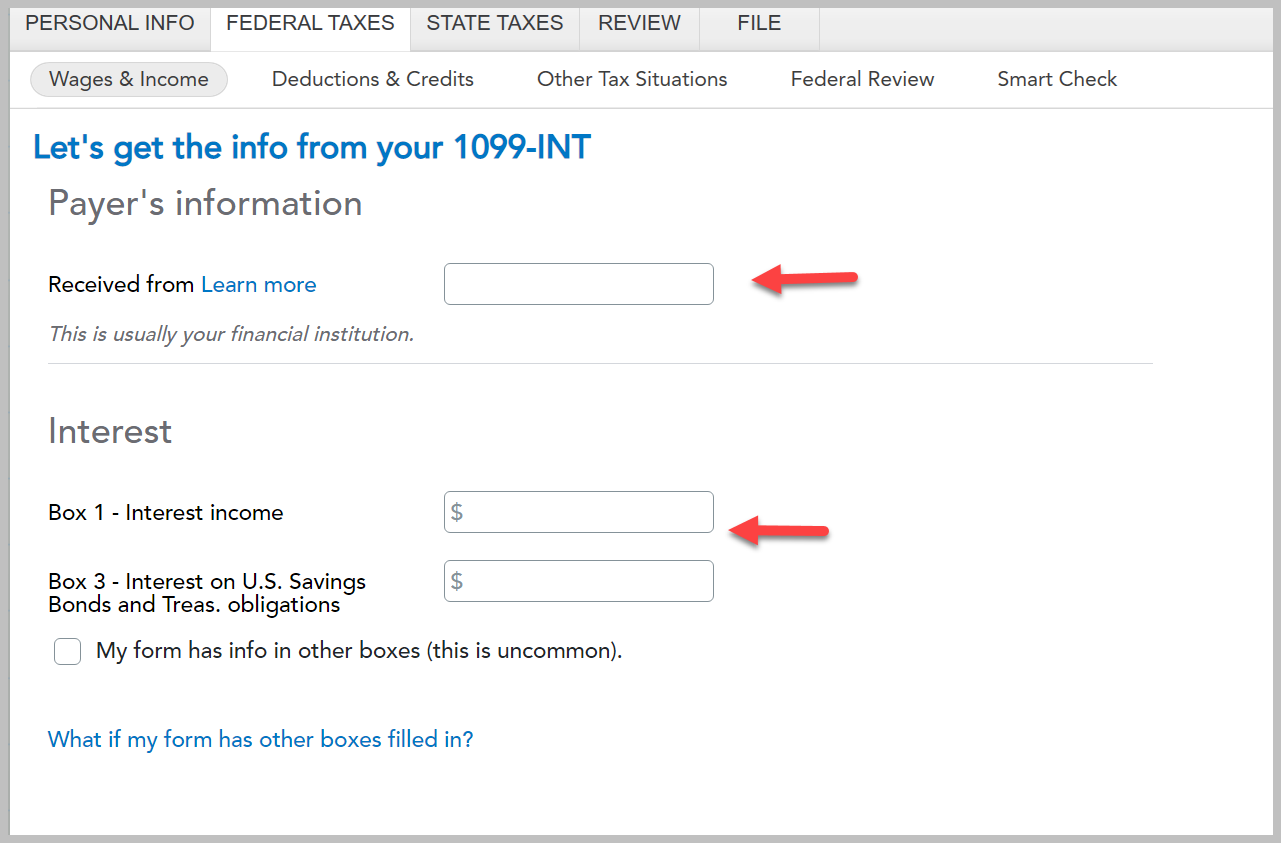

- Then you will see the screen "Let's get the info from your 1099-INT"

- You will type in the information from your Form 1099-INT on that page.

Your screens will look something like this:

Click here for information on entering a Form 1099-INT.

Click here for Turbo Tax information regarding Forms 1099-INT.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17539892623

Returning Member

pivotresidential

New Member

jjon12346

New Member

user17549300303

New Member

jstan78

New Member