- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: I have total Itemized Deductions of $29,697 (joint tax return with my wife), yet Turbotax sel...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

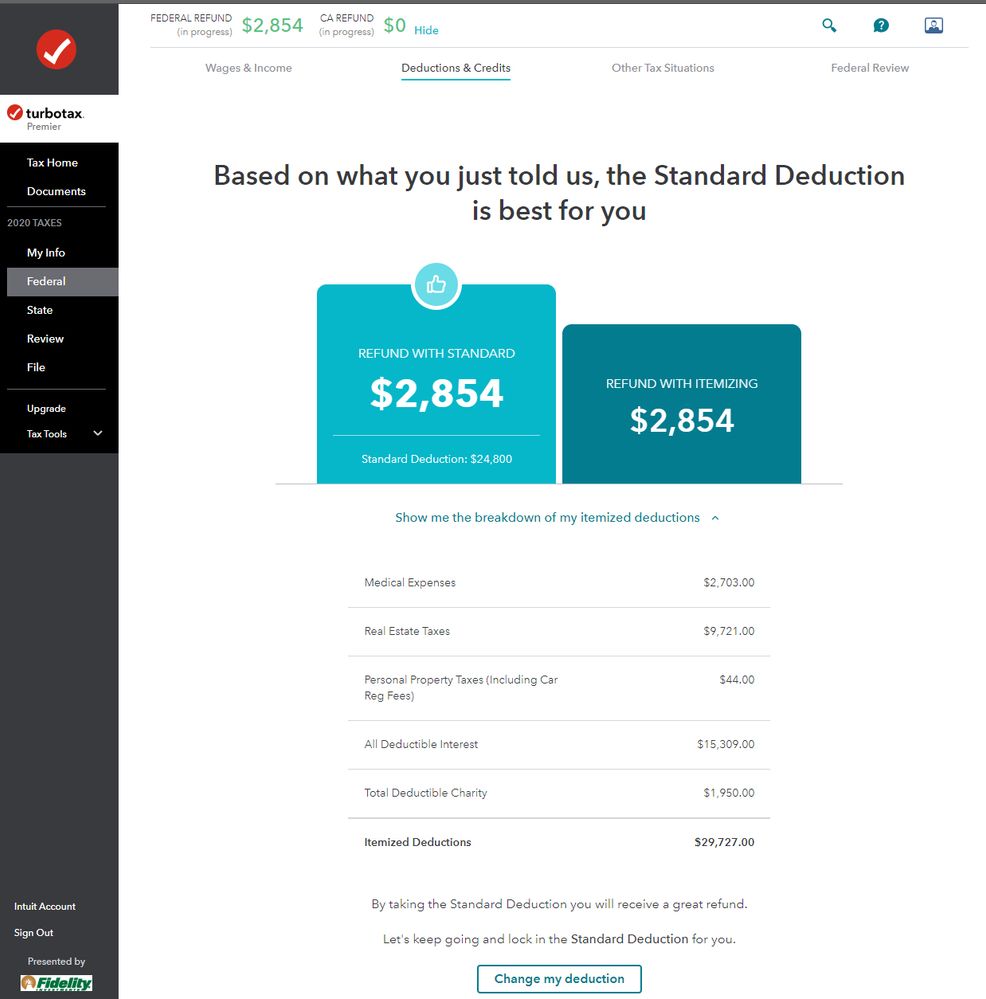

I have total Itemized Deductions of $29,697 (joint tax return with my wife), yet Turbotax selects the Standard Deduction of $24,800. Tried overriding but cannot. Why?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have total Itemized Deductions of $29,697 (joint tax return with my wife), yet Turbotax selects the Standard Deduction of $24,800. Tried overriding but cannot. Why?

It may be that the total of your itemized deductions is more than the allowable itemized deductions. For instance, you can only deduct $10,000 of state income/property taxes as itemized deductions on your federal return. Also, medical expenses are only deductible to the extent they are over 7.5 percent of your adjusted gross income.

So, it may be that your allowable itemized deductions are less than your standard deduction, but your total itemized deductions are more.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have total Itemized Deductions of $29,697 (joint tax return with my wife), yet Turbotax selects the Standard Deduction of $24,800. Tried overriding but cannot. Why?

Thomas,

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have total Itemized Deductions of $29,697 (joint tax return with my wife), yet Turbotax selects the Standard Deduction of $24,800. Tried overriding but cannot. Why?

There is another possibility, that your income is low and that your standard deduction is sufficient to eliminate it. Also, if that is all you withheld, that is all you would get back, apart from refundable credits.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

KarenL

Employee Tax Expert

Ninaya1

New Member

MADELYNNCAROL

New Member

Viking99

Level 2

cj5

Level 2