- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: How do I know if I've been eligible for/made the simplified foreign tax limitation election f...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I know if I've been eligible for/made the simplified foreign tax limitation election for AMT in a previous year?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I know if I've been eligible for/made the simplified foreign tax limitation election for AMT in a previous year?

If you did make the simplified foreign tax limitation election for AMT in a previous year, you would have only one Form 1116 for each type of income. For example, if you only had foreign tax credit on wages in a prior year, and you did make the simplified election, you would have only one Form 1116 for general limitation income.

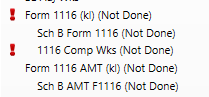

If you did not make the election, you would have 2 Forms 1116 for general limitation income in your return, one for regular tax and one for AMT.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I know if I've been eligible for/made the simplified foreign tax limitation election for AMT in a previous year?

If you did make the simplified foreign tax limitation election for AMT in a previous year, you would have only one Form 1116 for each type of income. For example, if you only had foreign tax credit on wages in a prior year, and you did make the simplified election, you would have only one Form 1116 for general limitation income.

If you did not make the election, you would have 2 Forms 1116 for general limitation income in your return, one for regular tax and one for AMT.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I know if I've been eligible for/made the simplified foreign tax limitation election for AMT in a previous year?

So years ago, I see that Turbo did crank out two form 1116’ s (we are dealing wiht small numbers here) and it looks like it didn’t change my taxes. Anyway now when I go through the interview for what I will call the complicated method I have nothing to enter. It makes me think I should have made the simplified election (was I elegible?) the first time years ago?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I know if I've been eligible for/made the simplified foreign tax limitation election for AMT in a previous year?

Been using TT since 2014. All our (small) foreign income and tax has always been passive, exclusively from mutual funds with international stock holdings in a taxable account. We've never owed AMT in any year (including 2019), and have never needed more than one 1116 - in fact, until 2018 we didn't need an 1116 at all because the total amount of the foreign tax credit was below the threshold, and in 2018, it was all utilized for the credit. I did not make any "simplified election" that year because TT never asked - completely irrelevant.

So why is TT now telling me that I have elected the "simplified method" before? And why is it computing an "AMT Foreign Tax Credit Carryover" when the entire foreign tax amount is being utilized in the normal way for the credit and no AMT is imposed? It's just as irrelevant this year as it was before.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I know if I've been eligible for/made the simplified foreign tax limitation election for AMT in a previous year?

Hi KarenJ2 I do not think it is accurate to conclude - that just because one has 2 forms: Regular Form 1116 & AMT Form 1116 it automatically means person is Using OR Not Using Simplified method.

=============================

If you see only 1 form 1116 - In ALL years from the first year you started doing Form 1116 - it means you never needed to deal with AMTFTC so the opportunity to choose - AMT Simplified method or Complex Method - Never Arose as yet.

If you see both forms - In any year from the first year you started doing Form 1116 - they you need to look Deeper at the numbers.

Detailed Explanation Below:

================================================================

As per my understanding:

[a] Normally the regular Form 1116 will be generated.

Note: In the Regular Form 1116 the:

Regular FTC Limitation = Tax (without ftc) x [Foreign Source Income / Total Worldwide Income]

[b] ADDITIONALLY

IF you have AMT taxes then you will see: (1) 6251 AMT Tax form (2) AMT Form 1116

Now on the AMT Form 1116 one has to calculate AMT FTC Limitation - i.e. the max FTC allowed for the year, rest you will have to carryforward.

AMT FTC Limitation =

AMT Tax (without any ftc credit) x [Foreign Source AMT Income / Total Worldwide AMT Income]

BUT since in above formula the "Foreign Source AMT Income" is a bit complex to calculate, IRS allows the tax payer to CHOOSE/ELECT to use in its place "Foreign Source Income" - same value that you used in the Regular Tax FTC Limitation numerator. This is called the "Simplified" method:

So your formula becomes:

AMT Simplified FTC Limitation =

AMT Tax (without any ftc credit) x [Foreign Source Income / Total Worldwide AMT Income].

Note: Basically if you do, you will use the same net foreign source income for AMT that you used for regular tax. (The amount on line 17 of your AMT Form 1116 will be the same as the amount on line 17 of your regular tax Form 1116.) You must make the election (to choose Simplified) for the first tax year after 1997 for which you claim an AMTFTC. If you don’t make the election for that year, you may not make it for a later year. Once made, the election applies to all later tax years and may be revoked only with IRS consent. [3]

=====Conclusion====================================

If you see only 1 form 1116 - In ALL years from the first year you started doing Form 1116 - it means you never needed to deal with AMTFTC so the opportunity to choose - AMT Simplified method or Complex Method - NEVER Arose as yet.

If you see Both forms - In any year from the first year you started doing Form 1116 - It does NOT tell you that you have used Simplified method or Not. - you need to look Deeper at the numbers

Note: From what I read - There is No Indicator that goes to the IRS on the Return saying I have chosen Simplified method or not. One has to Look at the number in AMT Form 1116 OR the top of Form 6251 and see if "Foreign Source Income" is being used in the numerator (so it will be matching with same as on Regular Form 1116) or "Foreign Source AMT Income" is used.

And IRS also uses this same way to determine what choice you have made.

=========================================================

Please comment if anyone think differently to share all our knowledge and correct me if I am mistaken.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I know if I've been eligible for/made the simplified foreign tax limitation election for AMT in a previous year?

@nikki20201 @I agree with you. Last time I did tax with some other company and they generated both amt and reg but reg foreign source income was same but while filling nothing was submitted related to amt. This year I m using turbo tax and it is not generating 6251 or alt min form 1116 irrespective of whether I choose simplified election or not

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I know if I've been eligible for/made the simplified foreign tax limitation election for AMT in a previous year?

I came across a discussion on another site which, if correct, might be an argument for not using the simplified method. Apparently, the simplified election does not allow for carryback/carryover of the excess limit. Accordingly, the absence of carryback/carryforward of FTC on prior returns where FTCAMT was relevant may also help identify whether you have used the simplified method previously. (Comparing the two Line 17s on the two F1116s is probably easiest though.) Likewise, more than happy to be corrected - I am definitly no expert.

Here is that discussion: https://talk.uk-yankee.com/index.php?topic=96044.0

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I know if I've been eligible for/made the simplified foreign tax limitation election for AMT in a previous year?

Thanks for your response, @Anonymous . However as many of us have pointed out, we have never owed AMT and never filed AMT-related tax forms, therefore the question of AMT FTC is completely irrelevant to us. You cannot elect to use a method for something you aren't doing at all - or should not have to, which is why it's of concern that TT is claiming we have. That's the real issue here.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I know if I've been eligible for/made the simplified foreign tax limitation election for AMT in a previous year?

Thanks Nikki!

Does this mean that if I am not seeing BOTH a Form 1116 AND a Form 1116AMT in any years I have filed then that means I have not made an election for either the simplified nor complicated method?

Will the Form 1116 AMT be named like that in Turbotax in the "Easy Step" section or will it be shown only as "Form 1116" and I have to look into it further?

What if I only see a Form 1116 and a Form 6251 in my taxes in any year I have filed taxes? Does that still mean I have not made an election for either the simplified nor complicated method?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I know if I've been eligible for/made the simplified foreign tax limitation election for AMT in a previous year?

The 1116 AMT is a separate form. About Form 1116, Foreign Tax Credit (Individual, Estate, or Trust), see page 5 for special rules regarding AMT.

@hellotax1111

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I know if I've been eligible for/made the simplified foreign tax limitation election for AMT in a previous year?

Would the heading to the form 1116 read :For Alt Min Tax purposes only --Foreign tax credit? So does this mean my tax preparer used the simplified method? Sorry, I am a true novice at completing these forms.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

girigiri

Level 3

izw0411

New Member

Lorob11

Level 1

VandB

Level 1

MJ23Bulls

Level 1