- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Found a clean way to do it within Turbotax 1040 within In...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I adjust capital gains and losses that I receive as a Nominee? How do I adjust these gains/losses?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I adjust capital gains and losses that I receive as a Nominee? How do I adjust these gains/losses?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I adjust capital gains and losses that I receive as a Nominee? How do I adjust these gains/losses?

Although TurboTax does a marvelous job of handling nominee interest and dividends, we don't have a simple system in place for dealing with capital gains.

If you have a 1099-B:

- Enter interest (Interest on a 1099-INT). When you come to the screen labeled Tell us if any of these uncommon situations apply, check We need to adjust the taxable amount. (see the screenshot below.) The following screen will list nominee interest as the first Reason for Adjustment.

- Enter dividends (Dividends on a 1099-DIV). The procedure to follow is similar to interest, above.

- For capital gains and losses, the answer is not so simple. Enter the sales exactly as reported on the 1099-B. Under the Sales Category box, you will see the sentence If you have additional info about this sale, you can enter it... (see the second screenshot.) Adjust the cost basis so that your gain comes out to your share as nominee. It's an ugly way to do it, but you will get the right answer for tax purposes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I adjust capital gains and losses that I receive as a Nominee? How do I adjust these gains/losses?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I adjust capital gains and losses that I receive as a Nominee? How do I adjust these gains/losses?

What if the capital gain is a distribution/reinvestment within a mutual fund? Same approach? (Mutual funds distributed/reinvested capital gains at the end of the year after my Mom's death so I need to zero that out of her 1040 and let the accountant reflect it on her estate's 1041.) As you observe: interest/dividends: easy; mutual fund reinvestment of tax-exempt income and capital gains, no so.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I adjust capital gains and losses that I receive as a Nominee? How do I adjust these gains/losses?

Never mind. I found the answer in the IRS instructions for 1040 Schedule D line 13: "If you received capital gain distributions as a nominee (that is, they were paid to you but actually belong to someone else), report on Schedule D, line 13, only the amount that belongs to you. Attach a statement showing the full amount you received and the amount you received as a nominee. See the Instructions for Schedule B to learn about the requirement for you to file Forms 1099-DIV and 1096."

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I adjust capital gains and losses that I receive as a Nominee? How do I adjust these gains/losses?

That worked! However, I still have a question.

Let's say that my wife and I file separately and have capital loss that we want to split 50/50.

The 1099-B comes on my SSN, which makes me the nominee, correct?

Then I will enter the 1099-B info w/ adjustment, resulting in the 8949 form w/ the adjustment and N code.

What about my wife? How can she indicate that that she has 50% of the loss reported on my 1099-B?

Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I adjust capital gains and losses that I receive as a Nominee? How do I adjust these gains/losses?

Yes, you should report the full amount of the transaction and adjust it using the N code. Your wife can enter her half just as if she received a separate 1099-B.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I adjust capital gains and losses that I receive as a Nominee? How do I adjust these gains/losses?

Where is this N code located? Does this still apply for tax year 2019? I can't seem to find this screen(s) in the 2019 TurboTax (Business and Home Edition). Please elaborate further.

Thanks,

Joseph

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I adjust capital gains and losses that I receive as a Nominee? How do I adjust these gains/losses?

Is there an update to this for 2022? I am not able to find a 'Sales Category' box on the 1099-B worksheet.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I adjust capital gains and losses that I receive as a Nominee? How do I adjust these gains/losses?

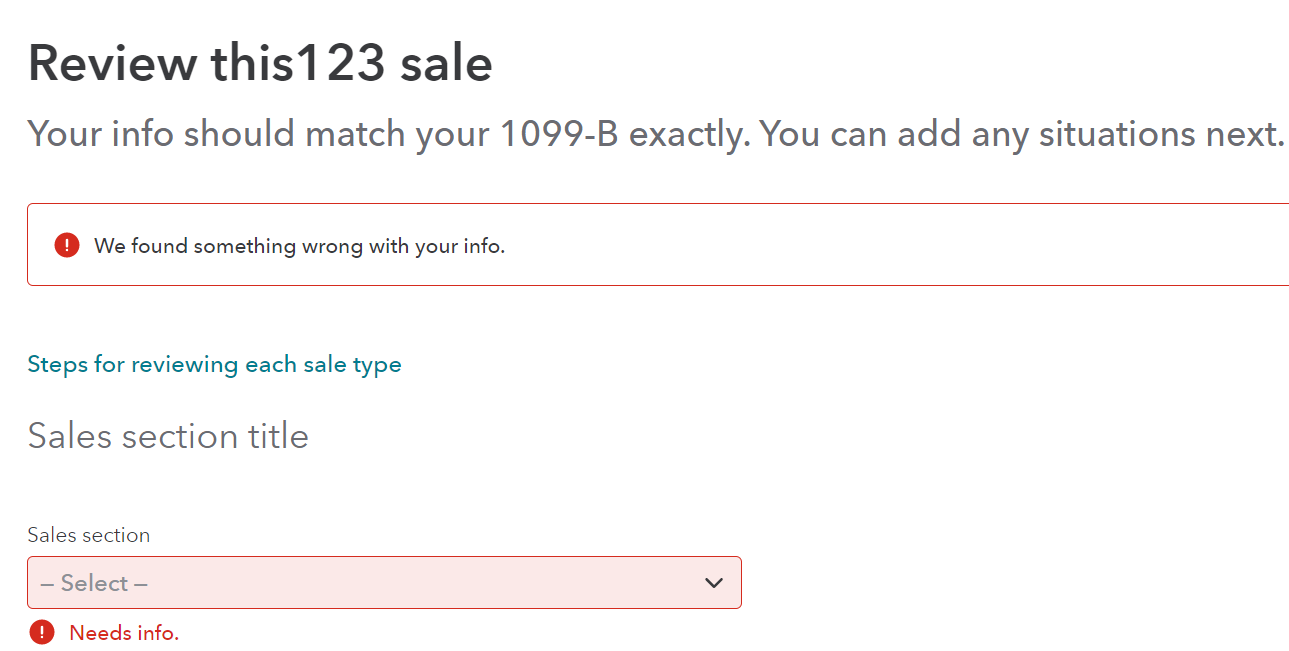

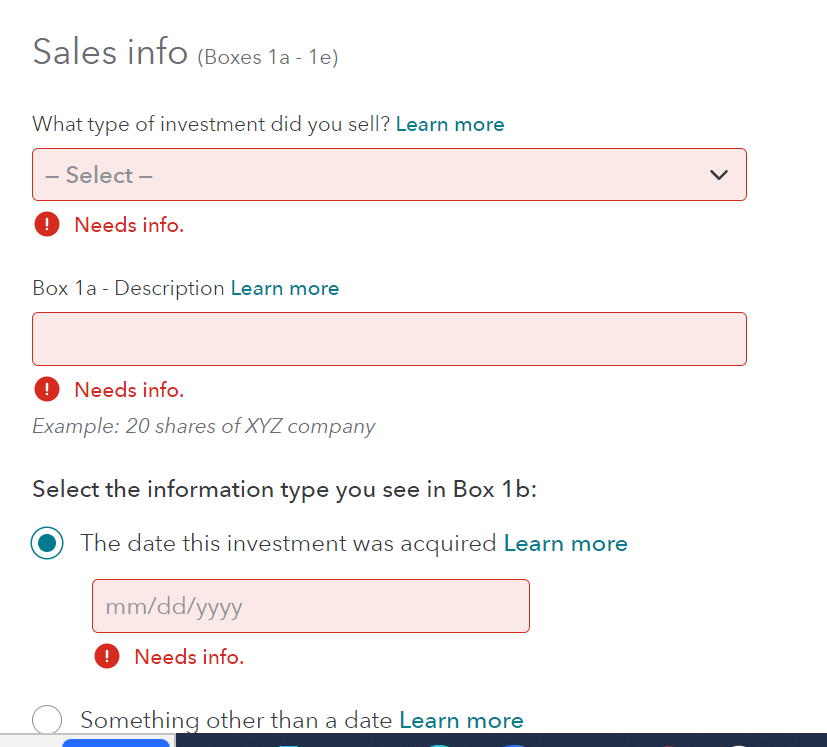

It is not clear what you are asking. However, TurboTax shows the Sales Section in the Investment interview. Please follow the steps. Also, see the screenshots.

Capital gains, losses, and 1099-B forms are all entered in the same place:

- Open or continue your return in TurboTax

- Search for investment sales and then select the Jump to link in the search results

- Answer Yes to the question Did you have investment income in 2022?

- If you land on the Your investments and savings screen, select Add investments

- Follow the instructions and we'll calculate the gain or loss from the sale

Your total capital gains for the year minus your total capital losses result in a net gain or a net loss.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I adjust capital gains and losses that I receive as a Nominee? How do I adjust these gains/losses?

Hi,

Thank you for your response. I apologize that I was unclear. I have a similar situation to what the original poster described - My wife received a consollidated 1099 from an investment account. She and her sister are each responsible for 50% of it. My wife is the nominee. My wife and I file jointly. The 1099 contains 1099-DIV, 1099-INT and 1099-B portions.

I was able to apply adjustments for the 1099-DIV and 1099-INT portions, but I cannot figure out a clean way to make an adjustment to the 1099-B (Proceeds from Broker and Barter Exchange Transactions}. I was able to make the final gains and losses come out to 50% by filling in the box "Form 8949 Reporting Exception Transactions" with imaginary proceeds and cost bases. This doesn't seem like a clean way to do it and it doesn't allow me to indicate the adjustment is a nominee (N) adjustment.

If I try the method you described above, it doesn't seem to fit because I've already imported the consolidated 1099. When I jump to investment sales my choices are to "add more sales" or "edit" the one I have. I don't want to add more, I only want to make an adjustment. If I click on "edit" I get a list of over 200 lines of individual sales followed by a summary of Box A and D gains and losses. If I chose "edit" for the summary it takes me back to the very long list of individual sales.

Is there a clean way to do this. Thank you in advance for the assistance.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I adjust capital gains and losses that I receive as a Nominee? How do I adjust these gains/losses?

Doing it your way will involve editing each transaction individually.

Delete the imported 1099-B and enter summary totals coming up to 50% of the total in each category. Once you have done this the system will generate a form 8453 and tell you that you need to mail in a copy of that form along with a copy of your 1099-B. You will electronically file the tax return and then mail in a copy of the 1099-B along with form 8453 and include the nominee information in that mailing.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

suill

Level 1

HollyP

Employee Tax Expert

HollyP

Employee Tax Expert

HollyP

Employee Tax Expert

Nutthouse

New Member