- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Form 1116 - Explanations

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1116 - Explanations

The form 1116 and 1116 Copy 1 shows an error. T. Tax is asking for Explanation statements for Line 3 A, 3 B and 3 C. These are Deductions not related to the foreign source income.

What exactly is the software asking ? Can you help ?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1116 - Explanations

From TT's on demand guidance:

Lines 3a and 3b, deductions not definitely related:

Some deductions on your return may not definitely relate either to your foreign income on line 1 or your U.S. source income. Some examples of these deductions might be medical expenses that you deducted on Schedule A, line 4, or alimony that you paid and deducted on Schedule 1 (Form 1040), line 18a. These types of deductions need to be entered on lines 3a or 3b on the Foreign Tax Credit Computation Worksheet.

If you don't itemize your deductions, your standard deduction will automatically be brought to Form 1116.

Describe on the explanation statement what the deduction was for such as the examples given above.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1116 - Explanations

From TT's on demand guidance:

Lines 3a and 3b, deductions not definitely related:

Some deductions on your return may not definitely relate either to your foreign income on line 1 or your U.S. source income. Some examples of these deductions might be medical expenses that you deducted on Schedule A, line 4, or alimony that you paid and deducted on Schedule 1 (Form 1040), line 18a. These types of deductions need to be entered on lines 3a or 3b on the Foreign Tax Credit Computation Worksheet.

If you don't itemize your deductions, your standard deduction will automatically be brought to Form 1116.

Describe on the explanation statement what the deduction was for such as the examples given above.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1116 - Explanations

Yes, it has picked up my Std deduction for line 3 (a) and Schd 1 deduction amount for Other Deductions line 3 (b)

So I should list out these deductions in the Expl statement, is that correct ?

Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1116 - Explanations

Line 3b in 1116 is wrong. Look at the instructions for 1116, line 3b should relate to foreign deductions, not IRA, not HSA, not Self Employment tax which are all US based. As a result, you would allowed a smaller tax credit, and end up paying more tax. In my case, the Intuit error would have cost me thousands of dollars.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1116 - Explanations

Mine shows the standard deduction and my return is getting rejected because of this stupid glitch.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1116 - Explanations

@goldiegirl, I have the same issue. Turbotax plugged my HSA deduction into Form 1116 3b How did you fix this error? Thanks in advance!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1116 - Explanations

Funny software. I re-ran through the Foreign Tax Credit section, making no changes (just clicking continue) and then re-submitted my return and it went thru. No idea why it was rejected at first and accepted the second time thru. Still interested in others experience with this as it seems like a glitchy area.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1116 - Explanations

Spoke too soon. Had to change the Date Paid or Accrued from 'Various' (which I've used for a number of prior year's tax returns) to a real date (I used 12/30/2020). That worked. Return is accepted by the Feds now.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1116 - Explanations

Same experience, and this happens EVERY YEAR. I went through the questionnaire again and on the second go around, it populated the explanation statement for me with, "Balance of deductions from income not claimed as definitely related on line 2."

At this point, I accept this and will file, although I'll be damned if I can understand where TT gets the numbers it put in part 3 of the FTC Computation worksheet. Using "data source" takes me to a place with different figures on Schedule A.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1116 - Explanations

I get the Smart check, "Enter, your explanation here to complete the required statement", what section did you rerun?

I too can't figure out what is being populated in the section State Income Tax Allocation Smart Worksheet. It has numbers in 3a(2) a zero in3a(4) and a number in 3a(5)a. Help says for the first two, the numbers will be transferred from a schedule A if taking itemized deductions. These numbers don't match what I have on my schedule A. And where does 3a(5)a get pulled from?

Thanks in advance!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1116 - Explanations

To look at this in detail, we would like to see a diagnostic copy of your return. The information in this file is a sanitized copy meaning there is no personal information, only numbers so that we can troubleshoot in depth, check for calculation issues, and to see how certain items are applied. Here is how to order.

For Turbo Tax online, go to tax tools>tools>share my file with agent. When this is selected, you will receive a token number. Respond back in this thread and tell us what that token number is.

If you use the desktop version, go to the black stripe at the top of the program>online>send tax file to agent. Once you receive the token number, reply back in this thread and let us know what that token number is.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1116 - Explanations

The code is:

1212436

I submitted my tax return over the weekend.

I entered what I thought the best answer ran a smart check and moved onto the problem at this thread. https://ttlc.intuit.com/community/tax-credits-deductions/discussion/turbotax-2023-capital-loss-carry...

Can you tell from my submission if I entered the correct info in these two smart check areas?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1116 - Explanations

The $39 you see on 3a(5) is the prorated amount of only your personal property taxes, whereas the $1180 is the prorated amount of only your real estate taxes. On Schedule A, these amounts are limited. But on Form 1116, the prorate percentage amount is each line divided by the total SALT deduction ($97,936). That % amount is multiplied by 10K (the amount allowed on Schedule A) to get the figure on the worksheet. You received the full amount of your foreign taxes paid ($885) on Schedule 3.

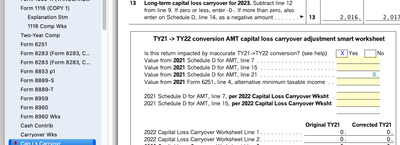

You have a $2401 capital loss carryforward for both regular tax and alternative minimum tax (AMT) to 2024.

Your capital loss carryovers appear to be correct. The carryover summary shows the correct amount of carryover from 2022. It was the 2021 capital loss carryover worksheet that had the issue, so as long as you entered the numbers from your 2021 Schedule D (AMT)/Form 6251, you are good, and your carryforward numbers are accurate.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1116 - Explanations

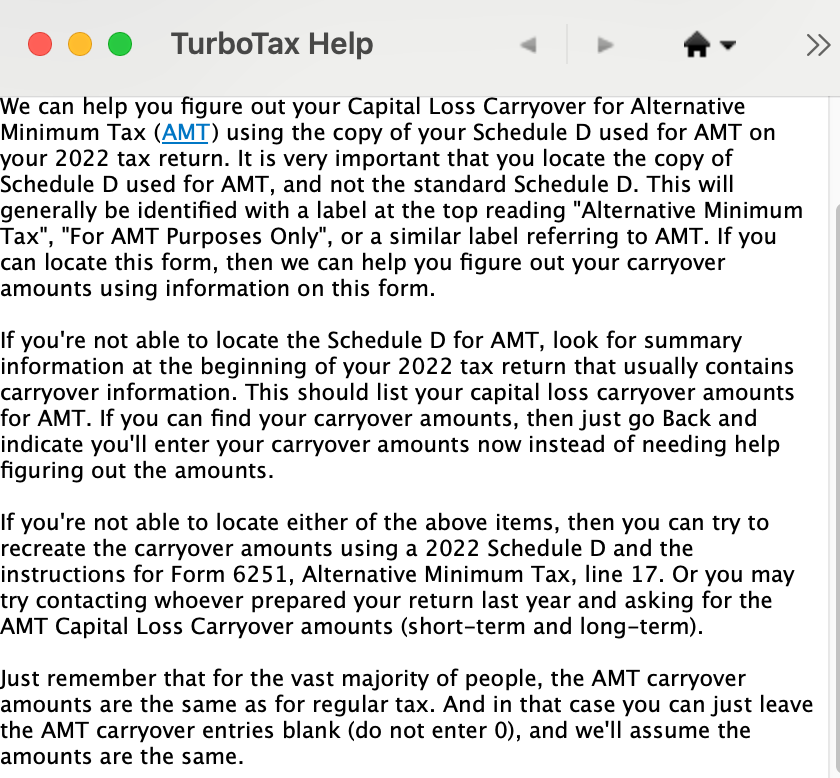

Hi Dawn,

My tax forms for that year didn't include the Schedule D (AMT)/Form 6251 and in my 2021 online TT version I had no option to amend the return as some recommend to get the forms.

Per the help (pic at the end of this post) on the screen where it asked for these numbers, the last section says something like if I leave the entries blank (do not enter 0), and we'll assume the amounts are the same. This did not work, I left it blank ran through the easy step section and I got the same error. So to get past this, I. used the numbers on my schedule D for 2021 and tried my best to recreate 6251. Once I got past that message, I had to correct the last two highlighted fields shown here.

The forms do exist in my desktop TT 2022 file these fields were blank so I entered zero. Is this correct?

Thanks for the help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1116 - Explanations

Form 6251 AMT vs regular depreciation. The AMT will be the same as regular depreciation for most people. For those who have a form 6251 in their tax return, it will reduce the allowed amount of depreciation and give you some to carry over. I see you have $1 difference on the carryover sheet pictured. If you have a carryover and can locate the amounts to enter, great. If you can't, you will be missing out on the tax difference on that amount. If it is only a few dollars, it would have no effect at all.

If you don't care about digging, you can use the regular depreciation and just lose the carryover. Normally, we can leave the AMT field blank and the computer will just use the regular depreciation. You may want to delete you form and let it repopulate or go in and enter the same amount in both columns.

You may some data stuck which is making the form think there is an issue with the blank lines. Try this if you continue to have trouble:

Desktop version:

- Delete the form

- Save your return while closing the program.

- Update the program

- Open

- Enter the information again.

Online version:

A full or corrupted cache can cause problems in TurboTax, so sometimes you need to clear your cache (that is, remove these temporary files).

For stuck information follow these steps:

- Delete the form/ worksheet- if possible, see How to Delete

- Log out of your return and try one or more of the following:

- Log back into your return.

- Enter the information again.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

AhuraMazda

Returning Member

AhuraMazda

Returning Member

user17702351396

New Member

slw4683

New Member

JimPueblo

Returning Member