- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

Hi Dawn,

My tax forms for that year didn't include the Schedule D (AMT)/Form 6251 and in my 2021 online TT version I had no option to amend the return as some recommend to get the forms.

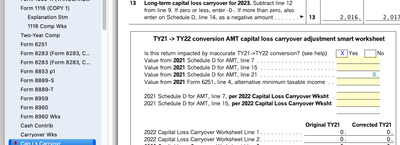

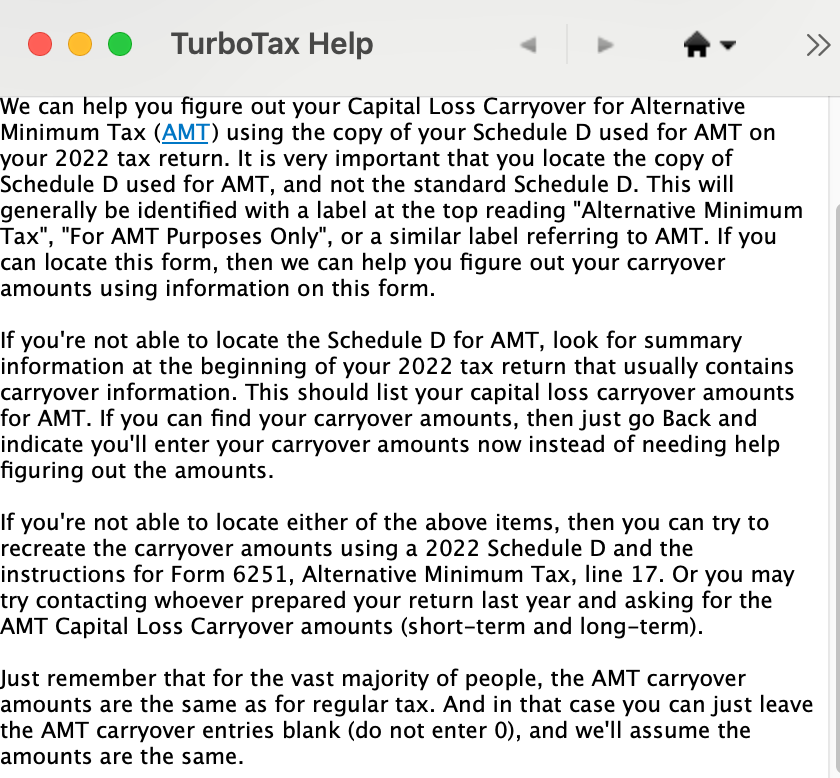

Per the help (pic at the end of this post) on the screen where it asked for these numbers, the last section says something like if I leave the entries blank (do not enter 0), and we'll assume the amounts are the same. This did not work, I left it blank ran through the easy step section and I got the same error. So to get past this, I. used the numbers on my schedule D for 2021 and tried my best to recreate 6251. Once I got past that message, I had to correct the last two highlighted fields shown here.

The forms do exist in my desktop TT 2022 file these fields were blank so I entered zero. Is this correct?

Thanks for the help!