- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Entering multiple 1098s due to a refinance is incorrectly triggering the $750,000 principal l...

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering multiple 1098s due to a refinance is incorrectly triggering the $750,000 principal limit on home loan interest deductions.

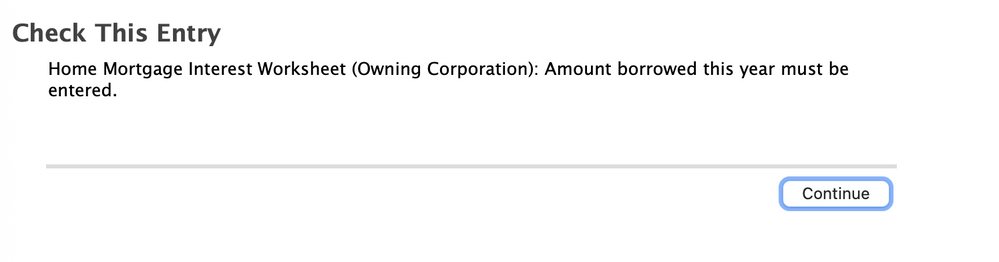

If you enter 1098 Box 2 as 0, it doesn't let you e-File.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering multiple 1098s due to a refinance is incorrectly triggering the $750,000 principal limit on home loan interest deductions.

That is correct because box 2 has either the outstanding balance on 1/1 or the original balance when the mortgage was obtained in 2020. It cannot be zero.

As others have said before you have to combine everything into one 1098, and only have the box 2 balance as the sum of mortgages open on 1/1 (do not add a mortgage box 2 that was opened later in the year if it 'paid off' a previous one (or more).

Or

TT needs to be fixed so it asks you if a loan was paid off in the year so they are ignored when adding up total debt.

i had 2 mortgages that were paid off with a new one. At the beginning of 2020 i had 2 mortgages, at the end i had 1 new one, and TT never asked me if either of the older mortgages were paid off so it thinks all 3 are still active and adds all of the debt from all 3 of them if i enter them all separately as i have to enter value from box 2 for the active mortgage that didn't exist on 1/1.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering multiple 1098s due to a refinance is incorrectly triggering the $750,000 principal limit on home loan interest deductions.

I hope that TT puts out an upgrade that fixes this issue.

If they don't, and I have to combine two 1098s into one, then what do I put in TT for the name field?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering multiple 1098s due to a refinance is incorrectly triggering the $750,000 principal limit on home loan interest deductions.

@dyee178 You want to enter the forms separately. The loan that was paid off should be marked as zero in box 2 for the program. Then, you should not have a problem.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering multiple 1098s due to a refinance is incorrectly triggering the $750,000 principal limit on home loan interest deductions.

A few posts up, Derek had shared that if you put 0 in box 2, then you cannot E-File?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering multiple 1098s due to a refinance is incorrectly triggering the $750,000 principal limit on home loan interest deductions.

That is true - if you put "0" in Box 2 (Outstanding mortgage principal balance), you will not be able to e-file.

If the mortgage in question was paid off, enter "1" in Box 2 of the 1098 Mortgage Interest form.

From an economic perspective, entering "1" is accurate - you owed virtually nothing on this mortgage at the end of 2020.

This will not have any effect on your tax calculation and will not generate an error in either TurboTax or with the IRS

There are many places in TurboTax where you must make a non-zero entry, primarily to let the program know that you answered the question and that the answer makes some sense.

In this case, entering "$1" tells the program that you didn't forget to answer the question and that you had at least some amount of a mortgage loan balance to justify claiming an interest deduction.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering multiple 1098s due to a refinance is incorrectly triggering the $750,000 principal limit on home loan interest deductions.

But box 2 is the outstanding mortgage amount at the start of the year, not the end of the year (ie Jan 1 ,2020 for tax year 2020). So why is Intuit suggesting putting $0 or $1 for the paid off loan?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering multiple 1098s due to a refinance is incorrectly triggering the $750,000 principal limit on home loan interest deductions.

This should allow you to proceed to complete your return if the following statement is true.

-

if you have a mortgage debt that is below $750,000, (or $1M for grandfathered debt incurred on or before December 15, 2017) this means all of the mortgage interest would be allowed to be used on your itemized deductions as long as there was no cash taken out that was not used on the home (all borrowed funds were used to buy, build or improve the home).

NOTE: If the amount of your mortgage is more than the cost of the home plus the cost of any substantial improvements, only the debt that isn't more than the cost of the home plus substantial improvements qualifies as home acquisition debt. This means that if 'cash out' proceeds were not used to improve the home they would not be part of home acquisition debt.

Any additional debt not used to buy, build, or substantially improve a qualified home isn't home acquisition debt. TurboTax will calculate the amount of allowed mortgage interest deduction based on your entry or you can choose to make the entries yourself.

- To review the information and worksheets you can use this link: IRS Publication 936, page 12

Use the following link (and hyperlinks) for more information: Home Mortgage Interest Limitation

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering multiple 1098s due to a refinance is incorrectly triggering the $750,000 principal limit on home loan interest deductions.

So... is Turbo Tax going to fix this issue and allow us to enter multiple 1098s with the actual box 2 that was sent to us from each lender? Clearly, there is an error in the coding which needs to be fixed, as the system adds the value of box 2 for each 1098 even though there is only ever one mortgage...

Or, are we going to have to try one of these workarounds?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering multiple 1098s due to a refinance is incorrectly triggering the $750,000 principal limit on home loan interest deductions.

Personally, I will not pay for tax software that cannot handle simple tax situations like this. I do not feel the workarounds given have been consistent and they are dangerous as they do not work in all situations. If this is not fixed by end of February, I’d restart using a competing product.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering multiple 1098s due to a refinance is incorrectly triggering the $750,000 principal limit on home loan interest deductions.

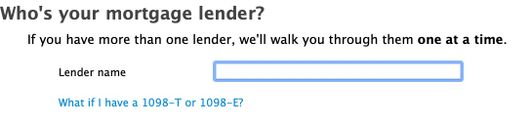

So, per Turbo Tax, if we refinanced in 2020 and received two form 1098s from the original and new lenders, we are being asked to combine both into a single 1098 in Turbo Tax. Following the instructions, in the combined 1098 form I know that I should combine box 1, 5, and the property tax field from both 1098 forms received from the original and new lender.

However, if we are supposed to combine two 1098 forms into a single 1098 in Turbo Tax, then what are we supposed to put in the "Lender Name" field?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering multiple 1098s due to a refinance is incorrectly triggering the $750,000 principal limit on home loan interest deductions.

Intuit has indicated that they will never fix this bug. They closed my thread on this issue to make it "go away" although at least for the moment other similar threads are still unlocked.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering multiple 1098s due to a refinance is incorrectly triggering the $750,000 principal limit on home loan interest deductions.

When combining the two 1098s together, you should use the original lender's name from the original loan.

These are the instructions that are given on TurboTax:

If you refinanced last year, you'll need your 1098 from your previous lender and the 1098 from the lender you refinanced with to enter the details for this screen.

Follow these steps to enter your mortgage info:

- Gather all of your 1098 forms related to your refinance, e.g. the form from your original lender and the form from your new lender.

- Grab a calculator and add the box 1 amount from each form and enter the total in TurboTax as Box 1

- Mortgage interest.

- Add the box 5 amount from each form and enter the total as Box 5 Mortgage insurance premiums. (If you weren’t required to pay mortgage interest, these boxes will be blank on your forms and you won’t enter anything here.)

- Add the property tax paid from each form and enter it next to Property (real estate) taxes paid.

Next, finish adding info for boxes 2, 3, 7, and 11 using the 1098 for the original loan.

You could also have additional 1098 forms because your loan was sold by your lender, or you refinanced multiple times. Just follow the same steps but be sure to include info from all of your forms in your calculations for steps 2-4

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering multiple 1098s due to a refinance is incorrectly triggering the $750,000 principal limit on home loan interest deductions.

I tried to follow the recommendation here but its not working for me.

Our original loan was in 2019 with Lender 1, but later sold to a different Lender 2, so we have 2 1098 forms. In 2020, we refinanced with Lender 3, who sold the loan to Lender 4.

All the 1098 forms are correctly showing Box 2 as the mortgage principal, and when i tried to manually override the value to 0 for Lender 1 and Lender 2, an error message shows up saying "outstanding principal can not be zero" . Lender 3 does allow me to change the value to 0.

Although, after I hit continue, the next page took me to a take to ask about the outstanding loan balance on Jan 1st 2021. when i tried to enter 0 for all three lenders that i do not owe any money to, the same error message show up again saying "outstanding load balance can't be zero".

this is quite frustrating, and i have no idea if turbo tax is handling our tax accurately. We have TurboTax Premier version.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering multiple 1098s due to a refinance is incorrectly triggering the $750,000 principal limit on home loan interest deductions.

On the first two loans, make sure you mark that the loans have been paid off as well as marking the outstanding loan balance as being $0. You will need to edit each input for your 1098 forms to access the screen below. Just continue through the screens until you see Was this loan paid off or refinanced with a different lender in 2020.

Please comment if you are still having issues and we will work on resolving your issue.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

waldo00

Returning Member

RGB15

Level 2

Bruce05

Level 2

dbergman

Returning Member

kotap004

Level 1