- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Does anyone know why my vehicle is being put on 4562 when I claim my business miles? I do not...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does anyone know why my vehicle is being put on 4562 when I claim my business miles? I do not want to depreciate my vehicle. I want to add my info onto my schedule C

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does anyone know why my vehicle is being put on 4562 when I claim my business miles? I do not want to depreciate my vehicle. I want to add my info onto my schedule C

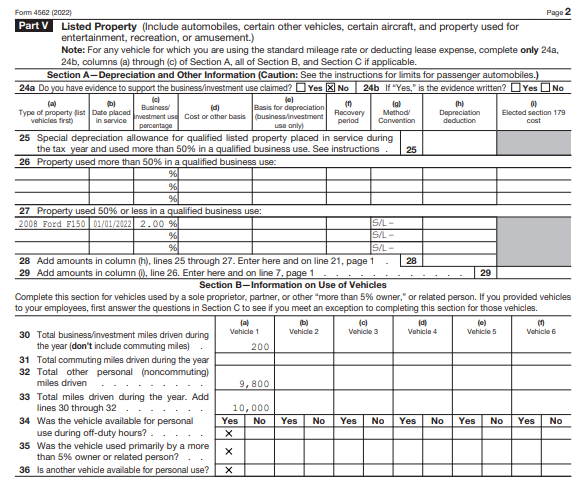

Are you seeing the vehicle listed in Part V Listed Property? Listed property is property that can be used for business and personal use and has special recordkeeping requirements.

If you are claiming business miles on a vehicle within a self-employment activity, as a listed property, you are required to disclose information about the listed property. That is done on page 2 of IRS form 4562 Depreciation and Amortization.

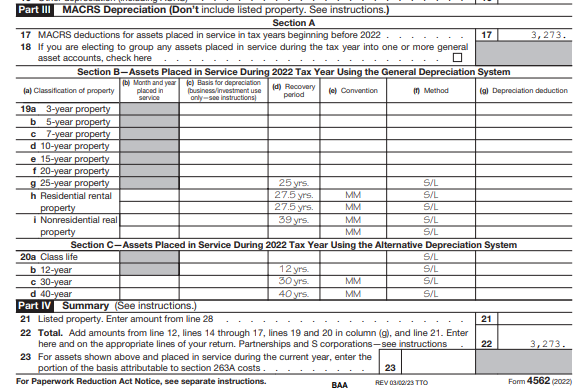

If you are claiming actual expenses and depreciating the vehicle, the depreciation will be noted on page 1 of IRS form 4562 Depreciation and Amortization in Part III and / or Part IV.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

RE-Semi-pro

New Member

pamrush123

New Member

justine626

Level 1

Letty7

Level 1

business mileage for rental real

New Member