- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Charitable Contributions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable Contributions

Does 2021 Turbotax support deduction of Charitable Contributions up to 100% of AGI? I cannot figure out how to stop TT from limiting the deduction to 60% of AGI. How does one input the amount of charitable donations to 100% limit organizations (Line 1 of the Charitable Deductions Limit Worksheet?

Thank you

RFA

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable Contributions

2021 TurboTax is not fully functional yet. A lot of these issues will be corrected as updates are rolled out.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable Contributions

Any idea when TT 2021 will be updated to provide for 100% Care Act charitable deductions? This is important for year end tax planning!

George E.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable Contributions

It depends. In the TurboTax Online version the special "above-the-line" deduction of up to $300 ($600 for MFJ) for cash donations made to charity during 2021, is working. This means the deduction lowers both adjusted gross income and taxable income – translating into tax savings for those making donations to qualifying tax-exempt organizations.

Go to the Charitable Donations section under Deductions & Credits to enter your cash donation.

To enter charitable donations follow these steps.

- Click on Federal Taxes (Personal using Home and Business)

- Click on Deductions and Credits

- Scroll down to Charitable Donations

- On Donations to Charity in 2021, click on the start or revisit button

Or enter donations in the Search box located in the upper right > Press enter > Click on Jump to donations

Complete your entry.

Once you make the entry you should be able to check it by using the Tax Tools:

- To find Tools:

- Sign into your TurboTax account and open or continue your return.

- Select Tax Tools in the left menu.

- You'll find Tools beneath Tax Tools.

- Select View Tax Summary

- Select Preview My 1040 (left black panel)

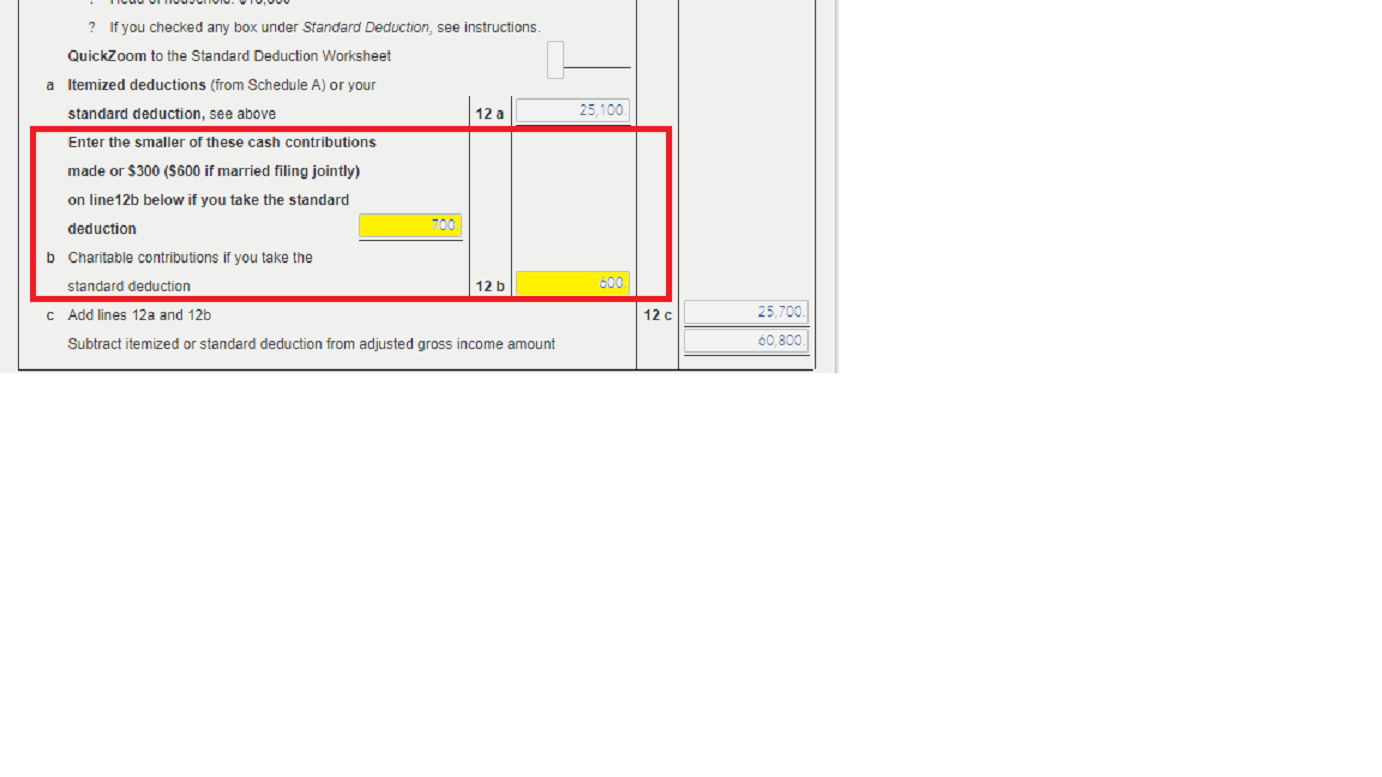

- See the image below for the desired result.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

tannerphilly35

New Member

Tom1116

Level 1

ribbonhead05

New Member

no-name1

Level 3

bigbruno

Returning Member