in Education

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: AOC -

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

AOC -

Where does TT ask all relevant questions - as defined in Pub 970 - to determine eligibility for Non-refundable part of American Opportunity Credit?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

AOC -

Your American Opportunity credit is 40% refundable. That means a portion of the credit will be refunded to you even if you don't owe any federal income tax.

The remaining $1,500 ($2,500 x 60%) is a nonrefundable credit that provides a benefit to you only if you owe federal income taxes.

The non-refundable part will show on schedule 3 Additional Credits and Payments line 8 and is included in the amount reported on form 1040 line 20.

To get to the education section to see if you qualify for the credit:

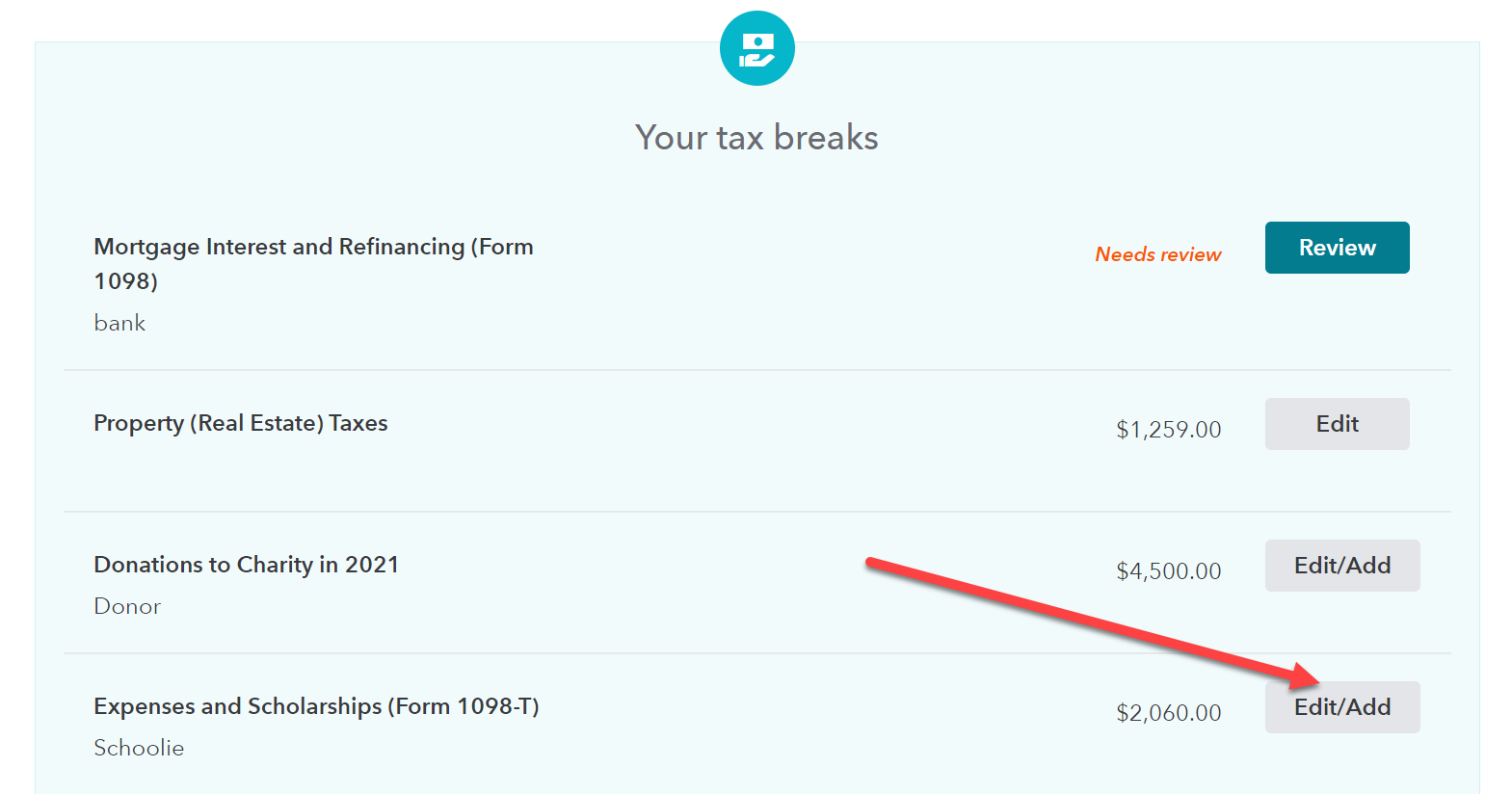

- Go to Federal Taxes,

- Go to Deductions and Credits.

- Scroll down to Education and click show more.

- Scroll down to Expenses and Scholarships (Form 1098-T) and click Revisit.

Please check the link below for AOC eligibility

Who is eligible to take the American Opportunity Tax Credit?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

AOC -

Thanks.

1) I do not see any "revisit" button to click!!!

2) Where does TT ask all relevant questions to determine eligibility for Non-refundable part of American Opportunity Credit?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

AOC -

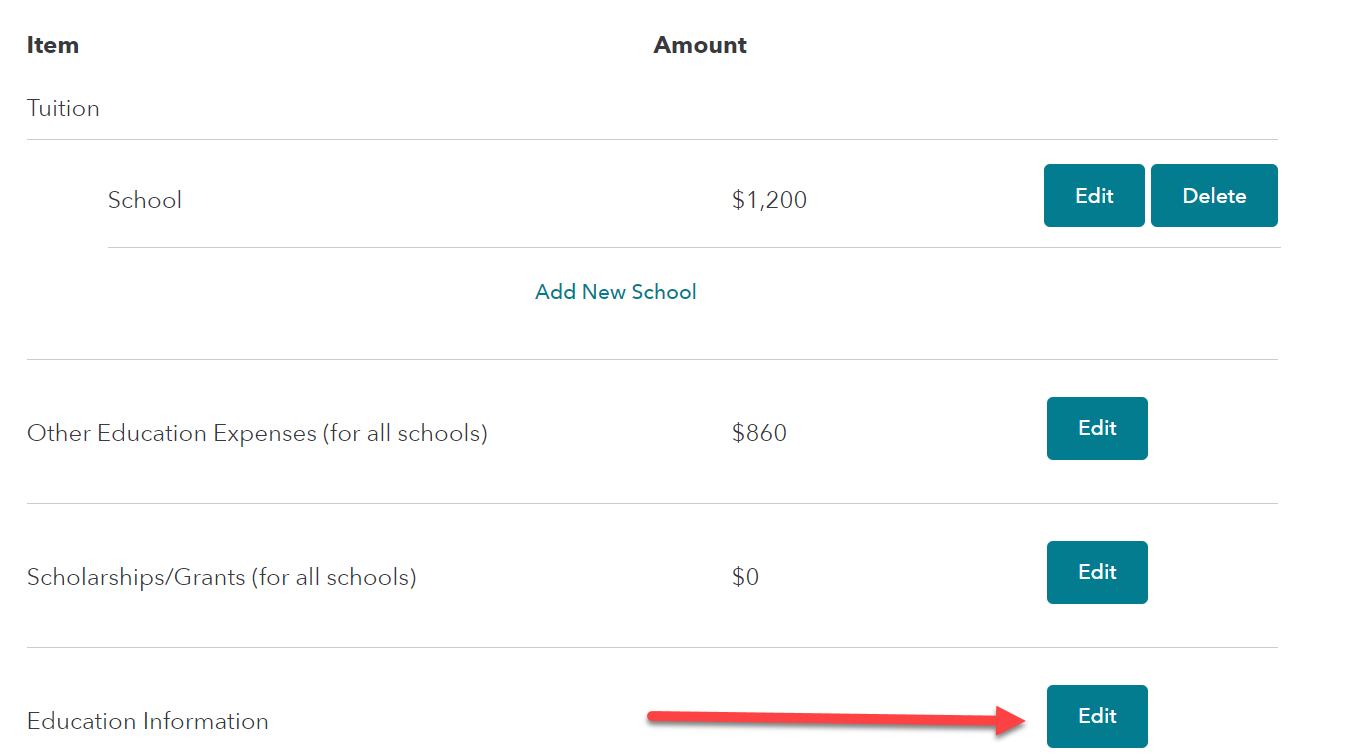

Depending on the version you are using and whether you already visited the section, the button may say Start, Update, Edit or Revisit. See the image below.

As far as those questions, the 1098-T input screen, boxes 8 and 9 are the start of it. More eligibility questions come up right after you pass the input screen.

If you need to edit this section, just Edit the Education information section.

The amount of the non-refundable American Opportunity Credit is limited to your tax liability (line 16 of Form 1040) on you return. TurboTax figures this based on the information you have entered in your tax return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

AOC -

Where does TT check the following constraints

(extracted from Pub 970)

You don't qualify for a refund if items 1 (a, b, or c), 2,

and 3 below apply to you.

1. You were:

a. Under age 18 at the end of 2021, or

b. Age 18 at the end of 2021 and your earned income

(defined below) was less than one-half of

your support (defined below), or

c. Over age 18 and under age 24 at the end of 2021

and a full-time student (defined below) and your

earned income (defined below) was less than

one-half of your support (defined below).

2. At least one of your parents was alive at the end of

2021.

3. You are filing a return as single, head of household,

qualifying widow(er), or married filing separately for

2021.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

AOC -

When the student files in TurboTax they are asked:

Can someone else claim you?

Will someone else claim you?

If Yes to the first, but no to the second, the student may receive the non-refundable portion of the American Opportunity Tax Credit.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17695426016

New Member

Glioma

Level 1

in Education

valaena

Returning Member

in Education

QRFMTOA

Level 5

in Education

ssptdpt

New Member

in Education