- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Additional Child Tax Credit Taxpayers (prior to 2021) with three or more children eligible regardless of income

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Additional Child Tax Credit Taxpayers (prior to 2021) with three or more children eligible regardless of income

Hello,

Can anyone please clarify the eligibility for three or more children regardless of income below. I do not have earned income but I have three kids. I did the child tax credit form 972 and came up with 0 for the child tax and credit for other dependents since I had no earned income. However it says if answered yes to line 16 and line one if more than zero I maybe able to take the additionall child tax credit. So I filled out Form 8812 with the following answers but I still end up getting rejected on question 8 if line 8 is zero stop here you cannot claim this credit. It seems like the sheet makes it impossible if you have earned income of zero to arrive with an additional tax credit even for this rare case. Answers for Form 8812:

1) 6000

2) 0

3) 6000

4) 4200

5) 4200

6a) 0

6b) 0

7) blank with no

😎 0 with with no (this is where is stays if line is zero stop here you cannot claim this credit.)

It says to stop however I filled out part 2 since I am certain filers who have three or more qualifying children

9) 0

10) 12400

11) 12400

12) 0

13) 12400

14) 12400

15) would be 0 if completed just part 1 however if I did part 2 it is 4200.

Can anyone tell me if I am doing something wrong. It looks impossible to arrive at an amount for additional child tax credit if you have no earned income with the three children see red below. Thanks very much!!!

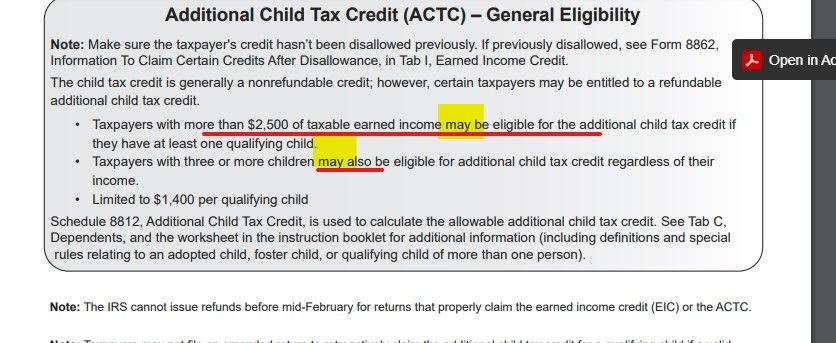

Additional Child Tax Credit (ACTC) – General Eligibility

.The child tax credit is generally a nonrefundable credit; however, certain taxpayers may be entitled to a refundable additional child tax credit.•

Taxpayers with more than $2,500 of taxable earned income may be eligible for the additional child tax credit if they have at least one qualifying child.

Taxpayers with three or more children may also be eligible for additional child tax credit regardless of their income.•Limited to $1,400 per qualifying

https://apps.irs.gov/app/vita/content/globalmedia/additional_child_tax_credit_4012.pdf

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Additional Child Tax Credit Taxpayers (prior to 2021) with three or more children eligible regardless of income

This was answered in your other post ... main reason is " I do not have earned income " ... without that you cannot get ANY of the CTC or ACTC period ... look at the instructions for line 16.

https://ttlc.intuit.com/community/user/viewprofilepage/user-id/4531344

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Additional Child Tax Credit Taxpayers (prior to 2021) with three or more children eligible regardless of income

Hello, Thanks for getting back to me however I still do not understand why it says regardless of their income on the IRS website eligibility....

Additional Child Tax Credit (ACTC) – General Eligibility

•Taxpayers with three or more children may also be eligible for additional child tax credit regardless of their income.

https://apps.irs.gov/app/vita/content/globalmedia/additional_child_tax_credit_4012.pdf

Thanks

Wendy

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Additional Child Tax Credit Taxpayers (prior to 2021) with three or more children eligible regardless of income

Again you must have EARNED INCOME of at least $2500 ... The key word is MAY ... so if you complete the form 8812 following all the line instructions you MAY have some ACTC even if your income is too high.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Additional Child Tax Credit Taxpayers (prior to 2021) with three or more children eligible regardless of income

"Taxpayers with three or more children MAY also be eligible for additional child tax credit regardless of their income" refers to Part II of form 8812, where it is possible to get some your social security and Medicare (FICA) tax paid back.

Since you have no earned income, you had no FICA tax withheld. So, you're not one of the "eligible taxpayers".

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

donbiggs

New Member

Charliepdl2

New Member

ja19584

New Member

tdasha10

Level 2

Stewie1

Level 1