- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- QBI 199A Deduction

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

QBI 199A Deduction

I am trying to get the QBI Deduction, 199A, I have a K-1 (form 1120-S) which was filled out by accountant

who indicates that I should be eligible for the Deduction. Attached is Statement A - QBI Pass- Through Entity Reporting. the box SSTB is marked, and listed is the ordinary Business income (loss) - no section 1231 gain (loss) - it also listed the W-2 wage that was reported to me. I do not find any place to enter the data and which I dig I get a message that I am not eligible for the Deductions. When talking with the accountant they are clear that I am eligible. Please tell me where to enter the data for this deduction.

John1970

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

QBI 199A Deduction

On your K-1, the QBI information should be indicated in Box 17 (code V - Section 199A info). When you enter the amounts with the appropriate codes into the TurboTax K-1 entry screen, your deduction will be generated. See page 2 of the instructions for your K-1.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

QBI 199A Deduction

I think it should be box 20(code V). There is no option for V in box 17 in TT. Its box 20 on my K1 and in my version of TT.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

QBI 199A Deduction

To enter your box 17 code V information properly for your Form 1120S Schedule K-1, Continue through the K-1 interview after you have entered your code V for box 17. You don't have to enter an amount on that box 17 screen. There is a screen near the end of the interview titled "We need some more information about your 199A income or loss". This screen must be completed in order for your box 17 code V information to be correctly input into TurboTax.

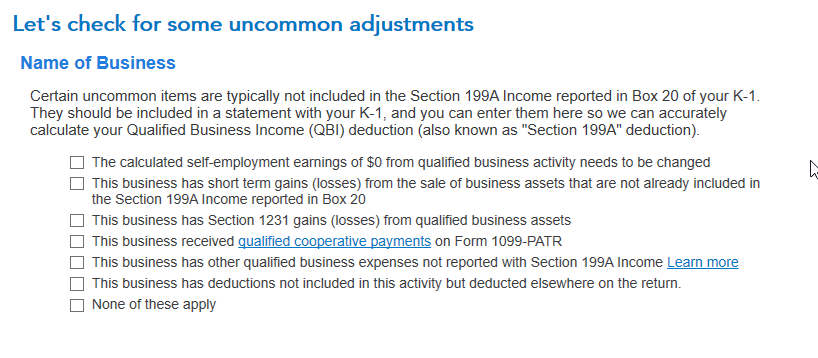

Here is a screenshot of the screen you are looking for:

And, depending on what is reported on your K-1 statement, you may need the next screen as well:

To get back to the K-1 summary screen and find the Schedule K-1 to edit, click the "magnifying glass Search" icon on the top row, enter "k-1" in the search window and press return or enter, and then click on the "Jump to k-1" link to find the K-1 you need to edit.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

vash771

New Member

jb.gabby

New Member

brianjohncook

New Member

Pedernales

Level 1

gerkes

New Member