- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- My NJ Tax return not picking property tax deduction but instead picking a credit

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My NJ Tax return not picking property tax deduction but instead picking a credit

Thanks @MarilynG1 but what I'm really concerned about is are we allowed to have one person take the Property Tax Credit and the other take the Property Tax Deduction. Generally if one person itemises, the other has to itemise. Is it not the same for Credit vs. Deduction?

Furthermore, would this 1/3 vs. 2/3 extend to medical expenses? Or do we do 50-50? We paid the majority of our 2021 medical expenses with spouse HSA (about 5k) and another grand outside of that (450 on my credit card which was ultimately paid from the joint checking though it was an expense incurred by me, 600ish directly from the joint checking - spouse was the one who incurred the expense, plus 800ish medical miles). Not to mention another 5.5k from medical insurance premiums through spouse's employment. I know federally that HSA withdrawals and insurance premiums can't be counted towards medical expenses as they are "pre-tax," but in NJ, HSA withdrawals for medical purposes and insurance premiums do count as the HSA contributions and premiums have been added to NJ wages.

Also thanks for clarifying that NJ status must be same as federal status. Was already planning on filing the same for all since I read NY (where I work) also requires same status for state and federal.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My NJ Tax return not picking property tax deduction but instead picking a credit

No, the 1/3, 2/3 only applies to your Property Tax/Mortgage Interest (and only because your property is titled that way).

You can divide your Medical Expenses any way that you agree on (since they were paid from a joint account).

However, if your spouse paid 5K into an HSA, she would want to report at least 5K in Medical Expenses, for example.

If her insurance premiums were 'pre-tax' they would not be deductible anyway.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My NJ Tax return not picking property tax deduction but instead picking a credit

Thanks. The premiums are pre-federal tax, but post-NJ tax, so we can add to the NJ return (but not the federal).

Don't think we'll see any benefit for splitting mortgage interest as we both would be taking the standard deduction federally.

My name is first on the bank account, so that means the 1099 ints get addressed to me; I didn't file a 1099 to give interest to spouse (I tried looking at Pub 504 to see if MFS means you need to give spouse a 1099 int for their share of a joint account, but this was not spelled out -- I know that you typically don't have to, but I wasn't sure if that was because of the assumption for filing jointly or not). Does this have any bearing on who gets to claim the medical expenses paid from that account? Spouse would certainly have the right to claim the HSA withdrawals since HSA is in their name. Premiums from work, too. But my guess is if I claim all the bank interest, then I claim all the medical expenses paid from that account as well.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My NJ Tax return not picking property tax deduction but instead picking a credit

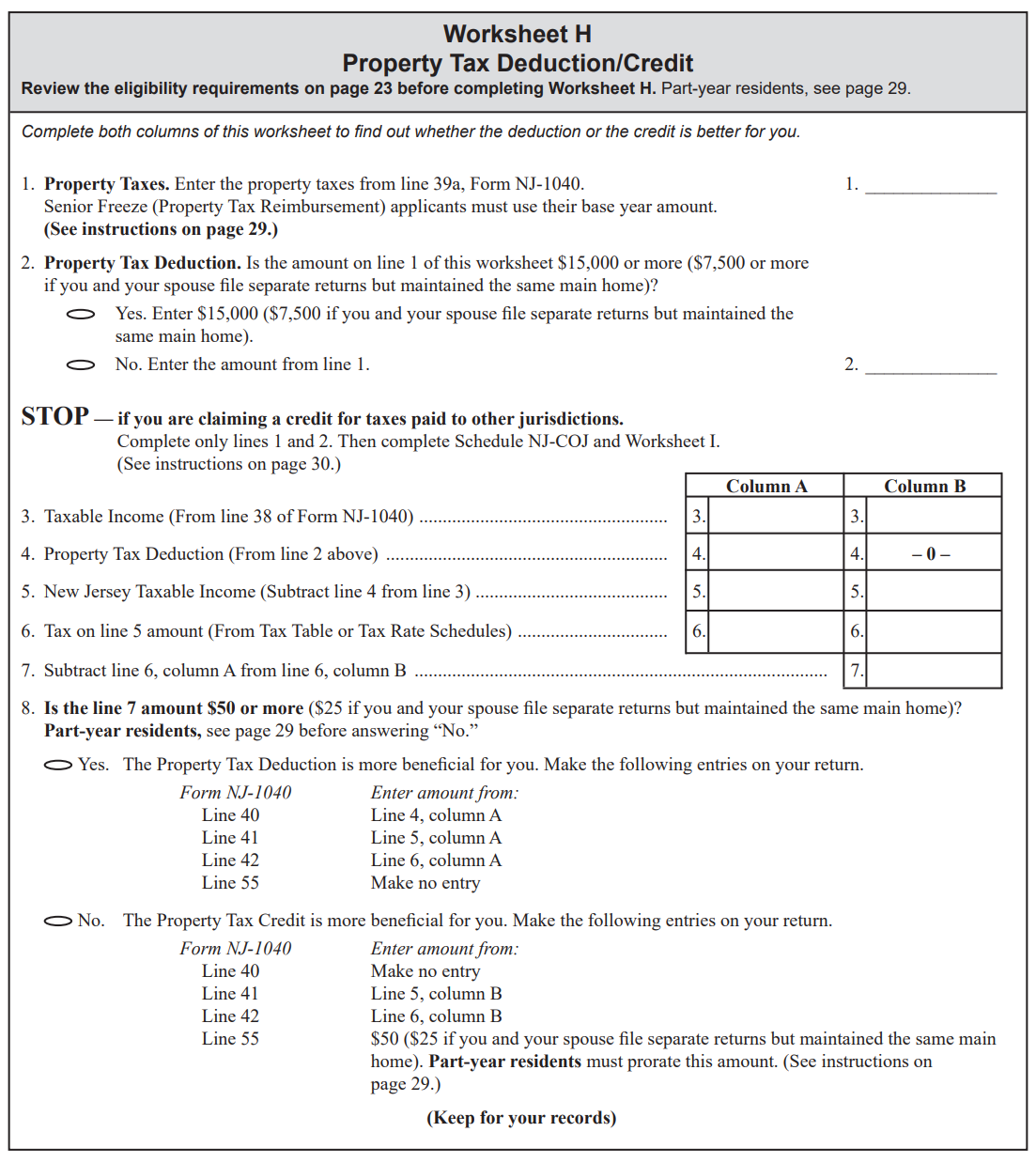

You can claim property tax deductions/credits if you file separate returns. As awesome tax Expert @marilynjoy said, you would have to take a 33%/67% split.

The New Jersey tax forms are set up to give you the better benefit between the property tax credit and deduction. Often, because of the credit for tax paid to NY, the credit works out better because the other state tax credit reduces most of your tax liability.

The property tax credit/deduction is separate from any standard deduction. New Jersey does not have a standard deduction so you can claim either standard or itemized on your federal return and it will not affect NJ.

If you file separate, the IRS will expect bank interest to be reported by the person who's social security number is on 1099-INT. You can issue your wife a 1099-INT and make an adjustment.

On a separate return medical expenses should be claimed by whoever paid for the expense. You can only deduct medical expenses that were not reimbursed or paid by the HSA.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My NJ Tax return not picking property tax deduction but instead picking a credit

Thank you @ErnieS0 . TurboTax automatically carried over HSA withdrawals listed on Schedule A even paid from the HSA (before I properly filled out Schedule A listing all the expenses, the NJ form had HSA withdrawals in there as I affirmed they were for medical expenses), I assume this is because medical expenses can be deducted on a NJ return but not a federal return even when paid for from HSA.

It looks like my gross income is too high to get a medical deduction on my NJ MFS return given how the majority of the expenses were paid, so I would rather say all the medical expenses were paid by spouse as they *would* get a deduction. However, since their gross income is in a higher bracket than mine, I would want to claim all the joint bank interest (it doesn't push me into the next bracket). I wanted to affirm that me claiming joint bank interest as income yet spouse taking joint medical deductions is not a problem 🙂 Would you say that me putting my 450 expense on my credit card (not our joint one) is my expense? Or because that portion of the credit card bill was paid from our joint checking, it makes the bill up for grabs? Spouse does all the driving, owned the car before we even knew each other, so they would get medical miles.

I do wonder if I can force the form to have me take a 33% interest in the property tax credit and spouse take a 67% interest in the property tax deduction. It didn't seem possible to do anything other than 50-50 when going through the prompts. I certainly don't want to claim more than I'm allowed even when that would bring me down to neither a refund nor owing. It would surely have a greater benefit to spouse as they get to reduce their liability more with a greater deduction.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My NJ Tax return not picking property tax deduction but instead picking a credit

If the bank interest is in your social security number, the IRS will be looking for that amount to match what is reported on your return.

Expenses paid from separate funds are only deductible by the spouse who pays them. Generally you would divide the expenses paid by joint funds.

There is no way to force a property tax deduction or credit in TurboTax. TurboTax uses the state-provided Worksheet to decide whether it's best to take the credit or deduction. It's a mathematical equation.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My NJ Tax return not picking property tax deduction but instead picking a credit

Okay, so I'll put half of the joint expenses on my return then, which almost means I'm paying for my 450 expense and all the medical miles and spouse has their nearly 600 expense on theirs.

I'll put all the bank interest on mine.

I can't see how to reduce my property tax credit based on our title. I could see about inflating spouse's to the 2/3 by entering an 6887 on line 39a, but that wouldn't be right if I'm taking a full 25 credit that's for MFS couples, so it's probably for the best to keep things 50-50...

- « Previous

- Next »

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

tljackson1542

New Member

betsy-leeman

New Member

terimac4

Level 3

cashrn-gmail-com

New Member

mishelk

New Member