- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Itemized deduction is slightly greater than standard deduction, and this appears to be causing problems

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Itemized deduction is slightly greater than standard deduction, and this appears to be causing problems

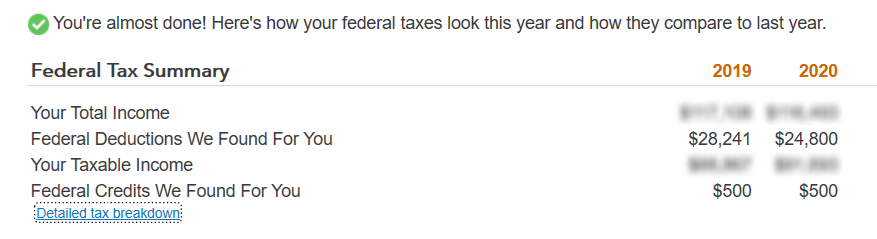

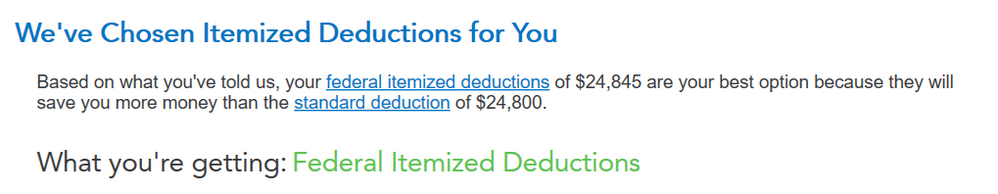

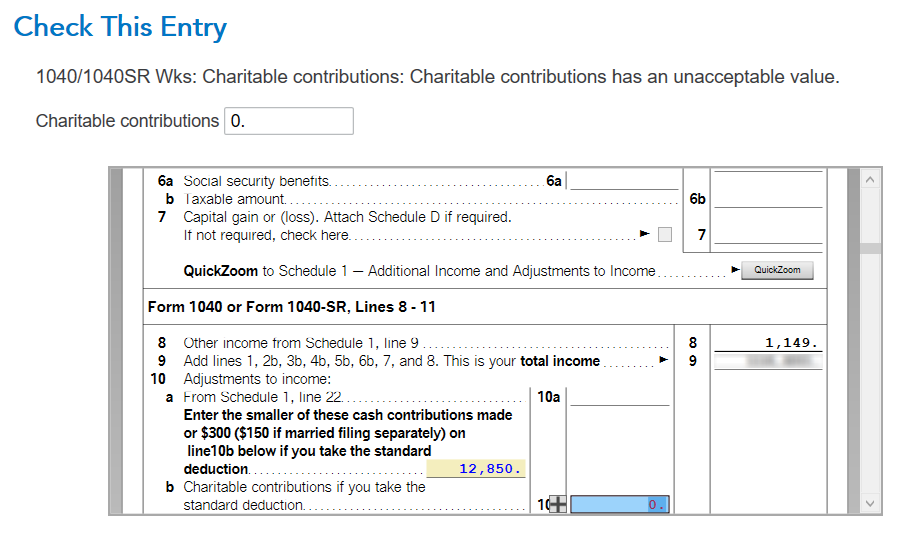

After all deductions have been entered, the summary of deductions has no values in the column for 2020 deductions, and indicates I am getting the standard deduction. But then the next step indicates TurboTax has chosen itemized deductions for me, because my itemized deductions are $45 greater than the standard deduction. But when I go through the federal review step, it is still showing the standard deduction amount of $24,800 instead of the itemized deduction amount of $24,845, and I am getting an error directing me to complete the charitable contribution value for line 10b. What is going on?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Itemized deduction is slightly greater than standard deduction, and this appears to be causing problems

looks like you are at the point where Itemized are more than the Standard BUT not more than Standard plus the cash deduction allowed on line 10.

In your situation ( Itemized =24,845) if you donated more than 45 as a cash donation in 2020, you can follow the steps below. the Standard plus cash donation should be more than your Itemized amount.

"The new "up to $300 above the line cash charity donation" is available for tax year 2020. This allows a Taxpayer to claim up to a $300 credit which is subtracted from income on the 1040 line 10c if the Taxpayer is claiming the Standard Deduction. (If you Itemize Deductions, all your donations will be listed on Schedule A.)"

TurboTax ONLINE

Click Tax Tools on the left side bar

Click Tools from the drop-down

Click the "Topic Search" box on the screen

Type or scroll down to standard deduction and exemptions

Click GO

The next screen gives you an option to change your selection from Standard to Itemized and back. You do not need to change your selection

Scroll down to the bottom of that screen and click CONTINUE

The next screen is the Charitable Cash Contributions under Cares Act screen

IF YOU ARE CLAIMING STANDARD DEDUCTION enter the amount of cash contributions you made, up to 300

IF YOU ARE ITEMIZING DEDUCTIONS enter 0

Scroll down and click Continue

Click Continue on the next screen

Next, view your 1040 to see what is reported on 1040 line 10 , if using TurboTax Online-

To verify, click “Review” if necessary, in order to get Tax Tools on the left side bar

Click Tax Tools on the left side bar

Click Tools on the drop down list

Click “View Tax Summary” on the “Tools Center” screen

When the next screen appears (Review Tax Summary) ON THE LEFT SIDE BAR you should see “Preview my 1040”

Click “Preview my 1040” on the left side bar

DESKTOP

Go to Step-By-Step input

Click Federal

Click Deductions & Credits along the top

Click “I’ll choose what I work on”

Edit or Update Donations to Charity in 2020 if needed, then click “Done with Charitable Donations”

Scroll down the “Your 2020 Deductions & Credits” screen and click “Done with Deductions”

Click Continue on the “Let’s Check Your Deductions and Credits” screen

Continue through the following interview questions until you get to the “Here Are Your 2020 Deductions & Credits” screen

Click Continue

If the next screen says “The Standard deduction is Right for You!” click Continue

ON THE NEXT SCREEN enter the cash contribution made in 2020 and click Continue

Your 1040 should update

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Itemized deduction is slightly greater than standard deduction, and this appears to be causing problems

Thank you for your excellent response - I do have the Desktop version, and you are correct - the standard deduction plus the $300 above the line charity donation amount results in a lower tax obligation for me. However, there is clearly a bug at play for this situation, as the screen after all my deductions have been entered, including charity donations, states that I am getting the Federal Itemized Deduction, since our deductions total 24,845, and there was no subsequent page asking me to enter my charity donation amounts.

I then receive an error telling me that I must enter a charitable donation value for line 10b, which has no value.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

cameron29

New Member

lizp1

Returning Member

ellen3ryan

New Member

257100km

New Member

jhans2256

New Member