- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Issue with "Limited interest and points must be entered"

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Issue with "Limited interest and points must be entered"

The link does not say the issue is solved.

Here is the message:

Some TurboTax customers are experiencing the following error message when running the Federal Error Check

Check This Entry:

Tax and Interest Deduction Worksheet: Limited Interest and Points must be entered

If you're experiencing the error above, please go here to receive email notifications when any updates related to this issue become available.

It is just informing that we are aware of the issue and it's under repairs. Click on the blue link "go here" to receive email notification when it's fixed. We do not know that the estimated time it will take, unfortunately.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Issue with "Limited interest and points must be entered"

Currently, there is a known issue with Turbo Tax customers experiencing problems with their Home Mortgage Average Balance. This can cause in the the Home Mortgage Interest to be incorrectly limited thus causing confusion in the return. If you're experiencing the issue above, please go here to receive email notifications when any updates related to this issue become available.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Issue with "Limited interest and points must be entered"

@Ginas602 @CaliforniaTaxed @Anonymous forms view is only available in the downloadable desktop version of the app.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Issue with "Limited interest and points must be entered"

How long is this going to take to fix? What is the ETA?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Issue with "Limited interest and points must be entered"

I had the same issue, have you heard anything back from them? Seems crazy to me that this takes more than 24 hours to fix, let alone weeks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Issue with "Limited interest and points must be entered"

Nope. There were a number of other threads that discussed this. There was some link going around where you could enter your email and you would be notified when they fixed the issue. I had another 1098 come in early this week, so I tried entering it, there were some different questions and I had to input more info pertaining to my three 1098s (when loan was paid off, how much was left when paid off, how much was left at start of 2021) but alas, my tax hit was still much greater than it should be; so they still haven’t fixed it. It’s a major issue, and one that dates back over a year now based on other threads, don’t know why it is taking so long to fix some code and implement it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Issue with "Limited interest and points must be entered"

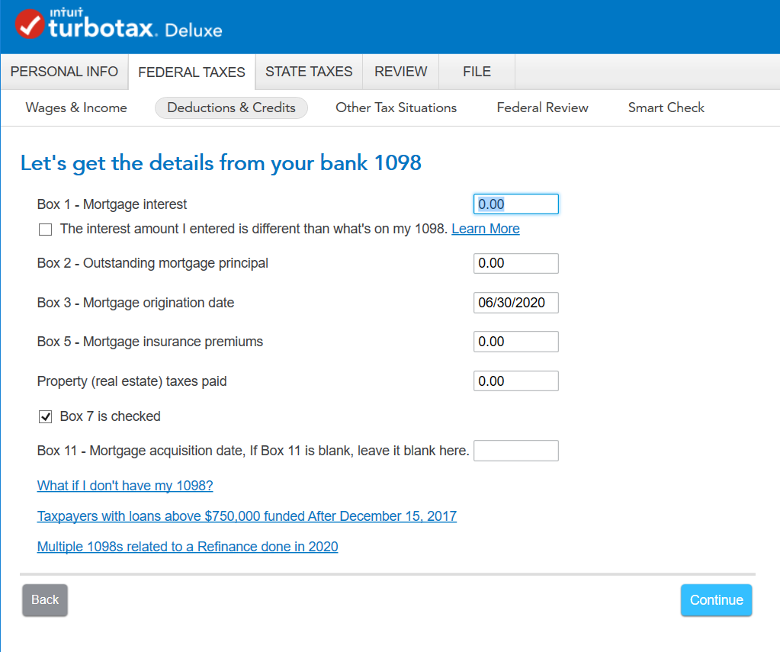

Try this.

If your total home debt is under $375,000 ($250,000 for married filing separate) there is nothing new for you to do in 2020. Enter each 1098 as you normally would.

Home Debt Over $375,000

Under tax law, you are limited on the amount of home interest you can deduct. The limit is based on the loan amount and date of the origination of debt. We want to make sure we calculate this correctly for you.

If you refinanced last year, you’ll have a Form 1098 from your previous lender and one from the lender you refinanced with. You’ll need both forms.

Follow these steps to enter your mortgage information:

- Gather all of your 1098 forms related to your refinance (the form from your original lender and the form from your new lender)

- Grab a calculator and add together the box 1 amount from each form. Enter the total in TurboTax as Box 1 Mortgage interest.

- Add the Box 5 amount from each form and enter the total as Box 5 Mortgage insurance premiums. (If you weren’t required to pay mortgage interest, these boxes will be blank on your forms and you won’t enter anything.)

- Add the property tax paid from each form and enter it in the Property (real estate) taxes box.

Next, finish adding info for boxes 2, 3, 7, and 11 using Form 1098 for the original loan.

What if I have more than two 1098s?

You should combine all of the 1098s directly related to the refinance and enter it as one 1098. An example of this is if you refinanced two loans into one loan. Any 1098s not directly related to the refinance should get entered separately.

What if I paid points?

Points on Loans Paid Off in 2020: Enter the points on your 1098 you have started and mark you paid off the loan when promoted.

Points on Loans on New Loans: You will want to enter a separate 1098 to cover these points paid. When prompted, enter 0.00 for Boxes 1, 2, 5, and the Property (real estate) taxes box, and checkbox 7, as you’ve already entered the details on your first 1098. For Box 3, add the date in 2020 when the loan originated.

On the Tell us about any points paid to bank screen, answer in regards to the new loan when asked about points.

On the Tell us about any points paid to bank screen, answer in regards to the new loan when asked about points.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Issue with "Limited interest and points must be entered"

@Cynthiad66 if we're going to be doing TurboTax's job by creating a fake 1098, which lender do we put?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Issue with "Limited interest and points must be entered"

I ended up just purchasing the client version to get to the forms "trick" that was mentioned before. It's a shame that it's taken this long for the online version to have a "fix".

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Issue with "Limited interest and points must be entered"

@hardcoded you were forced to pay more money by TurboTax because their product is broken???????

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Issue with "Limited interest and points must be entered"

I wish I had seen Cynthiad66's response before I went through all of the added trouble and expense of purchasing the client version. Assuming the IRS permits it, combining the two 1098s seems to be the most logical solution.

@samrom90 get this - I ended up paying twice, once for the Fed and State online version, and then again for the client version. I requested a refund to at least get some of my money back and they denied it. I've submitted a followup request and have yet to hear back 👎

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Issue with "Limited interest and points must be entered"

Another week(s) and this is still not fixed. I can't understand why a large company like this cannot assign a coder to spend 10 minutes and fix a simple calculation. If I hadn't already paid for the online version I would be looking elsewhere for a business that cares about their customers experience. A couple weeks ago TurboTax sent me an email saying my issue had been resolved and to rate my experience. Seeing as how my issue has in no way been resolved, my rating was not positive to say the least.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Issue with "Limited interest and points must be entered"

Here are the full instructions that will allow for the entry of multiple 1098 forms:

If you have multiple 1098 mortgage forms, you’ll enter them one at a time. After going through the steps with the first one, you can add a lender when you get to the Mortgage deduction summary screen. (In the case of a refinance, it's best to enter the 1098 from your original loan before the 1098 from your refinance.)

But, if they're both from the same lender, and one of them has the “Corrected” checkbox marked at the top, enter the corrected 1098 and discard or shred the other one.

What do I do if I have multiple 1098s from refinancing my home debt?

If your total home debt is under $375,000 ($250,000 for married filing separate) there is nothing new for you to do in 2020. Enter each 1098 as you normally would.

Home Debt Over $375,000

Under tax law, you are limited on the amount of home interest you can deduct. The limit is based on the loan amount and date of the origination of debt. We want to make sure we calculate this correctly for you.

If you refinanced last year, you’ll have a Form 1098 from your previous lender and one from the lender you refinanced with. You’ll need both forms.

Follow these steps to enter your mortgage information:

- Gather all of your 1098 forms related to your refinance (the form from your original lender and the form from your new lender)

- Grab a calculator and add together the box 1 amount from each form. Enter the total in TurboTax as Box 1 Mortgage interest.

- Add the Box 5 amount from each form and enter the total as Box 5 Mortgage insurance premiums. (If you weren’t required to pay mortgage interest, these boxes will be blank on your forms and you won’t enter anything.)

- Add the property tax paid from each form and enter it in the Property (real estate) taxes box.

Next, finish adding info for boxes 2, 3, 7, and 11 using Form 1098 for the original loan.

What if I have more than two 1098s?

You should combine all of the 1098s directly related to the refinance and enter it as one 1098. An example of this is if you refinanced two loans into one loan. Any 1098s not directly related to the refinance should get entered separately.

What if I paid points?

Points on Loans Paid Off in 2020: Enter the points on your 1098 you have started and mark you paid off the loan when promoted.

Points on Loans on New Loans: You will want to enter a separate 1098 to cover these points paid. When prompted, enter 0.00 for Boxes 1, 2, 5, and the Property (real estate) taxes box, and checkbox 7, as you’ve already entered the details on your first 1098. For Box 3, add the date in 2020 when the loan originated.

@pwc6t3

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Issue with "Limited interest and points must be entered"

Thanks, but this does not address my situation.

I didn't refinance. I had 3 different properties that I paid mortgage interest on. One was sold in 2020, the other two I still own. For one property my original mortgage lender sold my loan, and the new company sold it again, and that company sold it again, so I have a ton of 1098's all from that one property alone.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Issue with "Limited interest and points must be entered"

If you entered the same mortgage amount in Box 2 for all three 1098's, it is tripling the Mortgage loan balance to a point where it is limiting the interest. My suggestion is to:

- Enter the 1098 from the original lender with a Mortgage Loan Balance reported in Box 2.

- Enter the next two 1098 and put 0 in Box 2.

- This way, your mortgage balance will be the same that was reported by the original lender and your interest and points won't be limited and stays under the $750,000 mortgage limitation balance.

- Respond back and let me know if this works.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

smc89

New Member

mshelton

New Member

brelaz99

New Member

hativered

Level 2

trostlechet

New Member