- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Is the Colorado Child Care Charitable Contribution deduction calculating correctly? Instructions say to enter eligible amount (DR1317 L3) and TurboTax with calc the 50%.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the Colorado Child Care Charitable Contribution deduction calculating correctly? Instructions say to enter eligible amount (DR1317 L3) and TurboTax with calc the 50%.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the Colorado Child Care Charitable Contribution deduction calculating correctly? Instructions say to enter eligible amount (DR1317 L3) and TurboTax with calc the 50%.

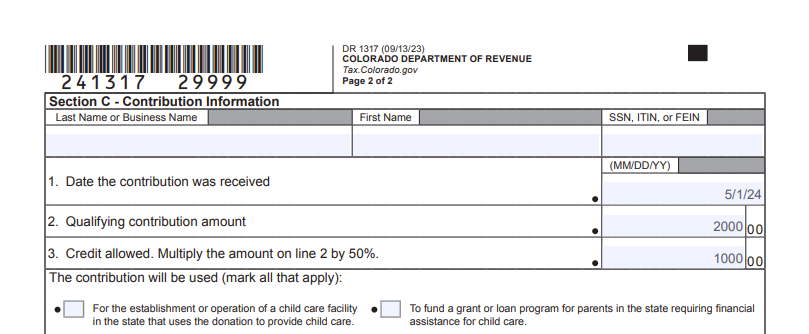

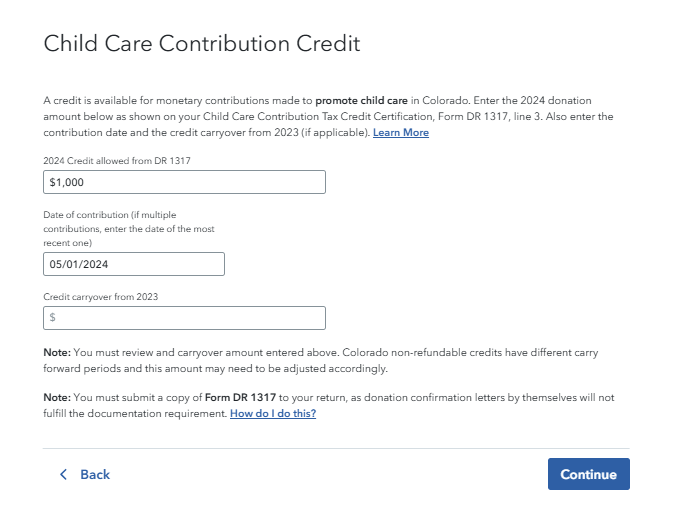

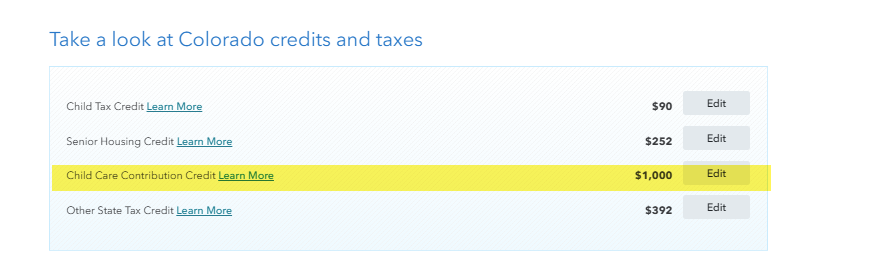

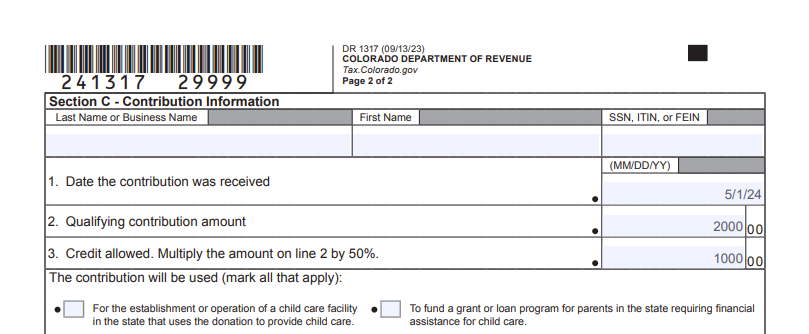

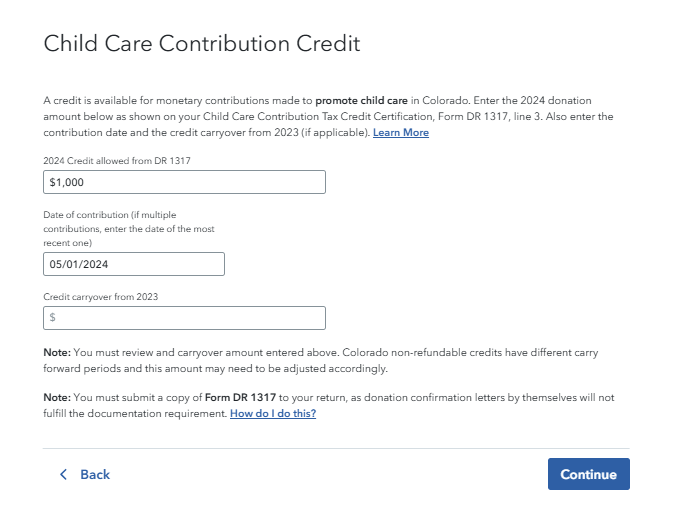

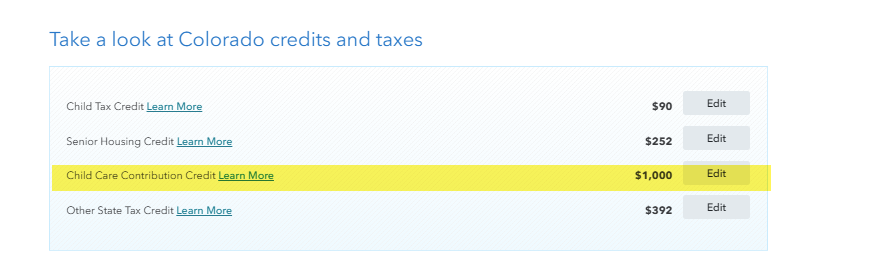

Yes. The Form DR 1317 line 3 is already reduced by 50%. For example, if you contributed $2,000, DR 1317 Line 3 will show $1,000. Enter $1,000 in TurboTax for "Credit Allowed" and your CO should decrease by the credit of $1,000.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the Colorado Child Care Charitable Contribution deduction calculating correctly? Instructions say to enter eligible amount (DR1317 L3) and TurboTax with calc the 50%.

Yes. The Form DR 1317 line 3 is already reduced by 50%. For example, if you contributed $2,000, DR 1317 Line 3 will show $1,000. Enter $1,000 in TurboTax for "Credit Allowed" and your CO should decrease by the credit of $1,000.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Blue Storm

Returning Member

xhxu

New Member

hnk2

Level 1

fpho16

New Member

crevitch

Level 2