- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- If I input sum of cost basis/sales from1099-B, but have wash sale losses, do I still add cost basis

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I input sum of cost basis/sales from1099-B, but have wash sale losses, do I still add cost basis

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I input sum of cost basis/sales from1099-B, but have wash sale losses, do I still add cost basis

In your other post you said you "want to use the total of sales and cost basis to enter into QB." This is the TurboTax community. If you are looking for help entering the sales into QuickBooks, please post your question in the QuickBooks Community at the following link.

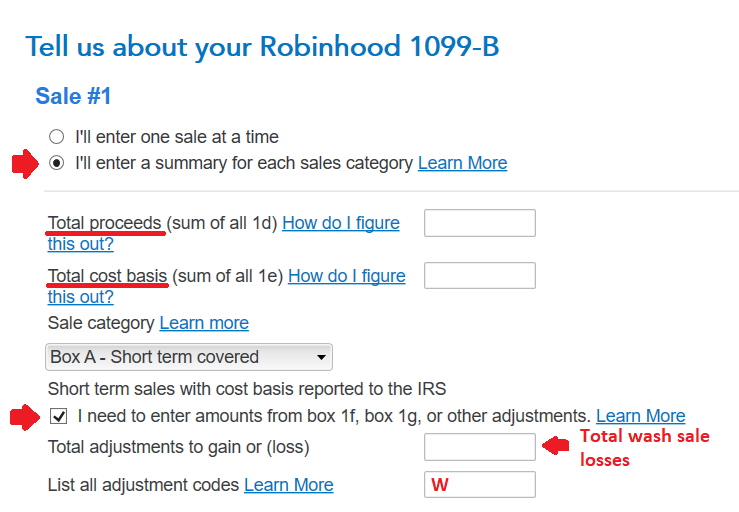

Here's how to enter summary totals, with wash sales, in TurboTax Premier. You have to do this separately for each category (short-term or long-term, covered or noncovered). Refer to the screen shot below. Select "I'll enter a summary for each sales category." In the appropriate boxes enter the total proceeds and total cost basis for all the sales in the category. Select the sale category from the drop-down list. Then check the box that says "I need to enter amounts from box 1f, box 1g, or other adjustments." That will give you two more boxes. In the "Total adjustments" box enter the total of the disallowed wash sale losses for all the sales in the category. In the box for adjustment codes enter W, which is the code for disallowed wash sale losses.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

kkrana

Level 1

Dslatt87

New Member

SB2013

Level 2

Idealsol

New Member

HNKDZ

Returning Member