- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- If a person is in a Memory Care Facility would I put the total amount for the year under Medical Facility Fee or Long Term Care Services?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If a person is in a Memory Care Facility would I put the total amount for the year under Medical Facility Fee or Long Term Care Services?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If a person is in a Memory Care Facility would I put the total amount for the year under Medical Facility Fee or Long Term Care Services?

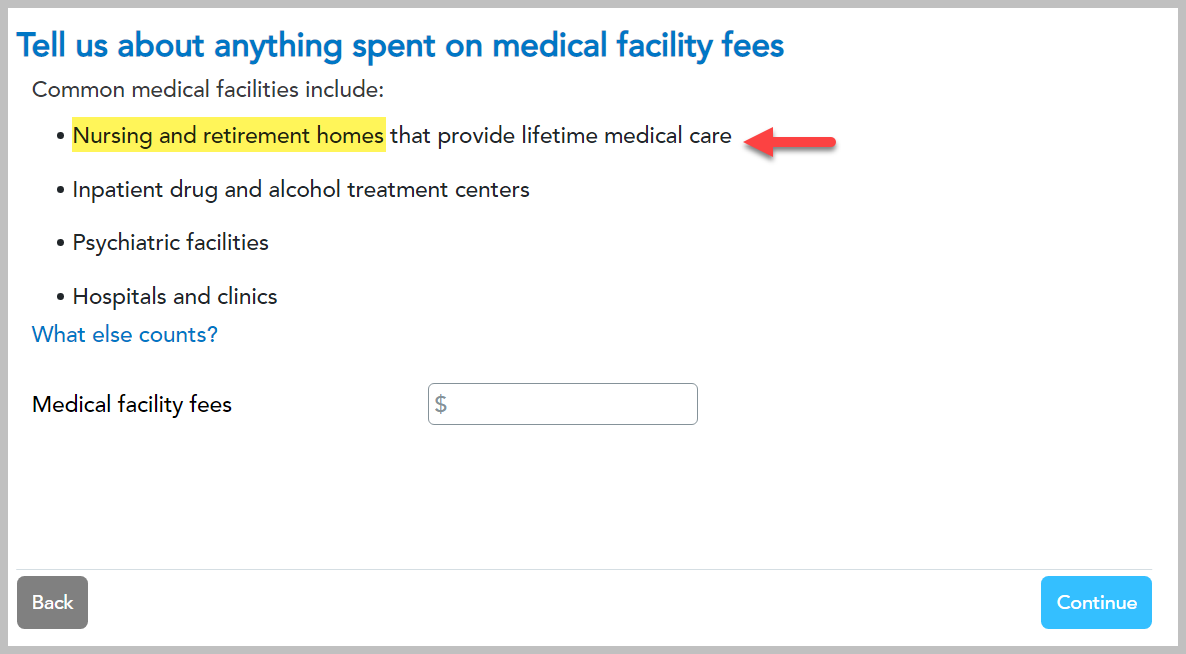

You can deduct the cost of the Memory Care Facility on the screen that says, "Tell us about anything spent on medical facility fees."

Nursing home and assisted living costs are only deductible if you itemize your deductions instead of taking the Standard Deduction. You can deduct any costs that exceed 7.5% of your adjusted gross income (AGI).

If you pay these expenses for a family member, they’re only deductible if you claim them as a dependent.

Things to keep in mind:

- If you, your spouse, or your dependent is in a nursing home primarily for medical care, then the nursing home cost not compensated for by insurance or otherwise (including meals and lodging) is deductible as a medical expense.

- If that individual is in a home primarily for non-medical reasons, then only the cost of the actual medical care not compensated for by insurance or otherwise is deductible as a medical expense, not the cost of the meals and lodging.

- Deduct medical expenses on Schedule A (Form 1040), Itemized Deductions.

- The total amount of all allowable medical expenses is the amount of such expenses that exceeds 7.5% of adjusted gross income.

You will deduct your Memory Care Facility costs on this screen in TurboTax.

Click here for "Medical, nursing home, special care expenses"

Click here for "Can I deduct nursing home costs?"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

lou-chapko

New Member

dixonmarr

New Member

bobster3366

Level 2

sking10

Level 3

lcab0293

New Member