- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- I am a home health aide and I work for a w2 company, but I also work for a 1099 company. Can I claim a mileage deduction when I drive from my 1099 Client to my W2 client on the same day?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am a home health aide and I work for a w2 company, but I also work for a 1099 company. Can I claim a mileage deduction when I drive from my 1099 Client to my W2 client on the same day?

I am a home health aide and I work for a w2 company, but I also work for a 1099 company. Can I claim a mileage deduction when I drive from my 1099 Client to my W2 client on the same day?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am a home health aide and I work for a w2 company, but I also work for a 1099 company. Can I claim a mileage deduction when I drive from my 1099 Client to my W2 client on the same day?

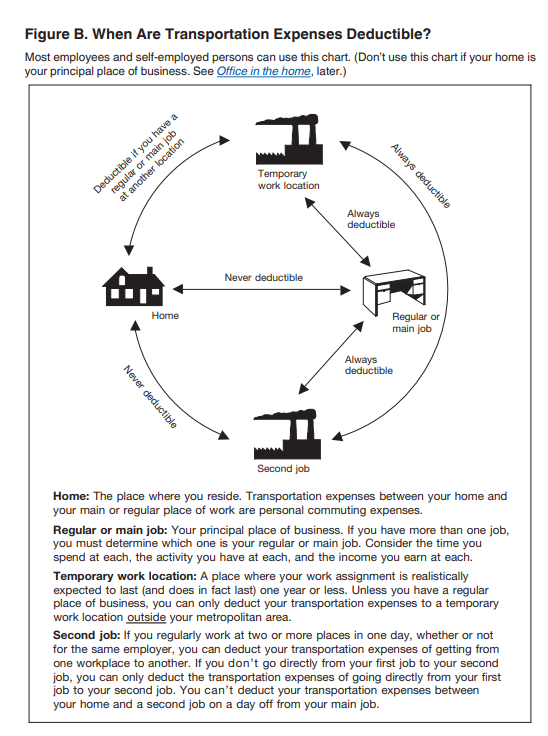

Yes, from a regular job to a second job is deductible.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am a home health aide and I work for a w2 company, but I also work for a 1099 company. Can I claim a mileage deduction when I drive from my 1099 Client to my W2 client on the same day?

So how much time inbetween is ok. Can you have lunch then go to your next job and still deduct miles?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am a home health aide and I work for a w2 company, but I also work for a 1099 company. Can I claim a mileage deduction when I drive from my 1099 Client to my W2 client on the same day?

If the client is in the same location every day and that is your only client, the mileage might be considered commuting and as such would not be deductible.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am a home health aide and I work for a w2 company, but I also work for a 1099 company. Can I claim a mileage deduction when I drive from my 1099 Client to my W2 client on the same day?

I have one client all week, but one day a week I have 2. So, when I go from my regular client (client #1) to my one day a week client (client #2), I think that is deductible. But, do I have to go immediately to the 2nd client, or can I stop for lunch if it is on the way and then go to the second client and deduct those miles from Client #1 to Client #2? What is the time frame to get to the other client?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17537417318

Returning Member

swick

Returning Member

JohnASmith

Level 4

aegisaccounting

New Member

NY taxpayer

New Member