- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Hurricane Ian - Other deductions/Casulty and Theft

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hurricane Ian - Other deductions/Casulty and Theft

I have very specific questions:

I was in Hurricane Ian. I had a loss of my pool cage screens (not the structure). I had a portion of the screens to be completely replaced. A total replacement would have cost $10,000.00. My partial cost me $4610.00.

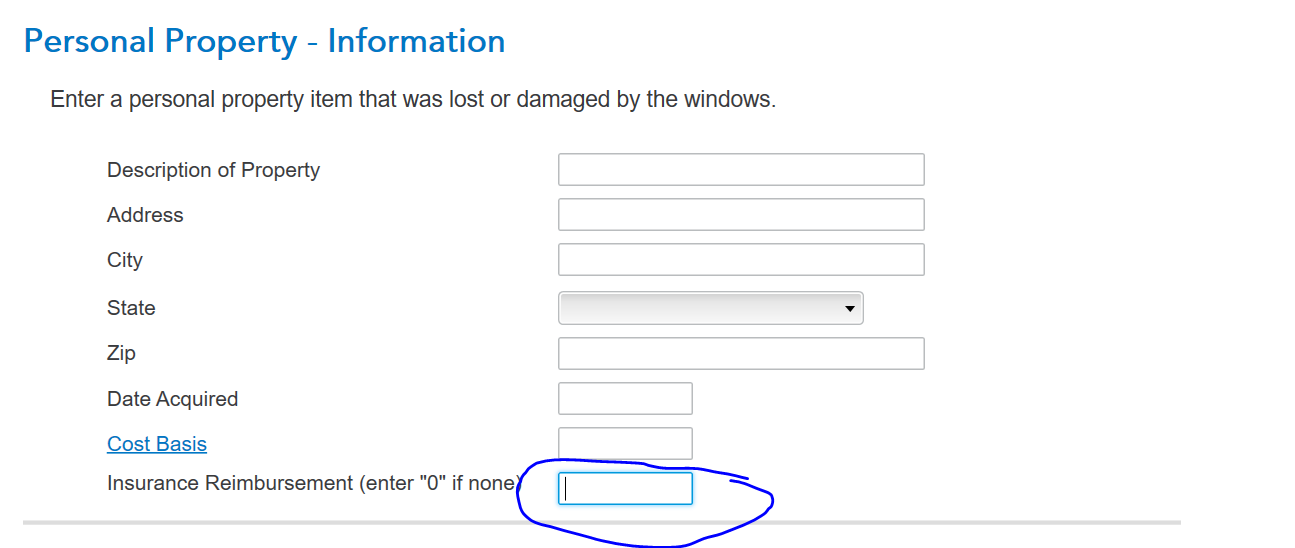

I do not understand the questions in the Casulty/Theft section. It asks me what the COST BASIS is. What amount would this be? Then it asks the FAIR MARKET VALUE before loss and after loss. What is FMV before loss? Is it what it would cost to replace? FMV after loss was 0 I assume??

My next question is: The day after the hurricane my generator broke and I had to purchase a new one. Can I write this off also? If so, what is the cost basis of the generator? And what is the FMV before and after for the generator?

My next question is my roof. I had a payment from my insurance company for my roof. But it did not completely cover the cost. It ended up being $4,000.00 short after the insurance payment. Again, the same questions as above?? New roof cost is $26,000.00

I appreciate so much your answering these questions for me.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hurricane Ian - Other deductions/Casulty and Theft

Please see this from the IRS about reconstructing records after a natural disaster. There is helpful information that will answer your questions about determining what to use in Casualty and Loss section. The damage to your generator is also part of the casualty loss.

The Casualty and Theft section asks for information using terms that aren't commonly used.

- The Cost Basis is generally what was paid for the property

- Fair Market Value is generally the price for which the property could be sold to a willing buyer

The IRS newsroom bulletin gives instructions to determine the Fair Market Value:

Determining the Decrease in Fair Market Value

Fair market value (FMV) is generally the price for which the property could be sold to a willing buyer. The decrease in FMV used to figure the amount of a casualty loss is the difference between the property's fair market value immediately before and after the casualty. FMV is generally determined through a competent appraisal. Without a competent appraisal, the cost of cleaning up or making certain repairs is acceptable under certain conditions as evidence of the decrease in fair market value.

Generally, the cost of cleaning up or making repairs if the repairs are:

- Actually made

- Not excessive

- Necessary to bring the property back to its condition before the casualty

- Only made to repair damage

- Not adding value to the property or making it worth more than before the disaster happened

The Cost Basis is what you paid for something, the Fair Market Value is what someone would pay for this after the casualty occurred. The Fair Market Value after the hurricane would be 0 if the items have no value after the event.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hurricane Ian - Other deductions/Casulty and Theft

Please see this from the IRS about reconstructing records after a natural disaster. There is helpful information that will answer your questions about determining what to use in Casualty and Loss section. The damage to your generator is also part of the casualty loss.

The Casualty and Theft section asks for information using terms that aren't commonly used.

- The Cost Basis is generally what was paid for the property

- Fair Market Value is generally the price for which the property could be sold to a willing buyer

The IRS newsroom bulletin gives instructions to determine the Fair Market Value:

Determining the Decrease in Fair Market Value

Fair market value (FMV) is generally the price for which the property could be sold to a willing buyer. The decrease in FMV used to figure the amount of a casualty loss is the difference between the property's fair market value immediately before and after the casualty. FMV is generally determined through a competent appraisal. Without a competent appraisal, the cost of cleaning up or making certain repairs is acceptable under certain conditions as evidence of the decrease in fair market value.

Generally, the cost of cleaning up or making repairs if the repairs are:

- Actually made

- Not excessive

- Necessary to bring the property back to its condition before the casualty

- Only made to repair damage

- Not adding value to the property or making it worth more than before the disaster happened

The Cost Basis is what you paid for something, the Fair Market Value is what someone would pay for this after the casualty occurred. The Fair Market Value after the hurricane would be 0 if the items have no value after the event.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hurricane Ian - Other deductions/Casulty and Theft

Hi PattiF

Thanks for response on FMV. I have a question about reporting Hurricane Ian loss on TT. I filled out cost basis and then the amount the insurance paid. I put in the FMV before the hurricane. My question is about the FMV after the hurricane. Do I subtract what the insurance company says is our total loss from the FMV before the hurricane? This number includes what the insurance company paid us plus our deductible. Also we only had $10,000 coverage on our pool cage but it costs $45,000. to replace it . Can I subtract the difference and include that in the FMV after the hurricane?

Thank you for your assistance.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hurricane Ian - Other deductions/Casulty and Theft

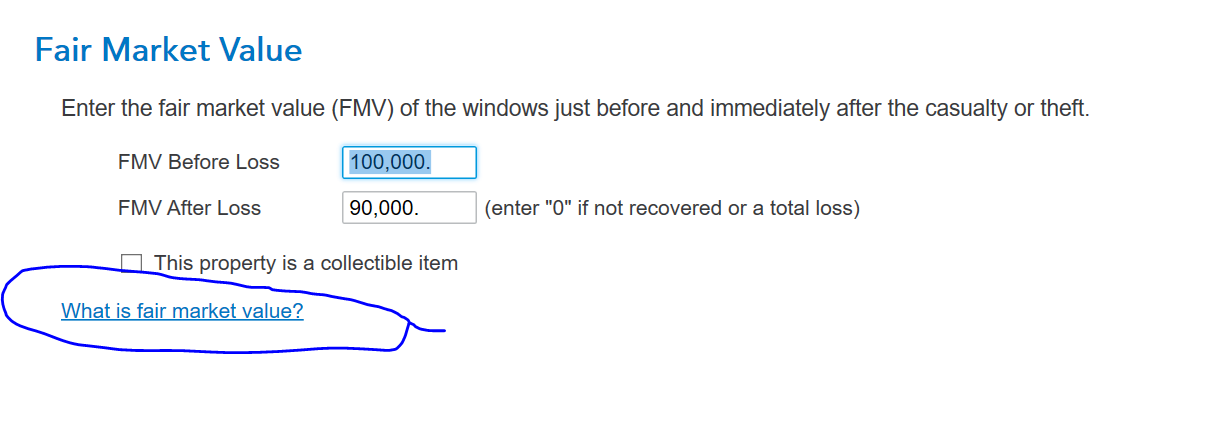

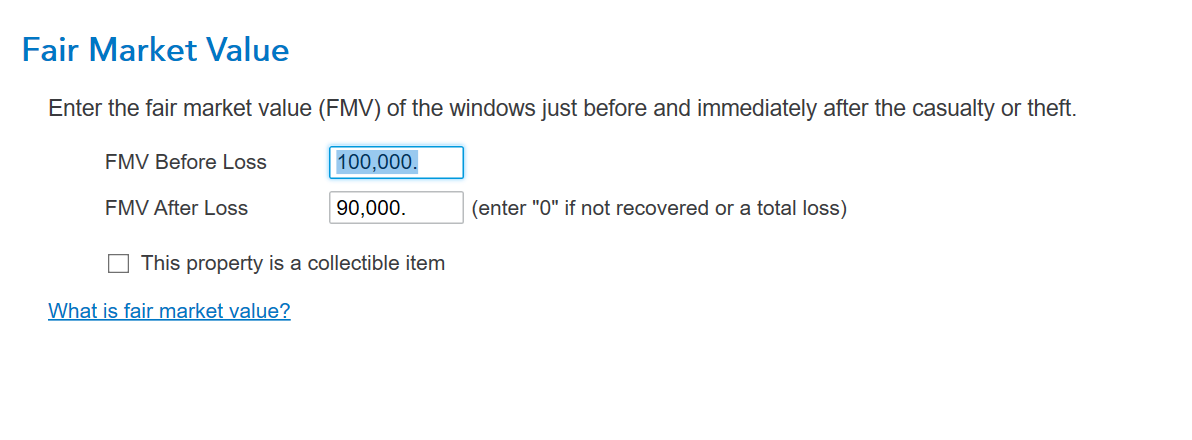

What is FMV before loss?

This is the value of an asset before it was damaged or stolen.

What is FMV after loss?

This depends on the asset and the damage that was done. For example, let's say you have a car with a FMV of $10,000 before it was damaged.

If a tree falls on your car in a storm and totals it, then the FMV after loss is $0.

However, if the tree only broke the car's windshield, which resulted in $500 worth of damages, then the car's FMV after loss is $9,500.

When you go into this screen, the information I just laid out for you will be presented here

So, since it doesn't talk anything about insurance, you will enter the total fmv before the loss including what the insurance co. paid you( don't subtract it), the total fmv after the loss(without deduction the amount you received from the insurance co). The insurance reimbursement that the company paid you was already entered in the previous screen

Enjoy!

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hurricane Ian - Other deductions/Casulty and Theft

I am Having Prentering casualty information on the program

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hurricane Ian - Other deductions/Casulty and Theft

We'd love to help you complete your tax return, but need more information. Can you please clarify your question?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Jackster8

New Member

MamaC1

Level 3

MamaC1

Level 3

corneliusconnelly

New Member

kelleyfrog

New Member