- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- How should I split the basis and sales price of a property between cost and land that I sold? I purchased in 2007, started renting it 100% in 2016 and sold in 2022

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How should I split the basis and sales price of a property between cost and land that I sold? I purchased in 2007, started renting it 100% in 2016 and sold in 2022

- Started Renting (100%) in 3/2016 until I sold it in 5/2022

- Sold for $380,000

I understand I will have to reduce my basis by the depreciation I had during the time as a rental but not sure how to ensure my correct basis is listed.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How should I split the basis and sales price of a property between cost and land that I sold? I purchased in 2007, started renting it 100% in 2016 and sold in 2022

What you should have done when you started renting it in 2016 was create two assets - one for the house and one for the land. I usually recommend that the value of the land be about 20% of the total. Then, when you set up the depreciation. the portion of the property that is the land would not depreciate and you would only depreciate the portion that was the building.

If you only created one asset at the time that you started depreciating the property then you don't have to think about the land at all. Just do the sale and you'll recapture the depreciation and pay long term gains on your profit.

If you did create two assets then you split the sales price along the same percentage lines that you split the original cost. Enter it as a sale of two assets and you're good to go.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How should I split the basis and sales price of a property between cost and land that I sold? I purchased in 2007, started renting it 100% in 2016 and sold in 2022

Thanks for your response. To further clarify my question, how does Turbo Tax breakdown between Cost and Land work? Is Cost the total price and Land a portion of the Cost Total?

I think FMV at time I converted to a rental was less than what I bought it for in 2007. Can I use the higher cost from 2007 since I am selling the rental for a gain?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How should I split the basis and sales price of a property between cost and land that I sold? I purchased in 2007, started renting it 100% in 2016 and sold in 2022

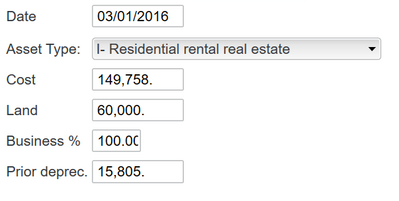

Note - the screen shot is from what was carried over from my 2021 Turbo Tax Return. It also had my business % at less than 100% (83.61%) but not sure why that would be since it was 100% rental from 3/2016 conversion. I also have a 50% ownership so those carried forward numbers likely represent 50% (my OP used full values).

Thanks in advance. I get very different tax results when changing the cost numbers and business %.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How should I split the basis and sales price of a property between cost and land that I sold? I purchased in 2007, started renting it 100% in 2016 and sold in 2022

First things, first. In answer to your first question, the answer is yes. You may use the higher cost value when you first acquired the property. Add costs of improvements to that cost and deduct all the depreciation from the time you purchased the home till you sold. See HERE for complete instructions on how to handle the sale of a rental property as in your particular situation in Turbotax. Remember we are using the purchase price when you initially bought the home in 2007.

When you first purchased the in 2007 for 324,009, you were supposed to have allocated 80% toward the cost of the home and 20% towards the land and taken depreciation on 80% from that amount.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How should I split the basis and sales price of a property between cost and land that I sold? I purchased in 2007, started renting it 100% in 2016 and sold in 2022

Great - thank you for the previous post as it was similar to my situation in terms of MV at the 3 time periods in question (purchase, conversion to rental, and sale).

I also reviewed my return in 2016 to see where the cost basis information was coming from in when I converted to a rental. My business % was less than 100% in that first year because I started renting it in March. A follow up question would be since that time, it was always a rental. Can I use 100% business percentage and change what pulled through from my first year?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How should I split the basis and sales price of a property between cost and land that I sold? I purchased in 2007, started renting it 100% in 2016 and sold in 2022

Do I also need to deduce my previous depreciation from my 2007 purchase price in the "Cost" number or does TT automatically deduct it since it list the previous years depreciation in the same section?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How should I split the basis and sales price of a property between cost and land that I sold? I purchased in 2007, started renting it 100% in 2016 and sold in 2022

Yes, TurboTax will automatically record the amount of previous depreciation when you enter an asset purchased in a prior year.

The program calculates a number for prior depreciation and you can change it if it does not match your tax records.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How should I split the basis and sales price of a property between cost and land that I sold? I purchased in 2007, started renting it 100% in 2016 and sold in 2022

I allocated the purchase price of my rental to land and building. But only building was depreciated when I converted my second home to rental in 2022. I sold it in 2023. Should I just allocate the purchase price to building and not reflect any part of sale price to land?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How should I split the basis and sales price of a property between cost and land that I sold? I purchased in 2007, started renting it 100% in 2016 and sold in 2022

No, you must allocate a portion of the sale to the land, and the remaining to the building.

If there is Depreciation Recapture, that will only be on the building since land is not depreciated.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How should I split the basis and sales price of a property between cost and land that I sold? I purchased in 2007, started renting it 100% in 2016 and sold in 2022

"The program calculates a number for prior depreciation and you can change it if it does not match your tax records." meaning is i can change it to total number of depreciation on the tax return schedule E each year since i rented the property? for example, the property rented 10 years, the program calculates the number is 60k, but i only did the depreciation 7 years for 40k, can i change the number 60k to 40k ? Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How should I split the basis and sales price of a property between cost and land that I sold? I purchased in 2007, started renting it 100% in 2016 and sold in 2022

Yes, you may change the amount of prior depreciation to reflect your records.

The cost basis for the land portion of the asset is not depreciated.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How should I split the basis and sales price of a property between cost and land that I sold? I purchased in 2007, started renting it 100% in 2016 and sold in 2022

Thank you for reply. I have sold this house and use “Sale of Business Property” to file form 4797, Can I fill in the actual depreciation number for 7 years $40k? the pregame ask "Depreciation allowed or allowable " , Is the meaning that total actual taken depreciation number of 7 years or rented property 10 years number ?

Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How should I split the basis and sales price of a property between cost and land that I sold? I purchased in 2007, started renting it 100% in 2016 and sold in 2022

The IRS requires that you claim all depreciation that you are allowed and it must be entered in the spot you are asking about. If the house was rented for 7 years, the dates of rental need to reflect 7 years. If it was a rental for 10 years and you just didn't take the depreciation, it needs to be the 10 year number. If you failed to claim depreciation in prior years, you can amend the last 3 years. Otherwise, you can file form 3115 with your tax return to ask for the missing depreciation.

See About Form 3115, Application for Change in Accounting

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How should I split the basis and sales price of a property between cost and land that I sold? I purchased in 2007, started renting it 100% in 2016 and sold in 2022

ok, i see. thanks.

i bought the house in 2004 for residence at 210K, conversion rental house in 2013 and the FMV is 100k. and sold it at 300K. which number ( 210K or 100K) for the cost basis to calculate the depreciation?

Thanks

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

scatkins

Level 2

realestatedude

Returning Member

eric6688

Level 2

MoisesyDith

Level 1

mana1o

New Member