- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- How do I use the Colorado child care credit contribution?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I use the Colorado child care credit contribution?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I use the Colorado child care credit contribution?

Taxpayers that make a qualifying monetary contribution to promote child care in Colorado may claim an income tax credit of 50% of the total qualifying contribution. In-kind contributions of property (non-monetary donations) do not qualify for the credit.

TAXPAYERS ELIGIBLE FOR THE CREDIT Any taxpayer that makes a qualifying contribution can claim the child care contribution credit. Resident and nonresident individuals, estates, trusts, partnerships, and corporations can all claim the credit for qualifying contributions they make.

QUALIFYING CONTRIBUTIONS Contributions must meet several criteria to qualify for the child care contribution credit. The contribution must be monetary; contributions of property do not qualify for the credit. The credit is allowed only for contributions that promote child care in Colorado. Additionally, the contribution must be made for an eligible child care purpose and to a licensed child care facility, an approved facility school, or a registered or grandfathered child care program.

HOW TO CLAIM THE CREDIT

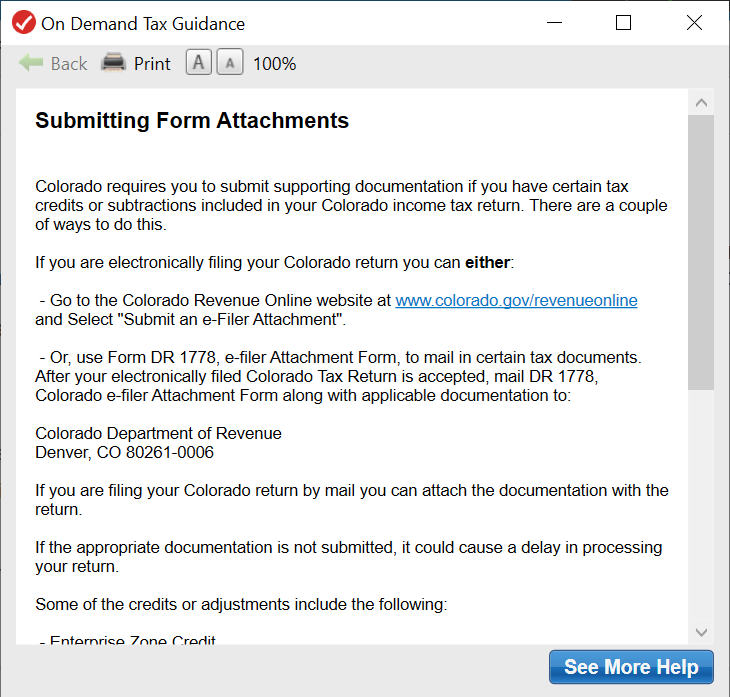

Taxpayers must file an annual income tax return along with the associated credit schedule in order to claim the credit. Taxpayer must submit with their return a copy of the completed Child Care Contribution Tax Credit Certification (Form DR 1317) obtained from the donee organization certifying the contribution. For electronically filed returns, a scanned copy of Form DR 1317 can be submitted either via e-file or by using the E-Filer Attachment function of Revenue Online. TurboTax will produce this form for you to upload or mail with your receipt.

For more information:

https://www.colorado.gov/pacific/sites/default/files/Income35.pdf.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I use the Colorado child care credit contribution?

Taxpayers that make a qualifying monetary contribution to promote child care in Colorado may claim an income tax credit of 50% of the total qualifying contribution. In-kind contributions of property (non-monetary donations) do not qualify for the credit.

TAXPAYERS ELIGIBLE FOR THE CREDIT Any taxpayer that makes a qualifying contribution can claim the child care contribution credit. Resident and nonresident individuals, estates, trusts, partnerships, and corporations can all claim the credit for qualifying contributions they make.

QUALIFYING CONTRIBUTIONS Contributions must meet several criteria to qualify for the child care contribution credit. The contribution must be monetary; contributions of property do not qualify for the credit. The credit is allowed only for contributions that promote child care in Colorado. Additionally, the contribution must be made for an eligible child care purpose and to a licensed child care facility, an approved facility school, or a registered or grandfathered child care program.

HOW TO CLAIM THE CREDIT

Taxpayers must file an annual income tax return along with the associated credit schedule in order to claim the credit. Taxpayer must submit with their return a copy of the completed Child Care Contribution Tax Credit Certification (Form DR 1317) obtained from the donee organization certifying the contribution. For electronically filed returns, a scanned copy of Form DR 1317 can be submitted either via e-file or by using the E-Filer Attachment function of Revenue Online. TurboTax will produce this form for you to upload or mail with your receipt.

For more information:

https://www.colorado.gov/pacific/sites/default/files/Income35.pdf.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I use the Colorado child care credit contribution?

Does a charitable donation from a DAF (donor advised fund) qualify for Colorado child care tax credit with Form DR1317?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I use the Colorado child care credit contribution?

No, contribution from a donor advised fund would not qualify on your personal tax return if you received a tax benefit (charitable deduction) for the contribution to the fund and it would be the Fund, not you personally making the donation,

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I use the Colorado child care credit contribution?

I am not seeing where to enter a child care contribution credit in the State tax section. Which page should I find this on? Is it "Additional Qualifying Charitable Contributions"? It doesn't say anything about a tax credit in this section.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I use the Colorado child care credit contribution?

You should find the credit under Colorado credits and taxes:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I use the Colorado child care credit contribution?

I don't see under Turbo Tax where I may electronically upload form DR1317 to my State return, assistance please

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I use the Colorado child care credit contribution?

On the screen in the Colorado interview titled, "Enter Your Child Care Contribution Credit", There is a link at the bottom: "How do I do this?". When you expand the link, you will see a box that explains how your send form DR 1317 to the state even if you e-filed.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I use the Colorado child care credit contribution?

I have already determined I can take the Child Care Contribution Tax credit for Colorado. And I have entered this into the correct section of the Colorado Tax form in TurboTax. Do I need to manually reduce the charitable donation on the Federal side by 50%? Or will this be reconciled next year when I get the 1099G form from Colorado? Or does TurboTax take this into account in the calculations once I enter the value in on the State form?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I use the Colorado child care credit contribution?

You are correct that you will need to reduce the amount on your federal tax return on Schedule A for the Child Care Contribution by 50%. Note that there are a number of exceptions - Please see this Treasury page on the subject.

As a general rule, TurboTax does not make modifications to the federal return based on state calculations.

Good catch!

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I use the Colorado child care credit contribution?

The TurboTax form "learn more" link correctly states

Taxpayers who make qualifying monetary contributions to promote child care in Colorado may claim a credit of 50% of the total qualifying contribution.

and then further states

We will calculate the correct amount for you.

However, after filling in the filling in the field "2023 Qualifying Donation Amount from DR 1317", the credit amount is calculated at 100% of the qualifying donation amount rather than 50%. This seems to be incorrect, even though TurboTax insists that it will calculate the correct amount. I guess I should manually reduce the amount myself? Or does TurboTax end up taking care of this at some point down the line?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I use the Colorado child care credit contribution?

You are correct, TurboTax is applying 100% instead of 50%. Thank you for bringing this to our attention; we will get this updated. You can either reduce it by half or wait for the update. You may want to wait, since manually adjusting it will require you to enter a different amount (1/2) than reported on your DR1317 @izzyp1

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I use the Colorado child care credit contribution?

Is there an ETA for this fix for Colorado( TurboTax is applying 100% instead of 50% )?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I use the Colorado child care credit contribution?

Take a look at the following TurboTax help article and click the link to register your email address for notifications as this situation is addressed:

Why is the Colorado Child Care Contribution Credit not calculating 50%?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I use the Colorado child care credit contribution?

When you I click on the link given, I get

We're sorry, we can't find the page you requested.

Can you double check link.

thanks,

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

bethwill48

New Member

pfAKaQYRwG

Level 2

vallygirl927

New Member

CP01

Level 3

toddrub46

Level 4