- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- How do I prevent the Deductible Home Mortgage Interest Worksheet from assuming that all of my mortgage refinances are additional loans?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I prevent the Deductible Home Mortgage Interest Worksheet from assuming that all of my mortgage refinances are additional loans?

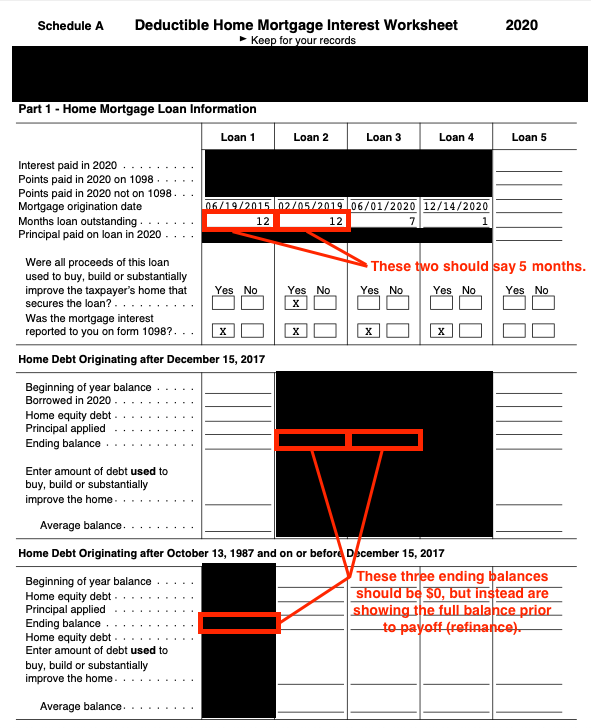

I started the year with two mortgages, a primary and a HELOC. Then refinanced in June to consolidate them into one home loan. Then refinanced again in December for a significant reduction in the interest rate. Only one loan existed at the end of 2020, but the Deductible Home Mortgage Interest Worksheet is adding the balances together into one massive home loan that is 4x the amount of my actual average loan balance during the year, which ultimately limits the mortgage interest deduction. Please see my replies below for additional detail and screen shots.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I prevent the Deductible Home Mortgage Interest Worksheet from assuming that all of my mortgage refinances are additional loans?

Thank you for providing this information. We are aware of this experience. Please sign up for email notification when an update related to this issue is available here.

If you choose to move forward with your return and if you have a mortgage debt that is below $750,000, (or $1M for grandfathered debt incurred on or before December 15, 2017) this means all of the mortgage interest would be allowed to be used on your itemized deductions as long as there was no cash taken out that was not used on the home (all borrowed funds were used to buy, build or improve the home).

If this is your situation then enter the mortgage debt for Form 1098 with the current lender, and then enter $1 for the second or former lender in that Form 1098. This will provide the correct amount of allowed mortgage interest deduction.

You may want to delete them first to begin again and also clearing your cache and cookies is a good ides (regularly).

Here's how to enter your mortgage interest statement in TurboTax:

- With your return open, search for 1098 and select the Jump to link in the search results.

- Follow the instructions to enter your 1098 info

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I prevent the Deductible Home Mortgage Interest Worksheet from assuming that all of my mortgage refinances are additional loans?

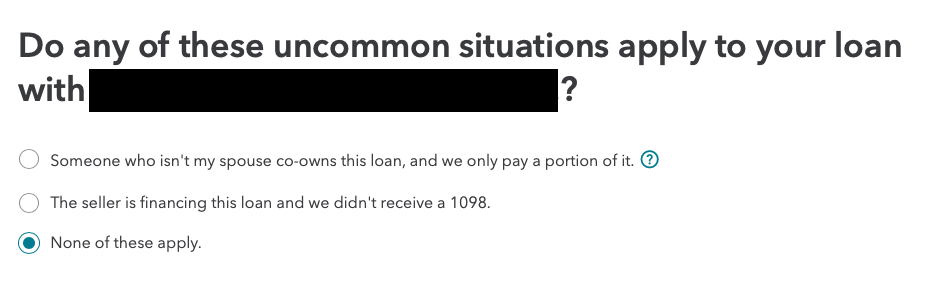

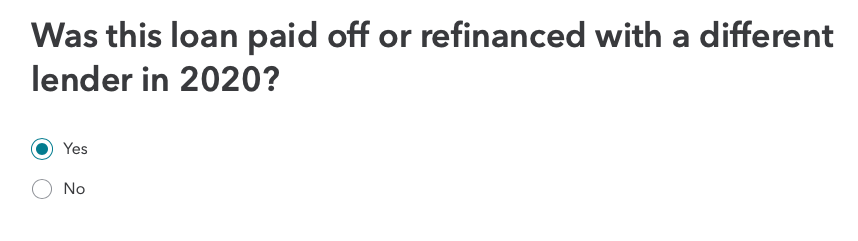

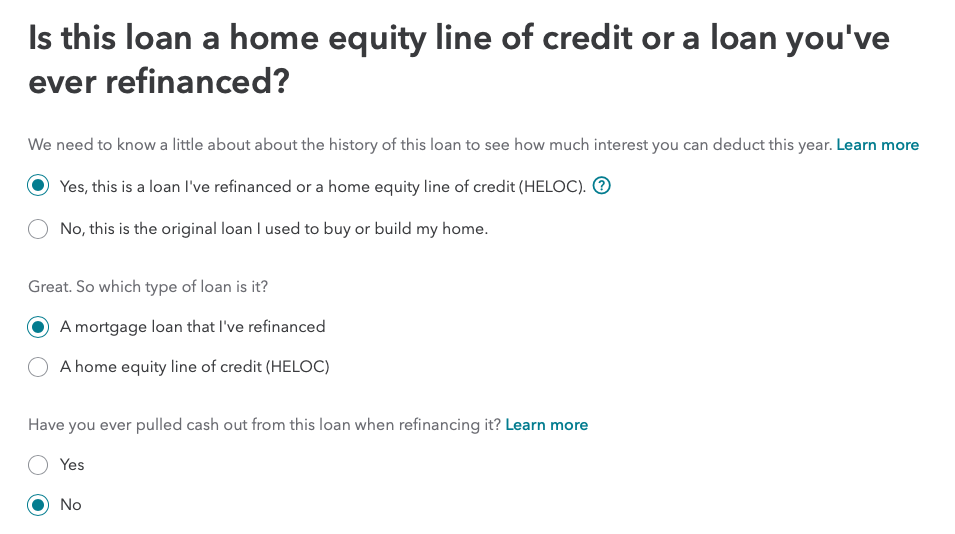

Here is some more detail from the entry screens.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I prevent the Deductible Home Mortgage Interest Worksheet from assuming that all of my mortgage refinances are additional loans?

Here are the resulting "errors" in the forms.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I prevent the Deductible Home Mortgage Interest Worksheet from assuming that all of my mortgage refinances are additional loans?

And here is ultimately the impact of this.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I prevent the Deductible Home Mortgage Interest Worksheet from assuming that all of my mortgage refinances are additional loans?

Thank you for providing this information. We are aware of this experience. Please sign up for email notification when an update related to this issue is available here.

If you choose to move forward with your return and if you have a mortgage debt that is below $750,000, (or $1M for grandfathered debt incurred on or before December 15, 2017) this means all of the mortgage interest would be allowed to be used on your itemized deductions as long as there was no cash taken out that was not used on the home (all borrowed funds were used to buy, build or improve the home).

If this is your situation then enter the mortgage debt for Form 1098 with the current lender, and then enter $1 for the second or former lender in that Form 1098. This will provide the correct amount of allowed mortgage interest deduction.

You may want to delete them first to begin again and also clearing your cache and cookies is a good ides (regularly).

Here's how to enter your mortgage interest statement in TurboTax:

- With your return open, search for 1098 and select the Jump to link in the search results.

- Follow the instructions to enter your 1098 info

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I prevent the Deductible Home Mortgage Interest Worksheet from assuming that all of my mortgage refinances are additional loans?

Is there a time line for this issue to be resolved. I am sure there are many people in this same situation.

Thanks,

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I prevent the Deductible Home Mortgage Interest Worksheet from assuming that all of my mortgage refinances are additional loans?

@Alhuggins I received the following update from TurboTax:

You are receiving this email because you signed up on a TurboTax support article regarding “Why is my home mortgage interest being limited?”

We have added some in-program help to assist with the entering of your home mortgage information. We also have a new support article on our support site with more information on how your home mortgage information should be entered.

Please review your home mortgage information in the program.

How do I handle multiple 1098 mortgage forms?

TurboTax update has been released resolving this issue. If you are usingTurboTax Online, updates are applied automatically. If you are using TurboTax Desktop, make sure you download and install the latest update. If you need assistance with updating, please refer to the following support article.

How to Update TurboTax

https://ttlc.intuit.com/questions/1901183

Thanks for your patience.

Sincerely,

The TurboTax Help Team

Looks like TurboTax is calling the issue resolved. However, when I logged back into the mortgage interest section in TurboTax online, nothing had actually changed. So I just set the paid off mortgages to to $1 principal balance as suggested by @DianeW777 and that worked for the interest calculation. Not sure whether there will be any issues in acceptance of the returns since the principle balances entered will not agree to the 1098 forms. We shall see! 😉

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I prevent the Deductible Home Mortgage Interest Worksheet from assuming that all of my mortgage refinances are additional loans?

Some TurboTax customers are experiencing an issue with their home mortgage average balance. This can cause the home mortgage interest to be incorrectly limited. This may be affecting your tax return.

Please sign up for email notifications when an update related to this issue is available.

See this TurboTax Help.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I prevent the Deductible Home Mortgage Interest Worksheet from assuming that all of my mortgage refinances are additional loans?

A variant of this problem is still present. Refinance loans done in 2020 against debt from pre-2017 are showing up in the worksheet as post 2017 debt, causing the calculation to be wrong.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I prevent the Deductible Home Mortgage Interest Worksheet from assuming that all of my mortgage refinances are additional loans?

it depends. If these all loans for the same house, combine all of the 1098's into one entry. Use the latest mortgage loan balance as the loan amount and report the mortgage origination date from the original loan. You will find that you will be able to deduct the full amount of the interest if less than $1M.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Jeffsjams

Returning Member

afletchertfc

New Member

aegisaccounting

New Member

lizmckanna88

New Member

hgomez23

Level 1