- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- how do i get form 8889 to load into my return

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

how do i get form 8889 to load into my return

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

how do i get form 8889 to load into my return

You must always file a Form 8889 in any year you or an employer contributes money to your HSA or you make withdrawals from the account. The deduction you calculate on Form 8889 is taken on the first page of your income tax return, Form 1040 on line 25.

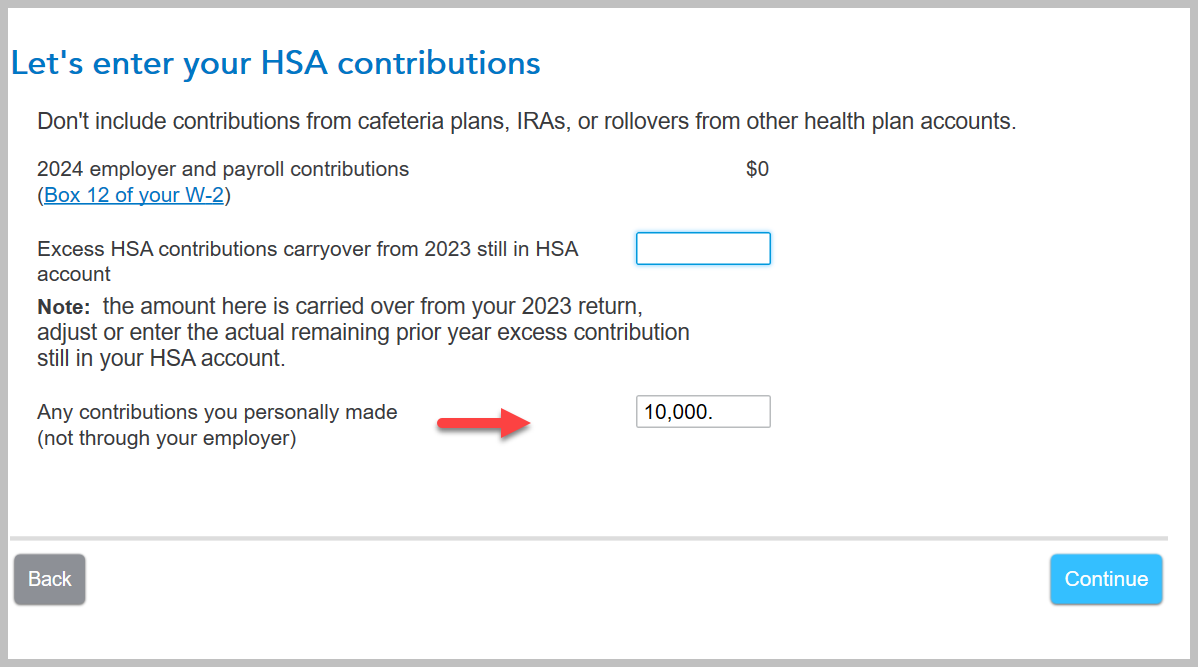

Your HSA contributions are entered into TurboTax two ways. You may have a Form W-2 with a Code W in Box 12. When you enter that the Form 8889 should generate. You will also enter your HSA contributions not reported on Form W-2 in the HSA section of TurboTax.

To get to your HSA screens in TurboTax you can:

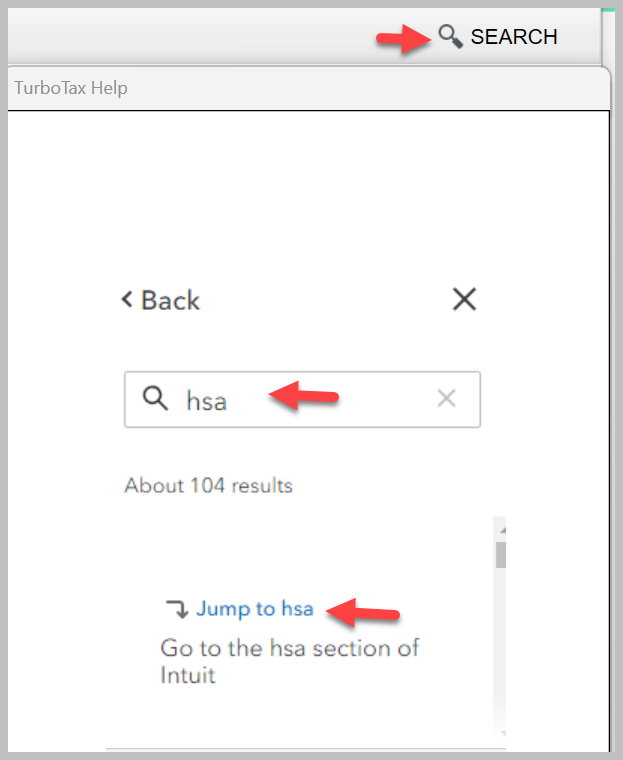

- Click on "Search" in the top right of your TurboTax screen

- Type "hsa" in the search box

- Select "Jump to hsa"

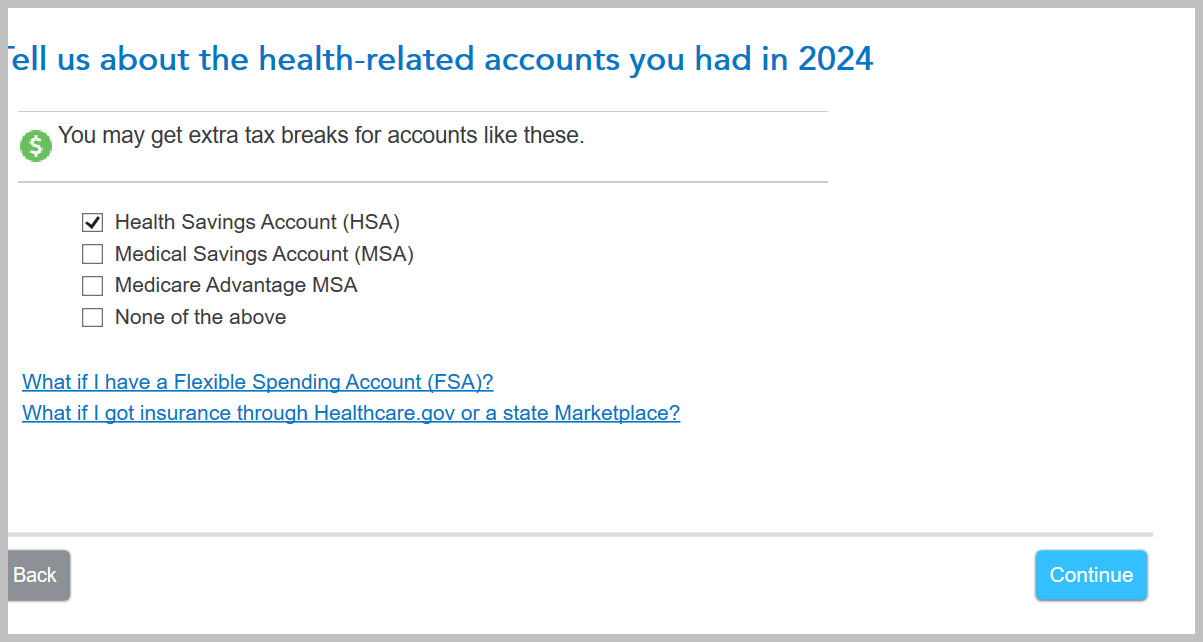

- Your screen will say, "Tell us about health-related accounts you had in 2024"

Your TurboTax screens will look something like this:

Click here for What Is the IRS Form 8889?

Click here for "What is a health savings account (HSA)?

Click here for more detailed information regarding HSA contributions.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

DennisK1986

Level 2

DolceDolce

Level 4

DolceDolce

Level 4

YT76

Level 2

apophasisx

New Member