in Events

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- How do I get back to the input to correct a double counting of my mortgage interest on my personal home?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I get back to the input to correct a double counting of my mortgage interest on my personal home?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I get back to the input to correct a double counting of my mortgage interest on my personal home?

Here's how to adjust these entries in TurboTax Online:

1) In TurboTax Online, enter 1098 into the search field (magnifying glass) in the upper right of your screen.

2) Select the Jump to 1098 button. Follow the guided interview to make your adjustments.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I get back to the input to correct a double counting of my mortgage interest on my personal home?

It would be good advice but the page I am on ( after Federal review) will not let me go back, only forward, so I cannot return to "Deductions"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I get back to the input to correct a double counting of my mortgage interest on my personal home?

Yes, you can either click on the Federal tab or you can type into the magnifying glass. Type exactly mortgage interest.

You can always move around in the program but you have to let the program know where you want to go.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I get back to the input to correct a double counting of my mortgage interest on my personal home?

What about in the full TurboTax? Can't seem to fix this error.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I get back to the input to correct a double counting of my mortgage interest on my personal home?

It depends.

I am assuming you mean the desktop or downloaded software when you say "the full TurboTax". If so, you can make your correction as follows:

- Log back into your TurboTax account

- At the top of the screen, select the Personal tab

- Then select Deductions & Credits

- Select I'll choose what I work on

- Under Your Home, select Mortgage Interest, Refinancing, and Insurance and select Update

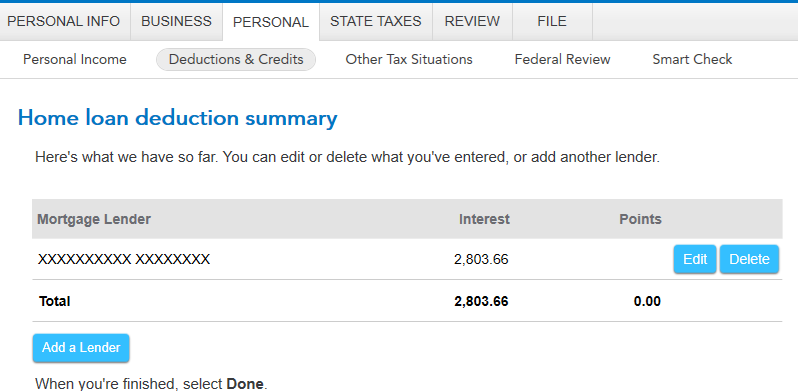

- On the following page, you will see a list of everything under the title Home loan deduction summary

- Edit as needed or select delete if you have a duplicate entry here

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Raph

Community Manager

Raph

Community Manager

in Events

Slemay925

Level 2

ohkimbui

New Member

gaving031

New Member