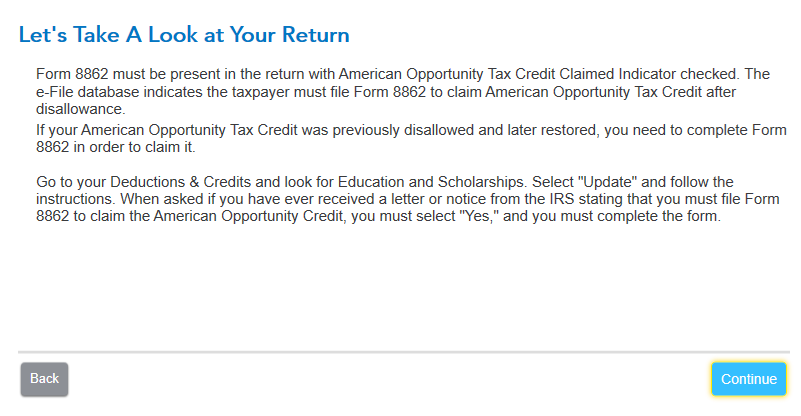

Federal tax file rejected 5 times. Each time the stated reason is Form 8862 in relation to the American Opportunity Tax Credit:

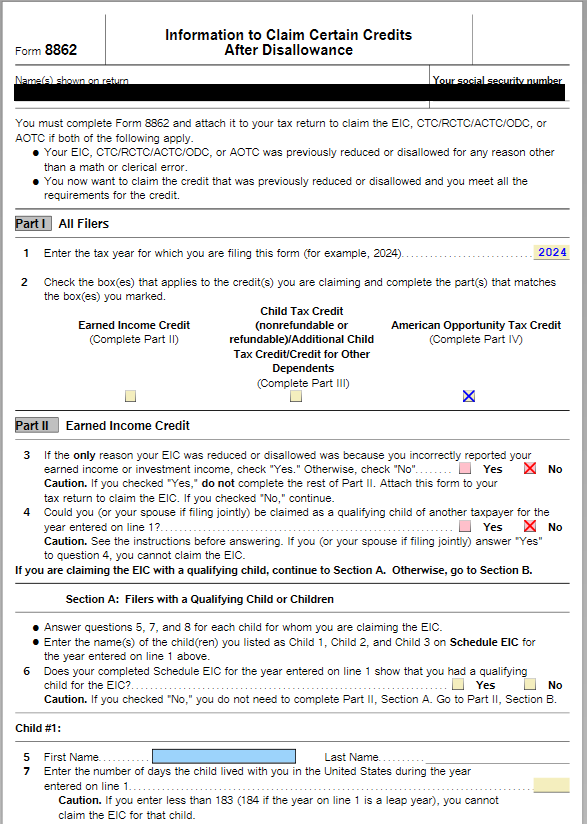

Attempts to complete form 8862 ALWAYS fail at the point where we attempt to complete Section IV for our remaining full-time student/dependent, who is a Junior in his 3rd year of eligibility for AOTC.

The result is always the same:

We tried removing AOTC, switching to Lifelong Learning Credit, and any other variation we could think of until we ran out of time and had to file for an extension. I'm out of ideas -- can anyone help?