- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Form 7203 not importing to Schedule E correctly

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 7203 not importing to Schedule E correctly

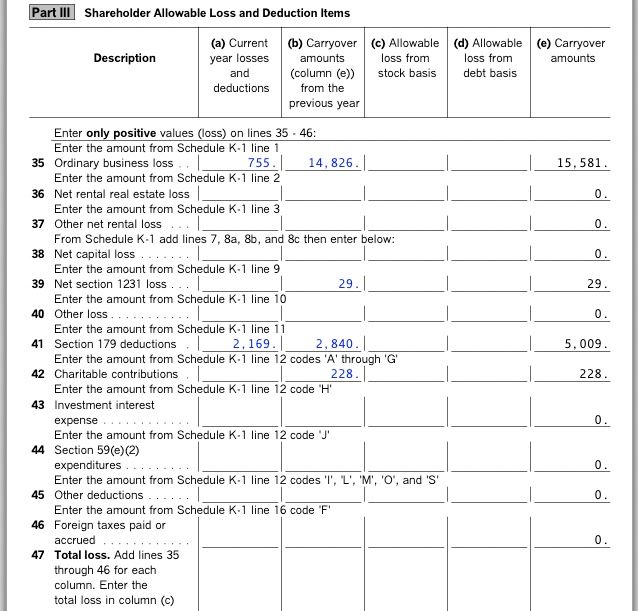

I see that similar questions have been asked before but I didn't see an answer to my specific question so will ask again. On my Schedule K-1 (1120-S), I have losses (ordinary business loss, Section 179 expense) for the current year that are completely disallowed for 2024 and will be carried forward to 2025. When using TurboTax to input my K-1, everything appears to be listed correctly with the entire loss listed as carryover:

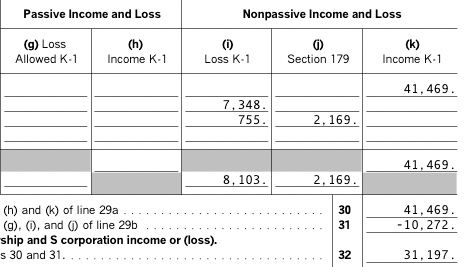

So all appears in order. However, when I go back to review my Schedule E after completing my taxes, all those losses are now taken from my income in the current year, leaving me with a greater refund than I should be allowed:

So, it's the $2169 and the $755 that are incorrectly being imported into the Schedule E. And even though I can see it, I can't make any changes to it. Does anyone know why this is happening or how to get around it? My business basis is listed correctly. My plan right now is to print out everything and make selective edits to the Schedule E and other lines that flow from it. Thanks.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 7203 not importing to Schedule E correctly

That is because TurboTax stupidly doesn't connect the 7203 to anything. You need to manually only enter any allowable losses and then next year manually enter any usable carryover losses. It doesn't do anything automatically so you need to manually do it all.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

terriforzayden

New Member

j_pgoode

Level 1

DIY79

New Member

TheSchulteMeistr

Returning Member

CRoxl

Level 1