- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Foreign Tax Credit: the system is not allowing me to enter amount of foreign taxes paid. It is referring me back to Wages and Salaries, but this is already complete?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

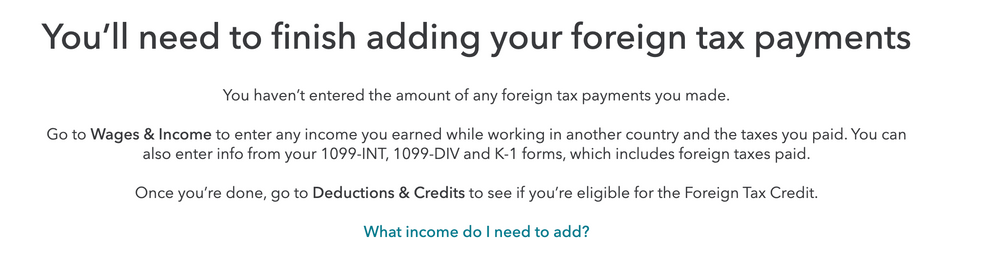

Foreign Tax Credit: the system is not allowing me to enter amount of foreign taxes paid. It is referring me back to Wages and Salaries, but this is already complete?

Thank you, but the problem is not entering foreign income. The problem is the system is not allowing entry of foreign taxes paid.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Tax Credit: the system is not allowing me to enter amount of foreign taxes paid. It is referring me back to Wages and Salaries, but this is already complete?

Hi @MaryK4,

You can replicate our steps very easy. You can just follow steps you provided with some fake amount, for example $100k as income:

1. Be sure your Foreign Income is entered.

2. Scroll down to the section under Income & Expenses that says Foreign Earned Income Exclusion and Select Edit/Add

3. Go through the On Screen Prompts until you get to the screen that asks you "Whose Foreign Income Would you Like to Try and Exclude," choose Neither of Us (for Joint Returns) and Continue. TurboTax will take you back to the Income & Expenses Summary Screen.

4. Go to the Foreign Tax Credit section under Deductions & Credits. You should be able to see that it will not allow you to enter the Foreign Taxes Paid.

I have deleted forms 2555, repeated the steps and I still get the same issue.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Tax Credit: the system is not allowing me to enter amount of foreign taxes paid. It is referring me back to Wages and Salaries, but this is already complete?

More information may help resolve your issue. For example, how did you enter the foreign income into TurboTax?

Note that if the foreign income is not on a W-2, 1099-INT, 1099-DIV, or K-1 you use the screens shown by Community user ThomasM125 to "get the income into the system". If after entering your foreign income you don't want to use the Foreign Income Exclusion, just answer accordingly and "finish out" the Foreign Income and Exclusion section.

Then, go to the Deductions & Credits>>Estimates and Other Taxes Paid>>Foreign Taxes section and follow the interview questions. You'll have to designate a category and country of origin for your income, and then you'll get a place to enter the income for that category and country. After that, you'll get a screen to enter the associated foreign tax you paid on that income.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Tax Credit: the system is not allowing me to enter amount of foreign taxes paid. It is referring me back to Wages and Salaries, but this is already complete?

I recognize your frustration. The IRS allows you to claim the exact amount of the foreign taxes paid if you meet certain conditions (see Form 1116 Instructions). However, it is beginning to look as if TurboTax can't handle this situation. TT seems to require that you claim a foreign tax credit through Form 1116, which will always reduce the credit to an amount less than the amount paid. I asked a Customer Service Rep and a CPA at TT how I could claim a credit for the amount paid rather than submit a claim through Form 1116 and neither one could help. I used to think TT was pretty good but now I'm not as confident.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Tax Credit: the system is not allowing me to enter amount of foreign taxes paid. It is referring me back to Wages and Salaries, but this is already complete?

If you do not need the form 1116, the $300 or less can go straight on your form. Otherwise, the form 1116 will be required for a credit.

Where do I enter the foreign tax credit (Form 1116) or deduction for 2019?

What qualifies for the Foreign Tax Credit?

Why doesn't the foreign tax credit show up on Schedule 3, Line 48 of my 1040?

Please see Instructions for Form 1116. Form 1116 says:

Election To Claim the Foreign Tax Credit Without Filing Form 1116

You may be able to claim the foreign tax credit without filing Form 1116. By making this election, the foreign tax credit limitation (lines 15 through 21 of the form) won't apply to you. This election is available only if you meet all of the following conditions.

-

All of your foreign source gross income was "passive category income" (which includes most interest and dividends). See c. Passive Category Income, later. However, for this purpose, passive income also includes (a) income subject to the special rule for High-taxed income described later, and (b) certain export financing interest.

-

All the income and any foreign taxes paid on it were reported to you on a qualified payee statement. Qualified payee statements include Form 1099-DIV, Form 1099-INT, Schedule K-1 (Form 1041), Schedule K-1 (Form 1065), Schedule K-1 (Form 1120-S), or similar substitute statements.

-

Your total creditable foreign taxes aren't more than $300 ($600 if married filing a joint return).

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Tax Credit: the system is not allowing me to enter amount of foreign taxes paid. It is referring me back to Wages and Salaries, but this is already complete?

After long call with TT support and going back and forth, we finally have solution/workaround. You need to follow exact steps documented in this link https://ttlc.intuit.com/community/tax-topics/help/where-do-i-enter-the-foreign-tax-credit-form-1116-....

TT did not accept that there is product issue but I can tell you from my experience, this is product issue. I am glad this is behind me and I can complete my taxes. Hopefully, this will help someone else to avoid going though the same pain as myself.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Tax Credit: the system is not allowing me to enter amount of foreign taxes paid. It is referring me back to Wages and Salaries, but this is already complete?

I have to take back my previous statement. TurboTax support found a workaround to let me enter data into form 1116 but data were not reflected in the TT calculation. I gave up and asked for refund today.

I am very disappointed that things like this could not be addressed. TT can not handle even basic staff to calculate income from one currency into another. For god sake, IRS provides your conversation rate and you can use these as default. Why users have to do this themselves!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Tax Credit: the system is not allowing me to enter amount of foreign taxes paid. It is referring me back to Wages and Salaries, but this is already complete?

I agree that TurboTax is very weak in supporting some basic stuff. I found one way to claim a tax credit without submitting a Form 1116, as allowed by the IRS (see Form 1116 Instructions). To get around TurboTax limitations, you need to either fill in Form 1116 as if you were going to submit it or select forms and go to Form 1116 I did the former but I suspect you can also do the later. When you have Form 1116 on your computer screen, go to line 33 and override it to enter the Foreign tax credit you can claim per the Form 1116 instructions. This will enter your claim on Line 1 of Schedule 3 and flow through to the 1040 or 1040-SR. Other than the fact that this is an annoying bypass of the TurboTax software design, the biggest issue is that this bypass will probably make it difficult to submit an electronic return. You will have to mail in your return. Also when you print out your return it will include Form 1116. Don't forget to throw out the Form 1116. Your return should be in full compliance with IRS regulations as long as the foreign tax credit you claim meets all of the conditions listed in the Form 1116 instructions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Tax Credit: the system is not allowing me to enter amount of foreign taxes paid. It is referring me back to Wages and Salaries, but this is already complete?

Here is an educated guess about what is going on. I spent most of two days using online TT and a competing product. The competitor allows easy entry of foreign income and tax credit. However, with TT in answer to the question in Form 2555 (Whose Foreign Income would you like to try and Exclude) I selected to exclude my wife's foreign income. Basically I tried for both the exclusion in 2555 as well as the tax credit in 1116! I entered the 2555 details first and then went to the 1116. Of course I had selected the Tax Credit in reply to the question whether I wanted the exclusion or credit. Somehow TT seems to be able to select the foreign tax credit automatically ignoring the exclusion data I entered.

And.... the TT refund numbers came up with an exact match with the competing product. So it is getting reflected in the calculation once you choose the foreign income exclusion in 2555 as well as the credit in 1116.

As long as I selected Neither of Us to the question Whose Foreign Income would you like to try and Exclude, I ran into all the problems described here.

People can try this and see whether it works. Good luck.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Tax Credit: the system is not allowing me to enter amount of foreign taxes paid. It is referring me back to Wages and Salaries, but this is already complete?

I'm stuck in the foreign tax credit section of the desktop program. I paid two types of foreign tax: 1) Tax withheld from payments made from a RRIF retirement plan in Canada, and 2) tax reported on an uploaded Composite Form 1099. When I get to the foreign tax credit section the 1099 tax is already entered and I can find no way to enter the RRIF tax. Here's my sequence:

Foreign taxes

Update

Foreign Tax Credit

Continue

Tell us about your foreign taxes

None of these apply, Continue

Foreign taxes

Continue

Do you want the deduction or the credit?

Take a Credit

Reporting Foreign Taxes Paid

Continue

Where Did You Receive Dividend Income From?

Canada, Continue

Income from foreign countries

Canada, Report Income

Report Foreign Tax Paid To Canada

Only option is to select the 1099-DIV source which has nothing to do with Canada. I've spent hours going in circles in this section.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Tax Credit: the system is not allowing me to enter amount of foreign taxes paid. It is referring me back to Wages and Salaries, but this is already complete?

How do I "make sure any existing Form 1116’s are deleted"?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Tax Credit: the system is not allowing me to enter amount of foreign taxes paid. It is referring me back to Wages and Salaries, but this is already complete?

If you are using Turbo Tax online.

- Go to tax tools

- tools

- delete a form

- Check to see if Forms 1116 exist in the list of forms. If so, delete them.

- In the software version, go to the forms mode.

- Check to see if Form 1116 is listed. If so, select the form and delete at the bottom.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Tax Credit: the system is not allowing me to enter amount of foreign taxes paid. It is referring me back to Wages and Salaries, but this is already complete?

I had the same problem last year and after using TT for more than 20yrs I was about to leave. TT called and one of their "volunteer" assistants somewhere in the USA was able to walk with me through the TT catacombs and find the issue I was having.

I did the FEI just fine.

I also paid foreign taxes so needed the 1116 and the 2225.

In TT the problem for me was that I was trying to input the taxes I had paid and the TT field at that point is titled "taxes paid on other income." I had gone "continue" beyond that multiple times because I considered it as I was working on the income that I had paid taxes on and I did not have other additional income. The TT field is misleading and should have been reformatted to say "foreign taxes paid" worked just fine at that point. TT accepted the taxes I had paid, form 1116 did the magic calculations to make sure I was not getting credit for taxes against the FEI amount...all good. But what a pain!

Now I know and this year (2021 tax year) has been super simple irght up to the point that TT says, "the IRS is still working on the 2021 version of f1116. Try agian later..." but the IRS website has a fully functional f1116 for 2021! TT get 2021 updated please!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Tax Credit: the system is not allowing me to enter amount of foreign taxes paid. It is referring me back to Wages and Salaries, but this is already complete?

I do want to take the credit for several foreign taxes paid (Form 1116). But Turbo tax said it is being worked on now for several days. But I still cannot enter the amounts. It has been about 2 weeks since I started trying. Once that is entered, I can complete my Fed Tax return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Tax Credit: the system is not allowing me to enter amount of foreign taxes paid. It is referring me back to Wages and Salaries, but this is already complete?

Form 1116 is scheduled for 03/03/2022.

Click this link for a listing of Federal Tax Form Availability.

Here's more info on How to Claim a Foreign Tax Credit.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

NICKS4HD

New Member

linkwalls

New Member

gehrkecarollyn

New Member

leeyounique

New Member

suridasika

New Member