- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Doordash car replacement

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Doordash car replacement

I wrecked the car from 23 return late Jan 24 and bought another vehicle which I used for rest of 24. How do I handle mileage reporting and do I need to somehow report vehicle change on my tax return? I only have the one car for personal and Doordash use.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Doordash car replacement

If you are taking the standard mileage deduction, you will handle it the same way as you would have with the previous vehicle. You will add the second vehicle if the first was transferred from last years taxes. If not, you will enter them both. You will go to vehicle expenses, then enter the mileage driven for business and the mileage driven for personal and total miles. If you don't know the total miles and personal miles, you can proceed as long as you have the business miles.

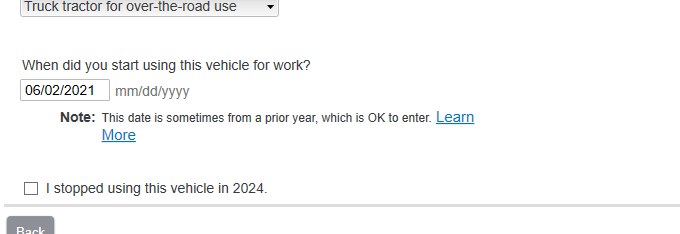

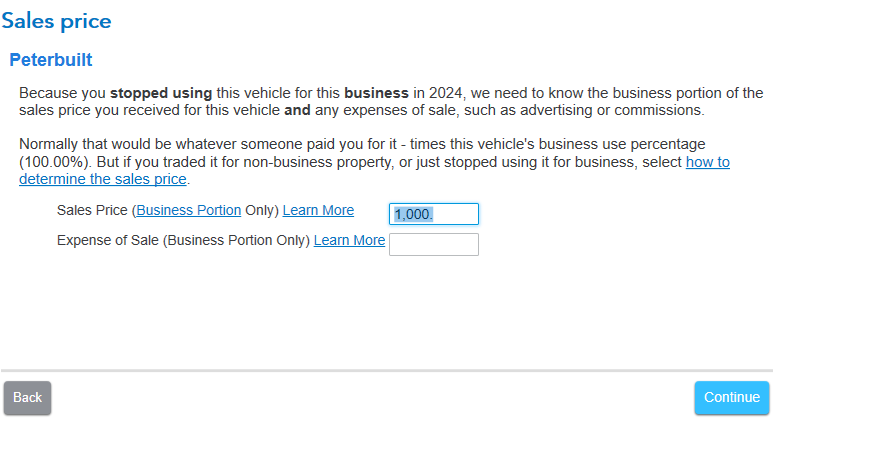

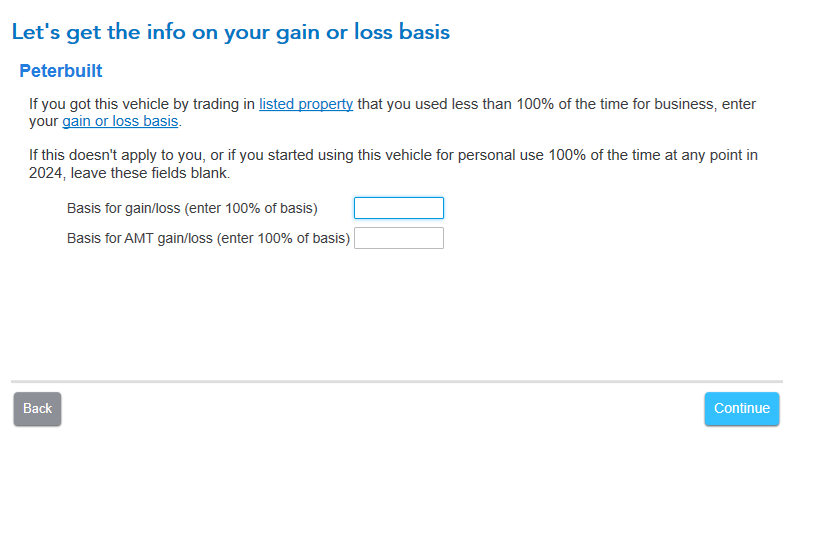

Yes, you will report that you disposed of the previous vehicle. When walking through the questions on the old vehicle, you will mark that you stopped using the vehicle in 2024. TurboTax will then ask you questions about what you did with it. If you had an insurance pay out, you would list is as a sale of business property and enter the amount you received for insurance then enter your basis in the vehicle. If this was both a business and personal use vehicle you will prorate the insurance and the basis based on percentage of use. So if you used it 50% for each, then you would only enter 50% of the insurance pay out and 50% of the basis.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

rogermarks1794

New Member

tjk589

New Member

lizam1

Level 1

Nonameavailable

New Member

liletsman

New Member