- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Does the tax program include the Nebraska Property Tax Incentive Act Credit? If so, where do I find it?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does the tax program include the Nebraska Property Tax Incentive Act Credit? If so, where do I find it?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does the tax program include the Nebraska Property Tax Incentive Act Credit? If so, where do I find it?

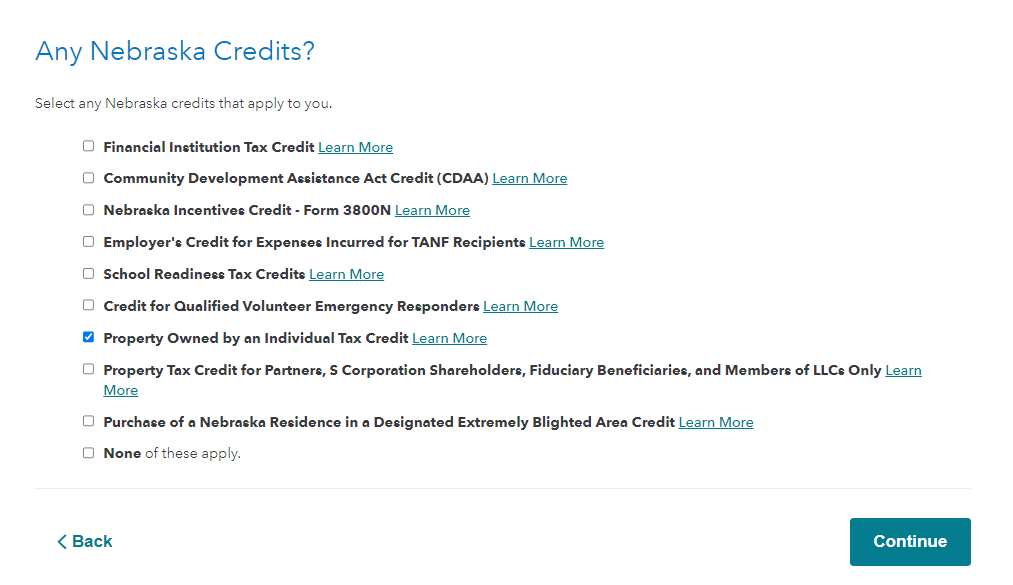

Look in the Nebraska Credits section (see below).

For taxable years beginning on or after January 1, 2020, A Property Tax Incentive Act Credit may be claimed by Nebraska property owners that pay school district taxes during a taxable year.

If you own only one parcel of real estate, owned it throughout the entire property tax year, and paid the taxes yourself directly or through your monthly payments into escrow, this form can be completed quickly and easily. Just look up your parcel in the Nebraska School District Property Tax Look-up Tool to complete. Print or save the information provided by the look up tool. You can only claim this credit if you are the person that paid the property taxes on the parcel.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

KM-NE

New Member

mlmavis

New Member

f4p1A2v

New Member

f4p1A2v

New Member

skdukelaw123

Returning Member