- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Does a 2018 NOL being carried back affect QBI carryforwards?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does a 2018 NOL being carried back affect QBI carryforwards?

I'm carrying back my 2018 NOL 5 years. Does this affect 2019 QBI at all? In other words, is my QBL from 2018 still going to be carried forward to line 3 on Form 8995? From my understanding it would be, even though it kind of seems like the same amount is being used twice, to reduce my taxable income in 2013 and my QBI in 2019. But I guess that makes sense, since reducing QBI is not a desirable thing, right?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does a 2018 NOL being carried back affect QBI carryforwards?

Yes. Turbotax computed the QBI carryforward accurately.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does a 2018 NOL being carried back affect QBI carryforwards?

No, your 2019 QBI is not affected by your 2018 NOL carry back. You'll need to exclude that loss when calculating your QBI.

See IRS FAQs about carrybacks of NOLs for taxpayers who have had Section 965 inclusions. There would not be a need to reduce QBI; you just would not factor the NOL into it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does a 2018 NOL being carried back affect QBI carryforwards?

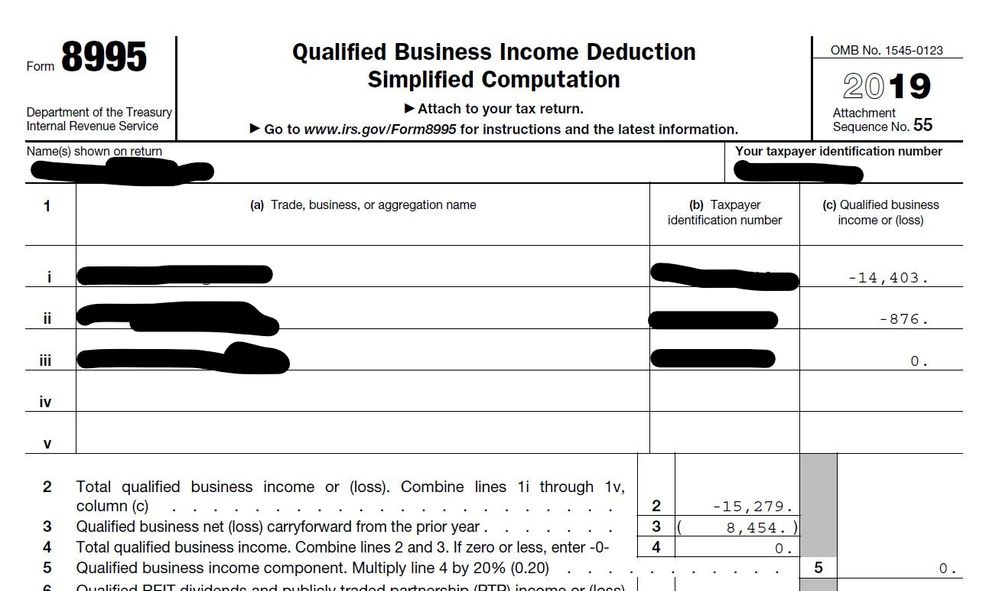

Is NOL the same thing as QBL then? It's confusing to me because Turbo Tax is automatically carrying forward my 2018 QBL of ($8454) to 2019 Form 8995. Is this because Turbo Tax is assuming I am carrying forward my 2018 NOL? But since I am not, then that 2018 QBL should be excluded from the 2019 Form 8995, because it's not being used against my 2019 taxable income? The ($8454) should be deleted from line 3?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does a 2018 NOL being carried back affect QBI carryforwards?

QBI is based on income. NOL means that you have a greater loss than income. These losses are usually business losses and add up to more than all of your income, including any W-2 income. An NOL is not a loss on your business.

Losses or deductions that were disallowed, suspended or limited in tax years ending before January 1, 2018, are not taken into account in calculating QBI for later years. Generally, a net operating loss (NOL) deduction is not considered a business loss or counted when calculating QBI.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does a 2018 NOL being carried back affect QBI carryforwards?

Ok, so NOL and QBL are totally unrelated, so therefore whatever I may do with my 2018 NOL, my 2018 QBL is still carried forward to 2019 in figuring 2019 QBI, therefore Turbo Tax is correct in carrying forward the QBL amount of ($8454) to line 3? And it will continue to be carried forward until used up against enough positive QBI?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does a 2018 NOL being carried back affect QBI carryforwards?

Yes. Turbotax computed the QBI carryforward accurately.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Sarmis

New Member

r-beckwith

New Member

chiroman11

New Member

PCD21

Level 3

HNKDZ

Returning Member