- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Deductions Help

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions Help

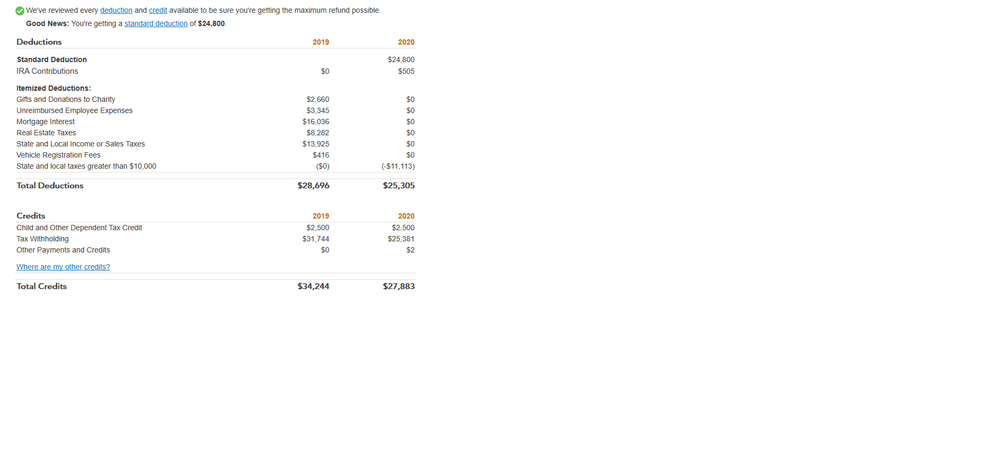

For some reason my Mortgage Interest, Property Taxes, donations etc ..aren't being deducted, When I compared 2019 (which it did deduct) to 2020, 2020 was all zero for deductions? is there a software error? or has there an income limit I reach which prevent me from getting any sort of deductions?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions Help

Since you are already comparing your 2019 return to your 2020 return, look at the amounts line-by-line to spot differences that may have triggered the Standard Deduction for you this year, when you were able to use Itemized Deductions last year.

A change in Income, less Medical Bills?

If you want to see the numbers TurboTax calculated, click this link for info How to Switch from Standard to Itemized Deductions (or vice versa).

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions Help

I'll redo my taxes friday and get back to you on this

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions Help

comparing the 2019 and 2020 deductions, how come the 2020 are all blank?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

bmeadows63

New Member

sam-romano-jr

New Member

JoeRids1

New Member

wcryan-assoc

New Member

amalitz2

New Member