- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Crypto CSV & TurboTax Universal Template - Upload Problems

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Crypto CSV & TurboTax Universal Template - Upload Problems

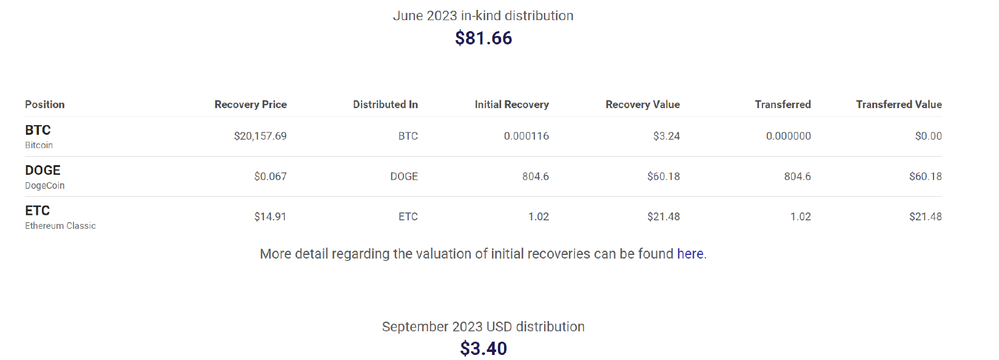

@unre thanks. So how do I capture the approximately 70% that Voyager took and liquidated? Basically, I put in $1500 and they ultimately only gave me $81.66 (which was only about 30% of the coins).

This image below is only the approx. 30% they actually gave me back. Of this, I transferred all the DOGE (804.6) to Coinbase and sold it there (I have that report). I lost the 1 ETC (I couldn't get the transfer right). And got $3.40 from Voyager selling the BTC.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Crypto CSV & TurboTax Universal Template - Upload Problems

Well, when things are confusing like this, I try to get a framework to start with to better get my bearings.

The screenshot shown in your reply refers to the 30% that had value, right? That portion has 3 parts, and you originally paid roughly 30% of $1,500 for those 3 parts, but 1 part, ETC, was lost and 1 part, DOGE, was moved through to Coinbase and reported there? The 30% details are on your return now that you got the upload?

I think what is confusing is that the 70% sort of disappeared from Voyager's ledger, so to speak. Since you have your own records of those purchases when money was invested, you have basis to claim it now as worthless.

Your question is how... the answer is to follow the IRS rule for worthless stock reporting.

That rule requires worthless stock to be claimed as a short-term loss.

Here is more details on how....

This will require adding those details (70% of your holdings) pretty much from your records.

Keep in mind the screenshot you shared (30%)--do not include any of that in the short-term loss/worthless reporting because the screenshot details were already reported in the long-term loss from the upload, right?

Back to getting the 70% reported...you will need 4 main details besides a simple description of crypto type & possibly number of shares:

*date of purchase,

*date of sale,

*amount paid at time of purchase and

*amount of the sale.....

Set the date of purchase hypothetically so that it is less than 1 year, or otherwise force the system to categorize it as short term. (This is the part where you will know better than I what options are available to identify it as worthless in the system...is there a checkbox for calling it worthless or is it part of the interview questions in reporting it?)

The date of sale can be the date of bankruptcy per your Voyager information.

Regarding purchase price-what you paid...

So, the remaining portion of your investment, the 70% of $1,500, should be entered. This will create the short term capital loss so that your full loss will be captured.

Keep in mind....

*Your crypto reporting should be identified exactly the same as to what was purchased. (Each type of coin included in the remaining 70%--(same as identifying each stock that was sold))

--However, if what you mean by showing the screenshot is that these were the only three categories purchased... if that is the case-that Voyager recognized a portion to liquidate of all coins held, then it is appropriate to allocate the 70% that "disappeared" at the same percentage of what was reported to and call it done....to allocate the 70% over the 3 types of coins in the same proportion.

[For example...if all three parts were equal to keep the example simple...for purchase price paid...

BTC 10, Voyager reported 3, then add in the short-term section the remainder of 7 BTC, (the 3 includes the portion reported through Coinbase)

DOGE 10, Voyager reported 3, then add in the short-term section the remainder of 7 DOGE.

ETC 10, Voyager reported 3, then add in the short-term section the remainder of 7 ETC.

In this example, then BTC, DOGE, ETC Voyager reported cost at 3+3+3= 9 (9 of 30 units=30%), and the sale would be what was actually received from Coinbase and Voyager.

Then, from personal records proving it, short-term cost would be entered at the remainder, 7+7+7=21 (21 of 30 units=70%), with sale being $0.]

Sale amount:

*Use $0 as the Sale amount

Sanity check:

*The total cost being reported between the 70%, where there's no report from Voyager, and the 30%, where there was a report, cannot exceed the original investment (70%+30%=100%) of $1,500.....after reducing that $1,500 total by the DOGE portion liquidated through Coinbase sinve you mentioned that was reported separately.

*All the sales (or bankruptcy) payouts for everything from crypto in 2023 should only total to what was actually received.

In that way, it seems the full $1,455 loss would be captured, with it split between the short term part (worthless part you reported from your records) and the long term part (Voyager report from 2023).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Crypto CSV & TurboTax Universal Template - Upload Problems

This worked. Check the Type. I had been having horrible trouble with Betterment. I had to change the Type of Fees to make it work, even though TurboTax was throwing errors with the transaction ID that was totally unrelated.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Crypto CSV & TurboTax Universal Template - Upload Problems

Thank you for providing the sample upload. I matched EXACTLY the column names, however, I only had dates in my CSV. It was erroring and saying needed column names etc. but the real problem is once I added "12:00" to the date, it loaded fine (so stupid).

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

VK20USA

New Member

cdonoho16

New Member

swati surana

New Member

klhrabosky

Level 2

tnl001

New Member