Follow these steps:

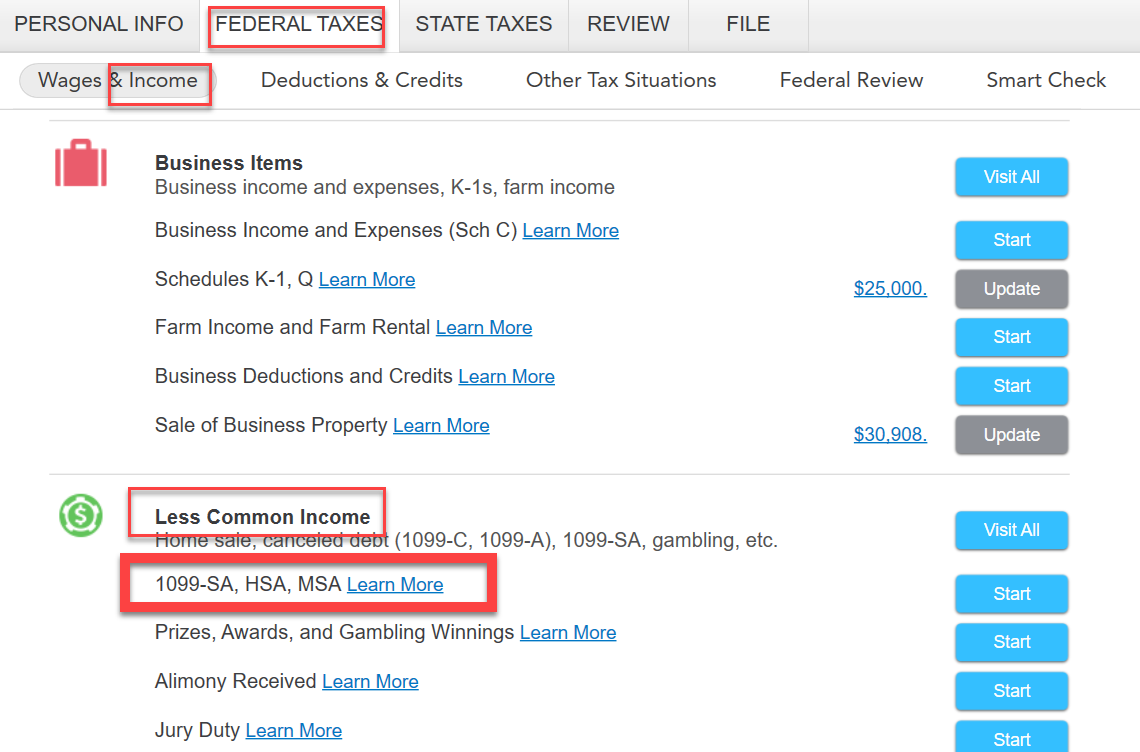

- Open to federal income

- Locate less common income

- Select 1099-SA

- Select HSA

- Select you got a form and fill it in

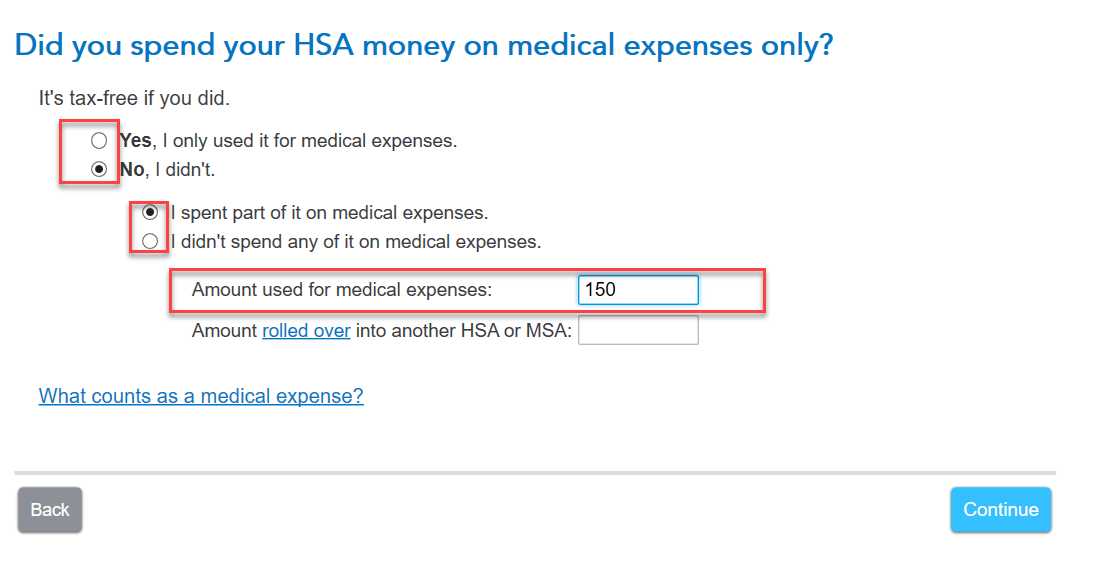

- The program will ask if your money went to qualified medical expenses.

- If all of it went to qualified medical expenses, none of it is taxable.

- Any portion not spent on medical expenses becomes taxable.

Some surprising things are medical expenses: crutches, protective equipment (think Covid), condoms and more. See About Publication 502, Medical and Dental Expenses - IRS.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"