- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Chevy Bolt 2023 preowned bought in 2024, I think will not receive credit, does it? please suggest

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Chevy Bolt 2023 preowned bought in 2024, I think will not receive credit, does it? please suggest

I feel like 2023 preowned EV will not get tax credit if bought in 2024 but i do see it get credited in Turbotax, is it a miscalculation from turbotax? please give me suggestion, i like the credit but i feel like it may not qualify.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Chevy Bolt 2023 preowned bought in 2024, I think will not receive credit, does it? please suggest

If it is a 2023 Pre-owned, then no, you should not be getting the credit. The credit for used vehicles states that the credit should be at least 2 years old. So if you bought it in 2024, then it would need to be a 2022 or older. Did you enter it for a new credit? If you selected a new credit, the requirement is that you are the first owner, so even a 2023 leftover would qualify.

The simplest thing is to delete the credit. You can do this by deleting form 8936.

- From the left rail menu in TurboTax Online, select Tax Tools (You may have to scroll down on the left rail menu.)

- On the drop-down select Tools

- On the Pop-Up menu titled “Tools Center,” select Delete a Form

- This will show all of the forms in your return

- Scroll down to the form you want to delete

- Select the Form

- Click on Delete.

Always use extreme caution when deleting information from your tax return. There could be unintended consequences.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Chevy Bolt 2023 preowned bought in 2024, I think will not receive credit, does it? please suggest

If you could send a diagnostic file prior to deleting the form, that would be appreciated.

I would like to take a deeper look at this. However, I need a diagnostic file which is a copy of your tax return that has all of your personal information removed. You can send one to us by following the directions below:

TurboTax Online:

- Sign into your online account.

- Locate the Tax Tools on the left-hand side of the screen.

- A drop-down will appear. Select Tools

- On the pop-up screen, click on “Share my file with agent.”

- This will generate a message that a diagnostic file gets sanitized and transmitted to us.

- Please provide the Token Number that was generated in the response.

TurboTax Desktop/Download Versions:

- Open your return.

- Click the Online tab in the black bar across the top of TurboTax and select “Send Tax File to Agent” *

- This will generate a message that a diagnostic copy will be created. Click on OK and the tax file will be sanitized and transmitted to us.

- Please provide the Token Number (including the dash) that was generated in the response.

*(If using a MAC, go to the menu at the top of the screen, select Help, then, “Send Tax File to Agent”)

@bikyash

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Chevy Bolt 2023 preowned bought in 2024, I think will not receive credit, does it? please suggest

thank. you so much for your responses.

Token number : 1302330

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Chevy Bolt 2023 preowned bought in 2024, I think will not receive credit, does it? please suggest

Its a preowned EV, so it can't be new or new owner. But well just that its calculated automatically but i see that it has to be 2022 or older, but wanted to make sure if i may not miss out on it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Chevy Bolt 2023 preowned bought in 2024, I think will not receive credit, does it? please suggest

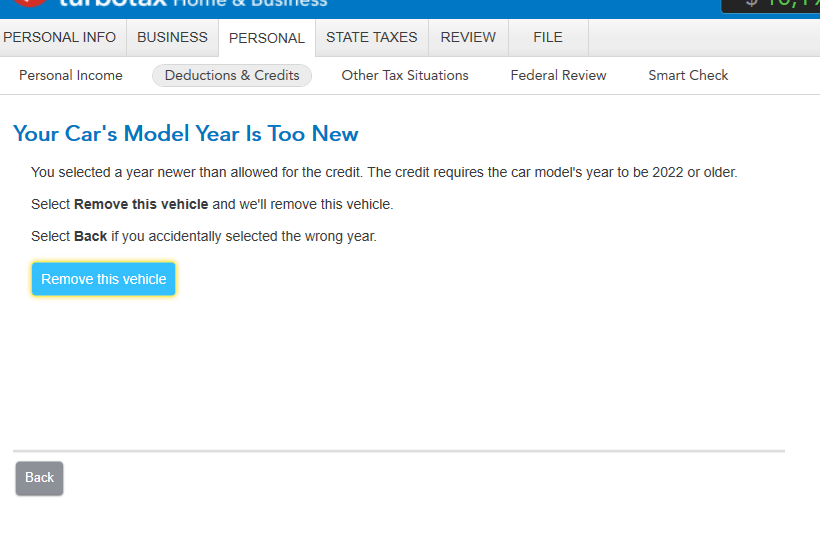

There was an update today April 25, that resolved this issue. Now, if you enter a model that is too new for the credit, you will get a message saying you cannot claim due to the year of the vehicle.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

chandan-jadhav

New Member

bikyash

Level 2

tacks_is_hard

New Member

johnsaraterrill

New Member

SLS2025

Level 1