- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Casualties and Thefts Deduction

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Casualties and Thefts Deduction

can i carry over a loss to my home from hurricane ide in 2021 for 2022

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Casualties and Thefts Deduction

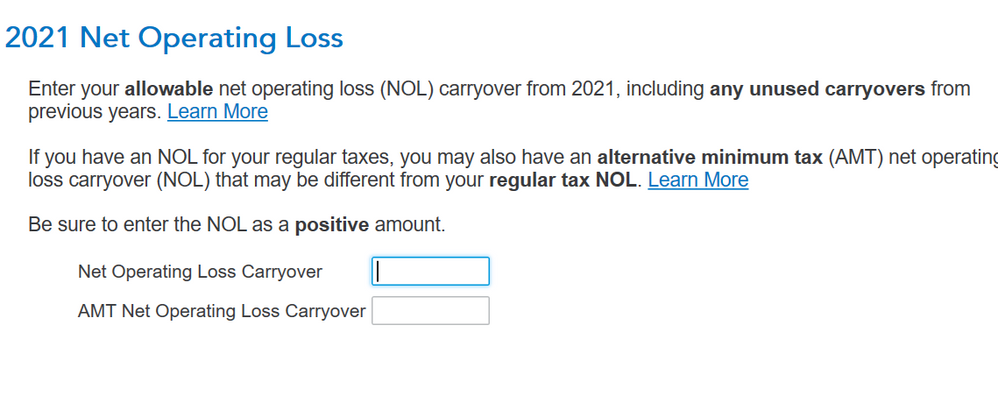

According to IRS Tax Topic 515, if your casualty loss exceeds your income for the tax year, you have a Net Operating Loss Carryover. You don't need to be in business to have an NOL from a casualty.

In TurboTax, this carryover is reported under Business Situations, as AbrahamT described above. Use one of the "jump to" shortcuts below to go to "NOL."

The easiest way to find any section of TurboTax for Desktop is to open your return and use the Search box at the top right side of the TurboTax header. Click on the magnifying glass, type in the topic you need, hit Enter, and click the "jump to" link to go directly to beginning of that topic.

In TurboTax Online, go to Tax Tools in the left column >> Tools >> Topic Search. Type in your topic, then click the topic in the list and then GO to go directly to the start of that section.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Casualties and Thefts Deduction

Yes, if you live in an area that was declared a federal disaster area after Ida, and you reported your loss on your 2021 tax return, then you may carry forward the loss for up to 20 years.

[Edited 01/30/23|5:41 pm PST]

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Casualties and Thefts Deduction

The expert is wrong.

what's important is that it be declared a federal disaster area. this is from FEMA

Louisiana Hurricane Ida (DR-4611-LA)

Incident Period: August 26, 2021 - September 3, 2021

Major Disaster Declaration declared on August 29, 2021

see form 4864 for your options for reporting your loss.

use section A if this is personal property.

and here's a thread from the IRS

https://www.irs.gov/newsroom/irs-announces-tax-relief-for-victims-of-hurricane-ida-in-louisiana

see the section on casualty losses.

*

personal casualty losses are no longer deductible unless they're in a federally declared disaster area.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Casualties and Thefts Deduction

where do i put in the information on my 2022 tax return. i tryed but it looks like it for a disaster this year not to carry over

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Casualties and Thefts Deduction

You would simply enter your carryforward losses as follows;

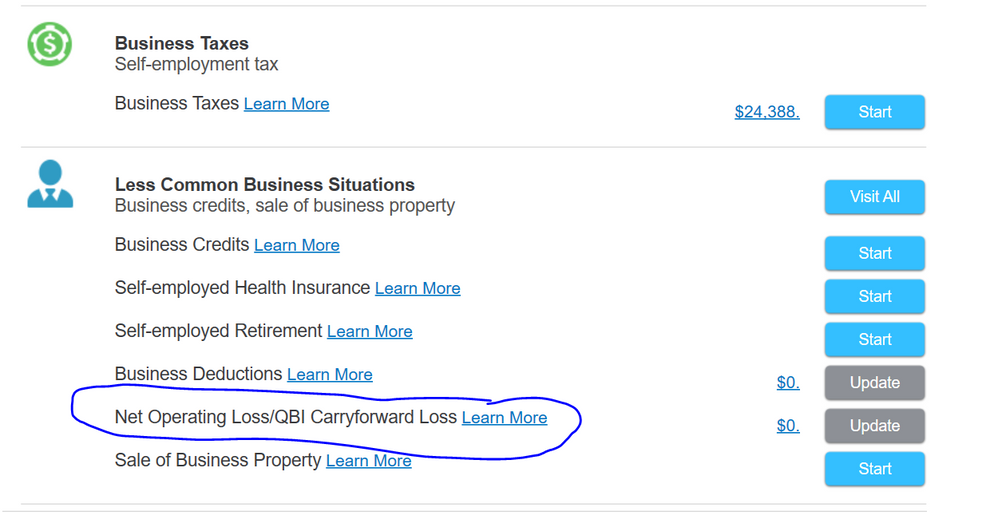

On the top, click on Business,

then; Less Common Business Situations

then;

years.

Good Luck!

[EDIT 2/06/2023 11:00 AM PST]

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Casualties and Thefts Deduction

so it would go under the business heading even though it a casualties loos from my house?

just making sure don't want the IRS knocking on my door.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Casualties and Thefts Deduction

Good point, there is actually a Casualties and Theft Deduction subsection under the Personal tab as well. You would actually go there.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Casualties and Thefts Deduction

can you show me that tab?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Casualties and Thefts Deduction

According to IRS Tax Topic 515, if your casualty loss exceeds your income for the tax year, you have a Net Operating Loss Carryover. You don't need to be in business to have an NOL from a casualty.

In TurboTax, this carryover is reported under Business Situations, as AbrahamT described above. Use one of the "jump to" shortcuts below to go to "NOL."

The easiest way to find any section of TurboTax for Desktop is to open your return and use the Search box at the top right side of the TurboTax header. Click on the magnifying glass, type in the topic you need, hit Enter, and click the "jump to" link to go directly to beginning of that topic.

In TurboTax Online, go to Tax Tools in the left column >> Tools >> Topic Search. Type in your topic, then click the topic in the list and then GO to go directly to the start of that section.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Casualties and Thefts Deduction

Thanks for the help

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jeannieb82

New Member

AggieParrothead

New Member

ma20003

Level 1

madatturbo5

New Member

Echo-33

New Member