in Education

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Cannot change recipient country error

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cannot change recipient country error

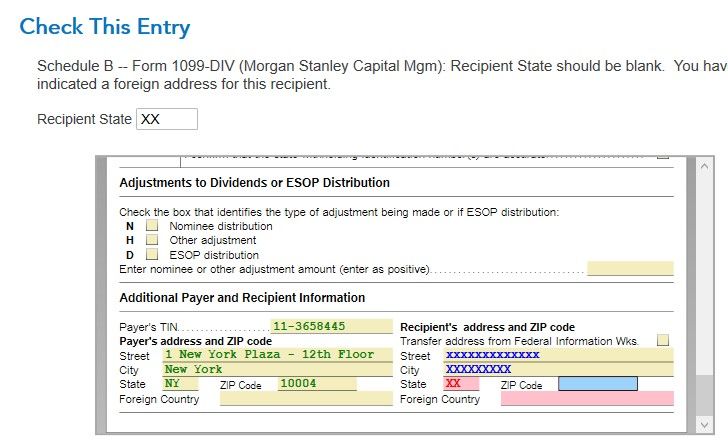

In the final federal check I have an error (repeated multiple times) concerning the recipient's address as being a foreign country. It is not a foreign country. It is a US address.

The data in question was downloaded by TurboTax directly from the broker.

In the entry error screen ("Check this Entry") the recipient's street address is correctly entered by TurboTax. But

- the state and zip code fields are both blank

- and the foreign country field is pink.

The check entry text says:

Schedule B - Form 1099-DIV (broker's name): Recipient State should be blank. You have indicated a foreign address for this recipient.

But the recipient's address is not a foreign address. It is in the US.

I've tried to correct this error by

a) filling in the correct state and zip code fields

b) changing the 'foreign country' field to "Not applicable" because there is no US option available to select. But the error keeps popping up on the next check.

How do I correct this? The entire address is a US address.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cannot change recipient country error

As others have noted, none of the attempted solutions in

work.......

I made a backup of the TurboTax file and on that backup I deleted the 1099 div form as suggested both here and in that link above. All that did is eliminate the entire dividend download and mess up the bottom line.

This is a TurboTax bug and needs to be corrected asap.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cannot change recipient country error

Here's a screen shot.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cannot change recipient country error

It sounds like the problem came from importing the document.

I suggest you delete and try again, or if possible, manually type it in .

- For TurboTax Desktop, switch to Forms (Upper right corner)

To Delete a Form using TurboTax Online:

Select Tax Tools on the left side-bar

Select Tools from that drop-down

Select “Delete a form” on the TOOLS CENTER screen

Select the Form 1099-B and delete - re-enter the 1099-B

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cannot change recipient country error

Thank yu for taking the time to reply.

It is TurboTax Desktop.

You say "delete and try again".

Please clarify.

I can delete the form. Will TurboTax then recreate the form from the broker downloaded data?

Or should I delete the entire broker downloads and redownload?

Isn't there a way in TurboTax to change the "foreign country" indication?

I can't be the only one this has happened to.

Thank you again.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cannot change recipient country error

I am not the only one.

No solution yet. Tried all the suggestions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cannot change recipient country error

As others have noted, none of the attempted solutions in

work.......

I made a backup of the TurboTax file and on that backup I deleted the 1099 div form as suggested both here and in that link above. All that did is eliminate the entire dividend download and mess up the bottom line.

This is a TurboTax bug and needs to be corrected asap.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cannot change recipient country error

SOLUTION

After additional research, this is definetely a TurboTax bug. TurboTax erroneously inserts the

US city and USA

from the downloaded data into the foreign country field instead of the proper US city and zip fields where they belong. TurboTax does this for all 1099-DIV forms.

In contrast TurboTax handles downloaded 1099-INT forms correctly.

Should be easy for Intuit to correct or at least notify their 'support' staff instead of wasting hours of users time on the phone. But they have yet to do so.

The only solution available to users is to:

SAVE YOUR TURBOTAX FILE UNDER A NEW NAME!

Then

1. go the each 1099-Div form produced by TurboTax and print them on paper.

2. Then delete all these forms produced by TurboTax.

3. Open (create) new 1099 forms from scratch in TurboTax and fill in all the data manually using the printed forms.

This works and the errors disappear. Since the numbers are unchanged, the tax calculations should remain correct.

(But who knows with this year's TurboTax? )

I hope this helps others.

Intuit, get with it!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cannot change recipient country error

It's a definite bug in the imports - and amazing TurboTax has not fixed (again this year). But here is the most efficient way to solve this...

Click on "Transfer address from Federal Information Wks"

Select a Foreign Country (it doesn't matter which one, just pick one)

Depending on the import, you might see some of the data populate. Don't worry if you don't.

Now - the hard to believe part - go back to Foreign Country and select "not applicable". I know it didn't work for you before, but it will work now. All US address info should populate, Foreign Country should be blank, and the Error disappears.

Hope it works for others. It worked for all 5 of my imports.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cannot change recipient country error

Hello Andersen,

I am having the same problem that you are having. It looks like your1099-DIV came from Morgan Stanley. I say this because your Payer's TIN and Address match the Payer TIN and address on my 1099-DIV.

Am I correct? If so, I think that the problem is either in the files that we downloaded from Morgan Stanley or in the way that TT is interpreting the information on those files. So I don't think that deleting the 1099-DIV and re-downloading the data from Morgan Stanley will be useful.

But there are a few other details about this issue that I can't explain:

- the 1099-DIV that we downloaded for my wife's Morgan Stanley account does not have that problem

- the 1099-INT forms that we downloaded from MS for each of our accounts do not have the issue

- the 1099-DIV for our joint account at Morgan Stanley also had the error. It's as if MS has some wrong

information about me.

None of the above facts will help us resolve this.

- if the MS downloaded data is bad, it won't help to delete the form and re-download it

- I am not going to delete the 1099-DIV and manually re-enter the data. I have four pages of dividend data

- We could try to bother MS and have them correct the download files

- We should apply pressure to TT to change the program to:

-to correct TT if it is misinterpreting the data

- give us the ability to over-ride bad downloaded data

Kind Regards

Brian

Please let me know if you've made any progress with this.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cannot change recipient country error

The IRS does not require that you enter each individual dividend. You can enter a summary as shown on the front page of your Morgan Stanley statements.

Since you are able to correctly import some statements and not others, it would be difficult to determine why this is happening.

Perhaps a session with Tech Support could provide insight.

Here's more info on Summarizing Dividends.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cannot change recipient country error

Long session with tech support did not help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cannot change recipient country error

IowaMarc's workaround worked perfectly for me. Thank you Marc!

I do hope that Intuit fixes this problem. I must have wasted 3 or 4 hours trying to override TT's bad import of data from Morgan Stanley. I also spent an hour on the phone with TT Support and that didn't help either.

IowaMarc rocks!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cannot change recipient country error

I just had the exact same issue with the Morgan Stanley 1099 for Schedule B. Its not picking up my street address and state correctly from the upload and I can't find a way to manually change it (it won't match the zip code which is the error). Now I can't even file my stupid taxes after spending all this money with Turbo tax

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cannot change recipient country error

Thanks Brian - I hope others notice as well (as the other "solutions" are definitely not a solution). I do not know that I have encountered every form of this "glitch", but anyone who has downloaded forms from Morgan Stanley and run into a similar error should try my approach. It hasn't failed me yet.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cannot change recipient country error

Check out IowaMarc's solution in this thread. It worked a treat for me

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

rwilsond

Level 3

tlord

New Member

Danielvaneker93

New Member

J2Hanson

New Member

beninporto1

New Member