- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Can't adjust mortgage interest exceeding $1m (financed prior to 2017) in turbotax. Is this a SW bug?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can't adjust mortgage interest exceeding $1m (financed prior to 2017) in turbotax. Is this a SW bug?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can't adjust mortgage interest exceeding $1m (financed prior to 2017) in turbotax. Is this a SW bug?

TurboTax may have calculated the Adjustment to your Mortgage Interest for you, based on the 1098 info you entered.

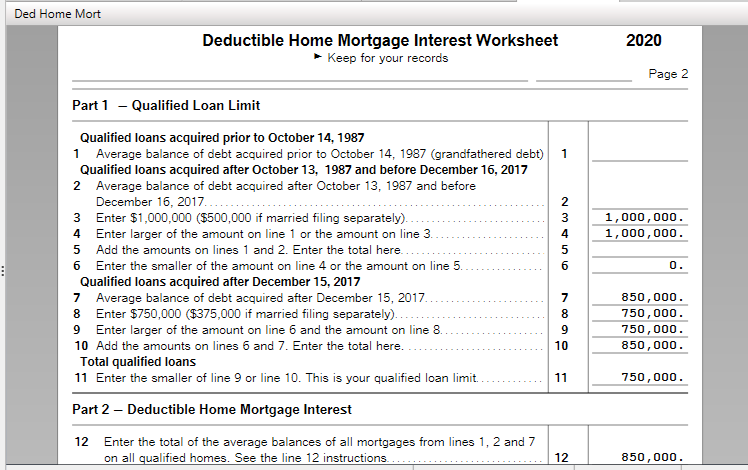

Review your Deductible Home Mortgage Interest Worksheet (screenshot), Part 2, Line 15 for a factor applied to calculate deductible interest.

Click this link for info on Adjusted Mortgage Interest.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can't adjust mortgage interest exceeding $1m (financed prior to 2017) in turbotax. Is this a SW bug?

No, I do not have such a worksheet. I used to have such a worksheet when turbo tax will direct me after I select that my mortgage amount exceeds $1m in all prior year returns, but not this year.

Instead I have a Mortgage Interest Limited Smart Worksheet, which simply adds up the mortgage interest I entered.

I believe this is a bug in this year's SW. Please help fix it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can't adjust mortgage interest exceeding $1m (financed prior to 2017) in turbotax. Is this a SW bug?

Some TurboTax customers were experiencing an issue with their Home Mortgage Average Balance. This can cause the Home Mortgage Interest to be incorrectly limited

We have added some in-program help to assist with the entering of your home mortgage information.

For more information, please see the following article:

How do I handle multiple 1098 mortgage forms?

Related Information:

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

kim-gundler

New Member

AndPhoton

Level 3

Lorob11

Level 1

JamKo

Returning Member

in Education

susanmbailey2002

New Member