- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Business Vehicle Expense - do not take depreciation, only actual expenses

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business Vehicle Expense - do not take depreciation, only actual expenses

I use my car for business 100% of the time. I want to write off my expenses (gas, insurance, registration, etc)...but I do NOT want to take the depreciation. In Turbo Tax, I can't find a way to NOT take the depreciation. Even with I go to the actual forms, I can't figure out how to only take expenses and NOT depreciate the car using Turbo Tax. The fields I would need to make "0" are not editable.

Any help would be greatly appreciated it.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business Vehicle Expense - do not take depreciation, only actual expenses

To avoid including depreciation in the vehicle expense calculation, enter a zero value for the fair market value of the vehicle on the date you first started using it for your business. There is no depreciation calculated on a vehicle with zero value. But you'll still be able to claim your actual expenses.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business Vehicle Expense - do not take depreciation, only actual expenses

There is no fair market value button on the form

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business Vehicle Expense - do not take depreciation, only actual expenses

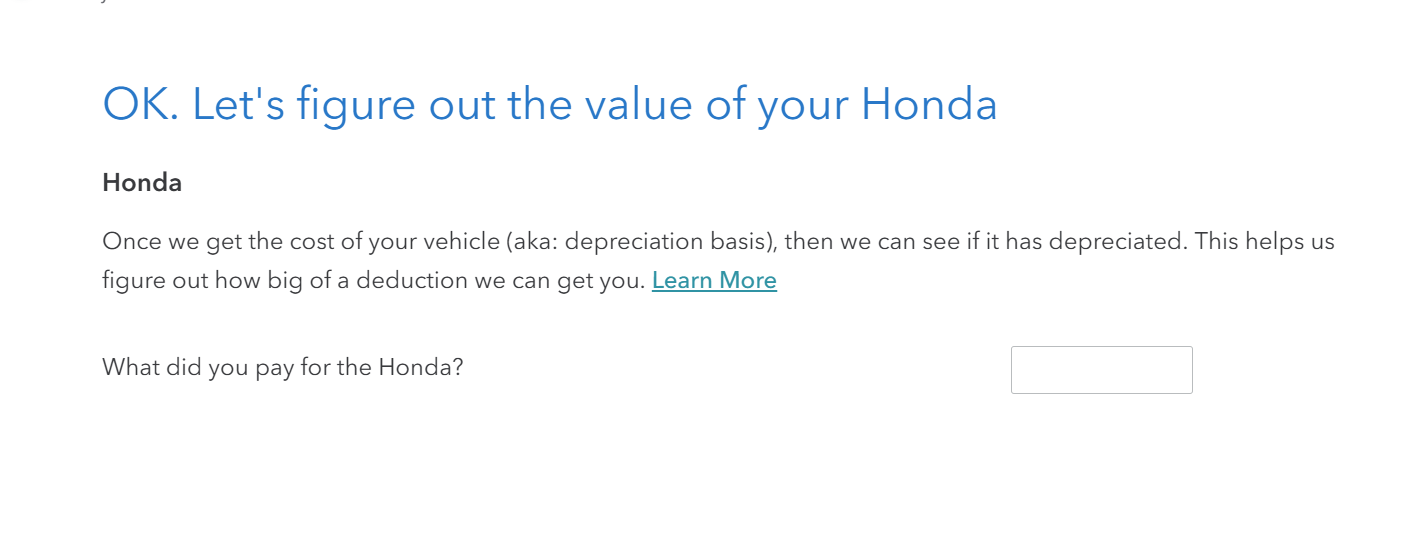

When you entered to use your actual expenses, you will come to a screen that states, "Let's figure out the value of your vehicle". You can enter $0 at this screen. (See Screenshot below)

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business Vehicle Expense - do not take depreciation, only actual expenses

Putting zero car value for car and taking off end of year, the system is creating a 4797. How do I avoid this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business Vehicle Expense - do not take depreciation, only actual expenses

Form 4797 just shows the sale of business property. If it is a zero then the form shouldn't be adding anything to your taxes, just reporting the sale. That should be fine.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

RE-Semi-pro

New Member

Bradley

New Member

andredreed50

New Member

user17522839879

New Member

RobertBurns

New Member