- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Bug in Software? Full mortgage interest deduction not be calculated when entering multiple mortgage lenders.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug in Software? Full mortgage interest deduction not be calculated when entering multiple mortgage lenders.

Just 2 "Loans" or Mortgages and my situation on Loan 2 was that it was sold to another bank, not a refi. Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug in Software? Full mortgage interest deduction not be calculated when entering multiple mortgage lenders.

Hi.

If they sent you 1098s and you have 2 for last year then you would treat your loan the same as refinanced. I would do my calculations the same as I outlined in my previous post.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug in Software? Full mortgage interest deduction not be calculated when entering multiple mortgage lenders.

If you have multiple 1098s I suggest you enter each one separately.

If a Mortgage is paid off, or re-financed you should:

- Enter $1 in Box 2 Outstanding Mortgage principal for the Refinanced / Paid off mortgage

- Every 1098 should be posted.

- The final 1098 for that property will have the full loan amount as reflected in Box 2.

- If you have multiple properties, you should follow this procedure for each property.

This will properly record every 1098, and avoid any issue with mortgage limitations.

When you have more than one Form 1098 with the refinance info and both show the same balance of the mortgage, TurboTax adds the amounts together. And that may lead to a limitation of the deduction, because the balance is then overstated. To avoid this, make sure that you're not reporting the same mortgage balance twice.

If your combined home debt is under $750,000 ($750,000 for married filing jointly and $375,000 for married filing separately), there's nothing new for you to do in 2020. Enter each 1098 as you normally would.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug in Software? Full mortgage interest deduction not be calculated when entering multiple mortgage lenders.

Entering my three 1098's separately did not work for me as suggested above. TurboTax was not summing up the total amount of interest paid from the three separate entries. I completely deleted the entries and tried a second time with the same result. Two of the loans were listed as paid off since this situation was due to a refi.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug in Software? Full mortgage interest deduction not be calculated when entering multiple mortgage lenders.

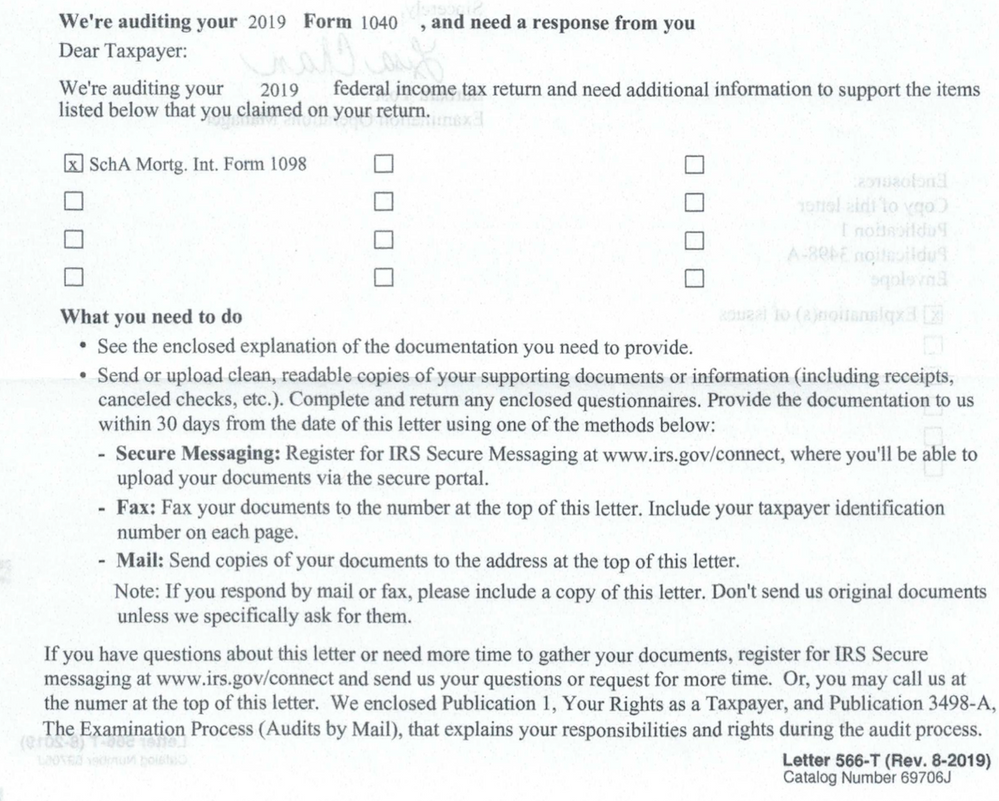

You know what happen! This is the issue that i had... i did not realized TT has add both up and average... guess what happen this week.. I just got AUDITed for IRS for this !!!

Now what should i do ? Amend first and then answer the audit or ????

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug in Software? Full mortgage interest deduction not be calculated when entering multiple mortgage lenders.

I understand that any time the IRS contacts you it will be unnerving. However, I expect that this is a request for information and not yet an audit.

I suggest you contact the phone number in the top right corner, and relate what you did to enter the 1098 information. If you cannot get through on that line your local IRS office is an alternative.

Visit a Taxpayer Assistance Center Local IRS Office .

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug in Software? Full mortgage interest deduction not be calculated when entering multiple mortgage lenders.

From the letter it does seem like an audit. See picture. Yes, i need to call them to see what is going on.

I recheck the calculation. The TTax worksheet is definitely wrong! but because my loan amount is over 1 mio... TTax software give me an option to over-ride it... and i override it with my own number (which is correct) and therefore... schedule A should be correct. Now, i am not sure what is wrong now... or why my taxes are auditted

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug in Software? Full mortgage interest deduction not be calculated when entering multiple mortgage lenders.

@Cynthiad66 I followed your advice in combining by two 1098s and entering it as one 1098 and it looks good to me. I could submit my return now (4/12/21) or wait until the May tax-filing deadline and hope that TurboTax pushes out a fix. Any thoughts? Does a return following your approach need to be amended in the future, or does your work-around just impact the data within TurboTax but produce the correct return for the IRS? Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug in Software? Full mortgage interest deduction not be calculated when entering multiple mortgage lenders.

Yes, this workaround just impacts the data in Turbo Tax but the end result is the same and will produce the same return with the IRS. Remember, Turbo Tax does have an accuracy guarantee which will pay for interest and penalties on returns that produce incorrect calculations.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug in Software? Full mortgage interest deduction not be calculated when entering multiple mortgage lenders.

As non-tax expert, how do we know that the workaround is working as expected and complies with the current tax code? I've see suggestions to merge 1098 as well as adding all individual 1098's while overriding the remaining outstanding balance. I feel like this is why people turn to TurboTax rather than do it themselves but the suggestion is to ignore what the software is calculating and do our own calculation/workaround.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug in Software? Full mortgage interest deduction not be calculated when entering multiple mortgage lenders.

Turbo Tax needs to get this fixed ASAP. It's ludicrous for us to be dicking around combing and changing the data on 1098's to achieve an intended result. TT needs to tell us when they will have the fix available to us.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug in Software? Full mortgage interest deduction not be calculated when entering multiple mortgage lenders.

This is a clever approach. It's obvious to me that TT completely over-simplified their approach to adequately capture the essence of the tax law regarding limits to mortgage interest deduction. How naive of them. My guess is that they will not have the fix available for the tax filing deadline next month. Their 1098 entry screens are way too simplistic to adequately describe the various scenarios and link various 1098's together so as not overstate total mortgage principal. It appears that the tax law has out-matched Turbo Tax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug in Software? Full mortgage interest deduction not be calculated when entering multiple mortgage lenders.

This bug is still occurring. I refinanced both my primary and secondary home in 2020 and both loans were later sold to other lenders in 2020. Both principal balances added together are less than $750K. TurboTax kept saying my mortgage interest would be limited because my total loan was over $750K!

There are two solutions to this scenario:

1) Enter both the "original" lender and "sold to" lender as two separate lenders but do NOT enter the "refinanced" lender since they are not your current lender any more. Combine the mortgage interest amount of the "refinanced" lender into the "sold to" lender.

-or-

2) Enter all lenders including the "original", "refinanced", and "sold to" lenders. Categorize both the "refinanced" and "sold to" lenders as refinance but only enter the actual Outstanding Mortgage Principal amount (Box #2) for the "sold to" lender. Enter "$0" for the Outstanding Mortgage Principal amount for the "refinanced" lender. This is logical because it's still the same loan but just happened to get sold to another lender. This avoids double counting the Outstanding Mortgage Principal amount for the "refinanced" and "sold to" lenders.

TurboTax needs to clarify this because many homeowners refinanced in 2020 and those loans usually get sold to other lenders.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug in Software? Full mortgage interest deduction not be calculated when entering multiple mortgage lenders.

Thanks a bunch. That resolved it. I am using Windows not Mac but you got me to the right place. My problem did not involve multiple lenders or 1098s or anything complicated, just one loan well below max allowed, one lender, one 1098. All my mortgage interest was deductible but TT was only giving me $10,240 vice $18,800. Big difference. But after I did the manual entries and TT corrected the error in deductions it could not even add my 4 deductions correctly. The 4 came to $30,326 and the total shown was $30,626. But I am not going to try and fix that.

As an aside I have been using TT since 2007 and until this year was very satisfied. This year has been terrible and TT is a joke as far as I'm concerned and it is unlikely I will ever use it again. I have made 8 calls to support and spent at least 10 hours on the phone and accomplished very little. The techs have been by and large terrible with two offering absolutely zero in effort or suggestions for fixes. It's gee, duh I don't know. I ended up solving most issues myself. Issues included failure to save after doing my input. When I reopened all data was gone. I needed to check some 2019 data and I could not open 2019 TT (known problem all over net). TT insisted Standard Deduction was best option which was ridiculous. Then every time I opened TT it wanted to update but failed. TT had me doing things like making command line entries to services etc. blaming MS (which admittedly is often a problem). Of course my computer was blamed as was my virus software. Been down that road before. I spent 23 years doing testing, documentation and scripting for a logistics software and consulting company so I know just a little. Then when update failed I could not even open TT. Ended up doing an uninstall and reinstall. After that a tech did get my deduction changed from Standard but with the incorrect amount until now.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug in Software? Full mortgage interest deduction not be calculated when entering multiple mortgage lenders.

This is still not fixed - when is Turbo Tax going to update their software to allow for multiple refinancings of the same property in one year? This must be impacting many people - mortgage rates were on a downward path all through 2020, I'm sure many people refinanced more than once!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

maryherndon54

Level 2

gangleboots

Returning Member

robin-binford

New Member

Stringerjj

Returning Member

user17643061879

New Member