- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Bought a Camera And Sold It for Another - Section 179? Excess Basis?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bought a Camera And Sold It for Another - Section 179? Excess Basis?

Hi,

I'm trying to wrap my head around the whole "like-kind trade" stuff regarding purchasing and selling of business equipment. I do video production and sometimes buy and sell equipment as I upgrade over time.

Say if I purchased a camera for my business early in the year for $3500.

Then towards the end of the year, ended up selling it for $2000, and then turned around and bought another camera to replace it for $1300.

what would I enter in the "Excess Basis Amount" box? How does this work?

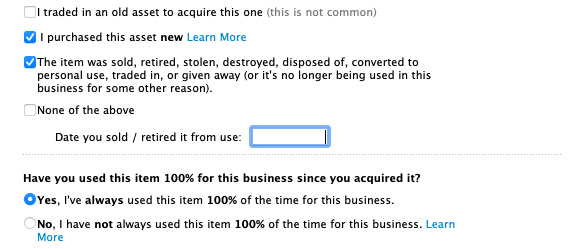

And I'd check these boxes, correct?

- "I traded in an old asset to acquire this one."

- "I purchased this asset new."

- "The item was sold, retired, stolen, destroyed, disposed of, converted to personal use, traded in, or given away."

Any help is greatly appreciated!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bought a Camera And Sold It for Another - Section 179? Excess Basis?

sorry but except for real estate there are no more like-kind exchanges starting with 2018

so if after 2017, show the old camera sold for $2,000. if you 179'd the entire cost you now have $2,000 of income. the new one would have a cost of $1300 and if used in your trade or business would also be eligible for 179 or bonus.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bought a Camera And Sold It for Another - Section 179? Excess Basis?

what year are you doing. these questions are strange since as I said 1031/like-kind exchanges, for Federal purposes, only exists for real estate for years after 2017

"I traded in an old asset to acquire this one." so if 2018 or later answer no

"I purchased this asset new." should not be asked if you marked not traded to the first question

"The item was sold, retired, stolen, destroyed, disposed of, converted to personal use, traded in, or given away."

answer yes.

however, states my have different laws

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bought a Camera And Sold It for Another - Section 179? Excess Basis?

Yes, I'm doing this for 2018 - Home and Business version.

It has a check box next to each of those options, and it asks the "I purchased the asset new." regardless of what other option boxes I tick. Doesn't seem like it would matter to just tick it since I did buy it new?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

MaxRLC

Level 3

MaxRLC

Level 3

nstuhr

Returning Member

fpho16

New Member

SueWilkinson2

Returning Member