- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Adding multiple mortgage lenders reduces my refund amount?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Adding multiple mortgage lenders reduces my refund amount?

Hello,

I have 1098 form from 2 different lenders because I refinanced my original loan. The amount of mortgage interest on the original loan is approx. 23K, while on the refinanced loan is approx. 4K.

When I only enter the details of the lender from the original loan, TurboTax is applying a deduction of 23 K, but as soon as I enter the 2nd lender and select 'Box 7 is checked', the Federal refund reduces significantly. The deduction applied is only approx. 12 K. Does refinancing affect my ability to claim deduction on mortgage interest?

I was expecting to claim 23K + 4K (total 27K), but looks like that's not the case.

Can someone please explain why this could be happening? What is the general suggestion here? Should I just enter the original loan? That at least allows me to claim 23 K.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Adding multiple mortgage lenders reduces my refund amount?

Box 7. If the address of the property securing the mortgage is the same as the payer's/borrower's, either the box has been checked, or box 8 has been completed. If more than one property secures the loan, shows the number of properties securing the mortgage. If only one property secures the loan, this box may be blank.

Don't see line 8a on 1098

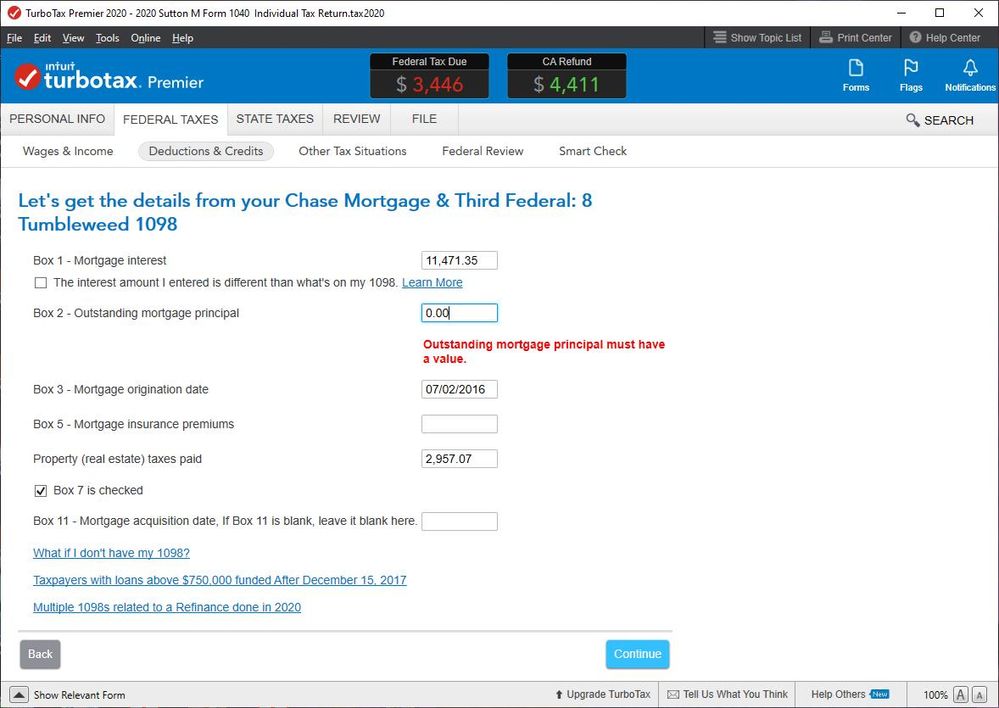

If there is a refi and there was an outstanding mortgage principal listed in both of them on Line 2 on the 1098. When you do put an outstanding balance in both forms, then the program adds them together and if that number is greater than $750k, then it puts you in the category to "limit interest". To get that to go away, you need to go back to the deductions section and click on "edit" mortgage interest statement. Change the line 2 of the mortgage that you no longer owe on (like the one that you refinanced and paid off) to a 0 (zero) because you have refinanced out of that loan and no longer have an "outstanding mortgage principal". Once you change one of them to zero (the one that was paid off by the refinance) then it should no longer pop up with that error at the end when you go to file.

[edited 2/5/21 | 1:04 pst]

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Adding multiple mortgage lenders reduces my refund amount?

I think I figured out what is the problem here. As soon as I add the information about the 2nd lender, TurboTax thinks it's a new loan and almost doubles my loan amount for the year, thereby restricting my mortgage interest claim. But in reality my loan amount is less than 750K.

I see the 'Does your mortgage interest need to be limited' set to Yes.

Can someone guide me how can I resolve this issue? How am I supposed to tell TurboxTax that it's the same loan and it's only being refinanced? I have tried all options in the UI, but that's not helping.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Adding multiple mortgage lenders reduces my refund amount?

Box 7. If the address of the property securing the mortgage is the same as the payer's/borrower's, either the box has been checked, or box 8 has been completed. If more than one property secures the loan, shows the number of properties securing the mortgage. If only one property secures the loan, this box may be blank.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Adding multiple mortgage lenders reduces my refund amount?

Box 7. If the address of the property securing the mortgage is the same as the payer's/borrower's, either the box has been checked, or box 8 has been completed. If more than one property secures the loan, shows the number of properties securing the mortgage. If only one property secures the loan, this box may be blank.

Don't see line 8a on 1098

If there is a refi and there was an outstanding mortgage principal listed in both of them on Line 2 on the 1098. When you do put an outstanding balance in both forms, then the program adds them together and if that number is greater than $750k, then it puts you in the category to "limit interest". To get that to go away, you need to go back to the deductions section and click on "edit" mortgage interest statement. Change the line 2 of the mortgage that you no longer owe on (like the one that you refinanced and paid off) to a 0 (zero) because you have refinanced out of that loan and no longer have an "outstanding mortgage principal". Once you change one of them to zero (the one that was paid off by the refinance) then it should no longer pop up with that error at the end when you go to file.

[edited 2/5/21 | 1:04 pst]

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Adding multiple mortgage lenders reduces my refund amount?

Thanks Cynthia, that seems to have worked well. It did not accept the value 0 for line 2, but it worked with 1 :).

But to me it looks like a hacky way to deal with things. Why can't TurboTax handle this in a better way? Would this affect my returns in anyway, since I am not declaring the fields in my 1098 form correctly?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Adding multiple mortgage lenders reduces my refund amount?

Well, it is a workaround designed to allow customers to successfully prepare their return while the programmers are working on a solution. There are so many things to do for 2020 that it is unreal. Your return should be fine. Now, IRS is not accepting returns for e-file till February 12, don't be in a rush to file. If the programmers get this fixed it will automatically adjust returns that are affected.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Adding multiple mortgage lenders reduces my refund amount?

Sounds good. I can wait till February 12, that should not be a problem. If this fix happens to come by before that, do let me know.

Thanks for your help and guidance.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Adding multiple mortgage lenders reduces my refund amount?

Please go here to receive email notifications when any updates related to this issue become available.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Adding multiple mortgage lenders reduces my refund amount?

It seems as though this issue still hasn't been fixed, I'm still having the same issue when I enter all the info on my multiple mortgage 1098s (the original loan was sold, then we refinanced). I'd rather not use the hack if Turbotax is going to fix this. Any insights as to when this will be fixed?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Adding multiple mortgage lenders reduces my refund amount?

This issue has been resolved. If the loan was sold rather than refinanced, it is important to be careful not to add the amounts together. Since you have both situations, it requires care:

- Enter you original 1098 that represented the original mortgage.

- Enter your refinanced 1098's. if you have more than one, you may combine them.

- In BOX 2 in the REFINANCEC 1098's put 0 as the mortgage principle balance. This represents the mortgage balance as of 12/31/2019 for that lender. Since the refinance took place in 2020, there was no beginning mortgage balance before the refinance thus this is 0.

Entering the mortgage balance for the refinance will combine balances and put you over that $750K mortgage balance limitation and will limit your interest deduction.

The following are general instructions for entering multiple 1098 forms:

How do I handle multiple 1098 mortgage forms?

If you have multiple 1098 mortgage forms, you’ll enter them one at a time. After going through the steps with the first one, you can add a lender when you get to the Mortgage deduction summary screen. (In the case of a refinance, it's best to enter the 1098 from your original loan before the 1098 from your refinance.)

But, if they're both from the same lender, and one of them has the “Corrected” checkbox marked at the top, enter the corrected 1098 and discard or shred the other one.

What do I do if I have multiple 1098s from refinancing my home debt?

If your total home debt is under $375,000 ($250,000 for married filing separate) there is nothing new for you to do in 2020. Enter each 1098 as you normally would.

Home Debt Over $375,000

Under tax law, you are limited on the amount of home interest you can deduct. The limit is based on the loan amount and date of the origination of debt. We want to make sure we calculate this correctly for you.

If you refinanced last year, you’ll have a Form 1098 from your previous lender and one from the lender you refinanced with. You’ll need both forms.

Follow these steps to enter your mortgage information:

- Gather all of your 1098 forms related to your refinance (the form from your original lender and the form from your new lender)

- Grab a calculator and add together the box 1 amount from each form. Enter the total in TurboTax as Box 1 Mortgage interest.

- Add the Box 5 amount from each form and enter the total as Box 5 Mortgage insurance premiums. (If you weren’t required to pay mortgage interest, these boxes will be blank on your forms and you won’t enter anything.)

- Add the property tax paid from each form and enter it in the Property (real estate) taxes box.

Next, finish adding info for boxes 2, 3, 7, and 11 using Form 1098 for the original loan.

What if I have more than two 1098s?

You should combine all of the 1098s directly related to the refinance and enter it as one 1098. An example of this is if you refinanced two loans into one loan. Any 1098s not directly related to the refinance should get entered separately.

This issue has been resolved. If the loan was sold rather than refinanced, it is important to be careful not to add the amounts together. Since you have both situations, it requires care.

- Enter you original 1098 that represented the original mortgage.

- Now enter your refinanced 1098's. if you have more than one, you may combine them.

- Now the most important point, in BOX 2 in the 1098's regarding the refinance, put 0 as the mortgage principle balance. What many don't realize is that this represents the mortgage balance as of 12/31/2019 for that lender. Since the refinance took place in 2020, there was no beginning mortgage balance before the refinance thus this is 0.

- Entering the mortgage balance for the refinance will combine balances and put you over that $750K mortgage balance limitation and will limit your interest deduction.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Adding multiple mortgage lenders reduces my refund amount?

OK....I have the same problem as I bought and sold during 2020 and also refinanced my new place...

so the solution is to enter the refinanced mortgage as a zero balance?....

but the TT system flags a warning when I do this....could it not generate a red flag at the IRS and prompt a rejection or audit?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Adding multiple mortgage lenders reduces my refund amount?

in fact this cannot be done.....I get blocked and cannot continue with a zero value

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Adding multiple mortgage lenders reduces my refund amount?

I apologize. I see you are working in the software and not the online version as this does work in that version.

- To test this, I enter the information in my Turbo Tax program, combining the two 1098's of $838K for your sold home and $644,000 for the new home.

- After entering the information and viewing the home Loan Deduction Summary

- The next page said We need a bit more information to wrap up this Deduction.

- In this screen, I labeled your house sold as Gershwin and the second as Mozart (you can tell I like classical music). For the house sold, I entered the mortgage balance of $838K and the date it was sold. Entered 0.00 for the house you currently own.

- This seemed to pass the test. Here is what the screenshot looks like.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Adding multiple mortgage lenders reduces my refund amount?

Hi Dave.

Unfortunately that doesnt work for me? It does not ask me for the additional information about the 2 loans

You're right - I'm using the desktop version of Premier. is there a bug?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Adding multiple mortgage lenders reduces my refund amount?

Yes, it does give you an option to add additional 1098's in the Home Loan Summary Screen. Let me show you.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

joroberts07040

Returning Member

schaackmobile

New Member

jpashkowsky

Level 1

LauDiet

New Member

praveenb235

Level 1