- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Add Form 5695

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Add Form 5695

I've found the following in the "Help Center", but when I click on the "Search" icon it takes me back to the "Help Center". How do I get to the "Search" bar?:

Form 5695 (Residential Energy Credits) is used to calculate tax credits for energy efficient improvements and alternative energy equipment.

To add or remove this form:

- Open or continue your return

- Inside TurboTax, search for this exact phrase including the comma and spaces: 5695, residential energy credit

- Select the Jump to link in your search results

- At the bottom of the Energy-Saving Home Improvements screen, answer Yes, then select Continue

- To delete the 5695, answer No, select Continue, and then answer Yes on the following screen to confirm the deletion

- Follow the instructions to enter your energy-saving improvement costs

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Add Form 5695

To enter Home Energy Credits -

Click on Federal Taxes (Personal using Home and Business)

Click on Deductions and Credit

Click on I'll choose what I work on (if shown)

Under Your Home

On Home Energy Credits, click the start or update button

Qualified energy property is any of the following.

• Certain electric heat pump water heaters; electric heat pumps; central air conditioners; and natural gas, propane, or oil water heaters.

Enter the cost in the box labeled Energy-Efficient Building Property.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Add Form 5695

@DoninGA I appreciate your help but here's what I found:

Building property

Enter the amount you paid for energy-efficient building property. Examples include: electric heat pump water heater, central air conditioner, natural gas, propane, or oil water heater.

These items must meet specific energy efficiency guidelines. See the IRS instructions for details.

You may also include the amounts paid for the assembly, preparation and installation of these items. The maximum dollar amount for energy-efficient building property is 10% with a credit limit up to $300.

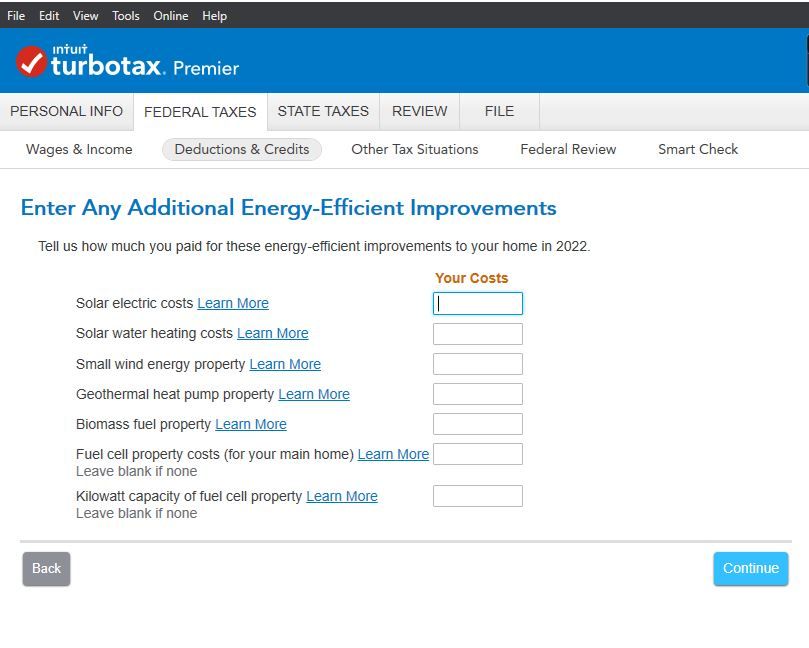

Energy-Efficient Improvements for Solar and Wind

We'll ask you about improvements you made for solar, wind energy, geothermal heat pumps, biomass fuel, and fuel cells a little later on.

It never asks later nor can I add Form 5695 to claim the credit.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Add Form 5695

@debbieleej In the TurboTax interview for the Home Energy Credits, after it shows the screen for the cost of Windows, Insulation, HVAC, etc. the program will ask several questions and then you will land on the following screen to enter your Solar system costs -

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

signal222

New Member

abarmot

Level 1

sam992116

Level 4

gavronm

New Member

phatmanz1

New Member