- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- 2024 form 5695 joint occupancy

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2024 form 5695 joint occupancy

Trying to file for a solar credit. However it's now been rejected 3 times stating some anonymous joint occupancy error.

Share a home with someone, not married. Line 32.a on form 5695 states to check a box of special conditions apply. I assume the box is automatically checked if you share the house. However I'm taking the full credit so we're not splitting it. The "help" person basically stated I needed to print off the form, write a statement on how we're splitting up the credit and mail it in...is there a way around this?

Additional my state return gets rejected for the same error even though the solar credit has nothing to do with them...

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2024 form 5695 joint occupancy

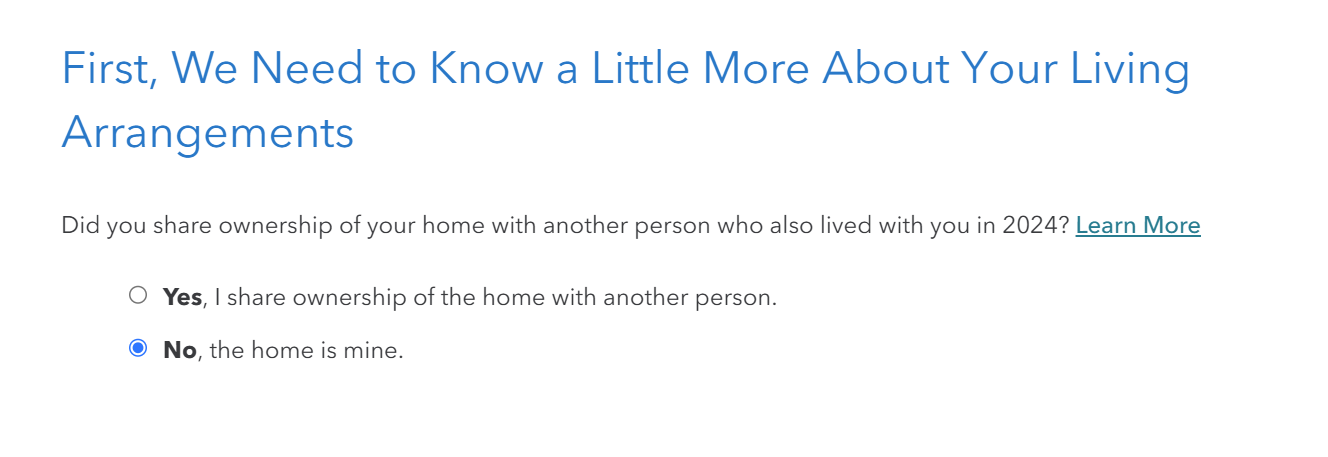

The amount of the allocation would depend on how much each individual paid of the total cost of the system. For example if you each paid 50% you would split the credit 50%. If you paid for the entire cost and are claiming the full credit you would need to mark the box as no, the home is mine to remove the joint ownership. See screenshot below:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

michelebailor

New Member

Random0x42

Level 2

Eneskey

New Member

yjordan444

New Member

HaiQ

Level 2