- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- 1099-Mic or 1099-NEC

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-Mic or 1099-NEC

I received a 1099-Misc with an amount in #7. Should I have received a 1099-NEC instead? when I try to enter the information on my 1099-MISC it wont allow me to enter the amount it is only a check mark option. Please help.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-Mic or 1099-NEC

Box 7 of form 1099-MISC is for information only. It only states that the payer has sold you more than $5,000 of goods for resale. If there is no other information on that form 1099-MISC, you do not need to enter it in TurboTax. This information does not replace form 1099-NEC if you should have received one.

If you do not receive any form 1099-NEC, you should report your gross income as Other Self-Employed income.

You report the income you received in cash, checks or bank transfers or without a 1099-NEC as self-employed income under Other self-employed income.

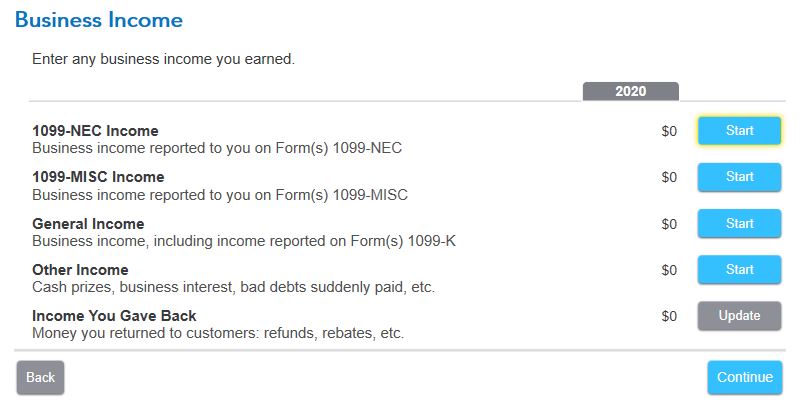

- In business income, just under Type of Income, click on Add Income for this work

- On the next page, click on the radio button next to Other Self-employed Income

- Click Continue to enter your income received in cash, checks or bank transfers.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-Mic or 1099-NEC

Box 7 of form 1099-MISC is for information only. It only states that the payer has sold you more than $5,000 of goods for resale. If there is no other information on that form 1099-MISC, you do not need to enter it in TurboTax. This information does not replace form 1099-NEC if you should have received one.

If you do not receive any form 1099-NEC, you should report your gross income as Other Self-Employed income.

You report the income you received in cash, checks or bank transfers or without a 1099-NEC as self-employed income under Other self-employed income.

- In business income, just under Type of Income, click on Add Income for this work

- On the next page, click on the radio button next to Other Self-employed Income

- Click Continue to enter your income received in cash, checks or bank transfers.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-Mic or 1099-NEC

I have the same situation and I guess my question is: what will the IRS do with the incorrectly filed 1099-MISC?

I'm concerned that if I enter the income as Other Self-Employed, I'll hear from the IRS down the line that I owe money based on that 1099-MISC, which should have been filed by my client as 1099-NEC. Perhaps they correct it later and the IRS thinks I'm on the hook?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-Mic or 1099-NEC

What is the money actually for? If you were an independent contractor, you need to enter the income on Schedule C. If you were not, enter it in some other format, such as other income. If it was incorrectly reported to you, you may get a letter but it is easily explained. The important thing is that you report it correctly, regardless of the mistake of the issuer.

The even better option is to get a corrected form.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-Mic or 1099-NEC

Thanks for your response. I'm an independent contractor, consultant. I'm using Turbotax Home & Business and filing other 1099-NECs.

It being so late in the tax season, I'm a little reluctant to ask for a corrected form, both for the client's sake and for my desire to get this done. Short of that, would it be best to report it as 1099-MISC and put the income in another box, maybe box 3? Or should I use Gross Receipts or Sales Not Reported on a 1099?

Thanks so much!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-Mic or 1099-NEC

Since you are filing a sch C as an independent consultant, enter the income inside of your business return. Edit your business, scroll down to income, edit. Select 1099-MISC and let the income be part of your business income. You don't say what box the income is in. It should add to your income and not be a problem going in this way.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Bradley

New Member

ngdonna2020

Level 2

Alex012

Level 1

ARJ428

Returning Member

rio4

New Member